It’s an old joke among value investors that none of us are ever “wrong.” We’re just “early.”

There is actually a lot of truth to that statement. It’s rare to find a good value investor who is also a good market timer. (It’s also hard to find good market timers—period—but that’s a different story for a different day.) A cheap stock can stay cheap for longer than you expect—as can entire markets—but over time, value strategies have proven to outperform.

This brings me to one of my favorite long-term ETF holdings, the Cambria Global Value ETF (GVAL).

Cambria’s timing could have been a little better. They launched GVAL—an ETF that invests in non-U.S. value stocks—in March of last year. This was just months before emerging markets and non-U.S. developed markets (i.e. everything that GVAL owned at the time) rolled over and gave up substantially all of their gains for the year.

GVAL was launched at $25 per share and bottomed out at $18.80 early in January of this year—generating losses of 25% in about 9 months.

Ouch.

GVAL has gotten off to a humble start. But if you’re a believer in value investing as a discipline, then GVAL deserves a serious look. In a market in which the U.S. has outpaced its foreign competitors for years, I consider GVAL to be an excellent, diversified rebound play on Europe and emerging markets.

Let’s take a look under the hood. In building GVAL’s portfolio, Cambria starts with a universe of 45 world markets and reduces this to the cheapest 25% as ranked by Cambria’s models. Cambria’s methodology is based mostly on the cyclically-adjusted price/earnings ratio (“CAPE”), a metric used by Benjamin Graham and made famous more recently by Yale Professor Robert Shiller.

From these cheapest 25% of world markets, Cambria then builds a portfolio of about 100 stocks with market caps over $200 million. The result is a global mid-cap value portfolio of stocks in countries where investors might normally be scared to tread.

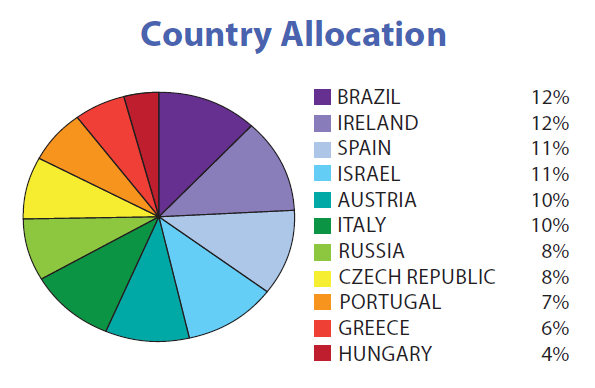

GVAL’s current country allocation is a who’s who list of problem countries:

Brazil—a country engulfed in a major corruption scandal surrounding state oil major Petrobras (NYSE:PBR)—is tied with Ireland as the largest country allocation at 12%. Spain, which is facing a secession movement in Catalonia in addition to its economic woes, Israel and Austria round out the top five. And moving a little further down the list, we get to the really scary countries like Russia and Greece.

But herein lies the beauty of GVAL. Few investors would have thick enough skin to take a large position in any of these countries individually. But even investors with nerves of steel would have trouble building a viable portfolio of stocks from most of these markets due to the lack of available U.S.-traded ADRs to buy. Very few investors have access to the small and mid-cap foreign stocks that dominate GVAL’s portfolio. (Think about it; how would you go about buying a small-cap Israeli stock even if you wanted to?) At best, you might be able to buy a cap-weighted country ETF that holds only the largest and most liquid stocks. In GVAL, you can systematically invest in pockets of the market that would normally be off limits.

So, what’s next for GVAL?

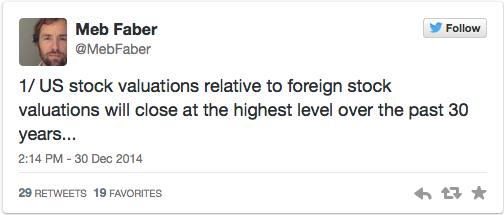

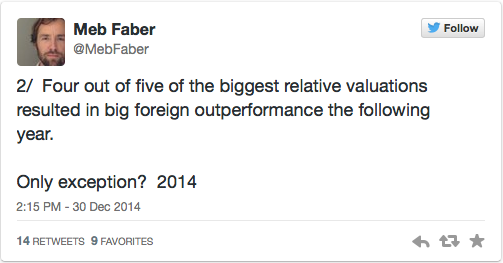

Only time will tell. The value investor’s curse is that cheap stocks can stay cheap for a lot longer than you planned. But consider these comments made late last year by GVAL’s manager, Cambria’s Meb Faber:

If history is any guide, GVAL should beat the pants off the S&P 500 this year…and for several years to come.

Disclosure: Long GVAL

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.