Just days after Alan Greenspan stated “we’re in trouble” and pointed to productivity in his discussion with Tom Keene at Bloomberg, the Bureau of Labor Statistics reported nonfarm business sector labor productivity dropped 2.2% year over year … this compares to an average year over year increase of 0.7% from 2014 – 2015 and 0.5% from the 4th quarter of 2014 to 2015.

Whether the maestro can see into the future and productivity is as important as ever … is irrelevant given what we can see today with fundamentals. By the way he also has an issue with NIRP.

But before we get into it…let’s touch on a few minor details related to the health of the US economy.

No I won’t bore you with the details behind the U-6 unemployment rate, which is at about 10%, I’m thinking of the latest stats on the jobs recovery and wages…

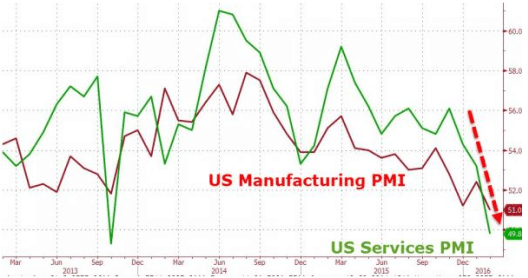

Services

In the latest Markit survey of service providers, pessimism abounds and sentiment among 85% of their responders … “signaled the weakest service sector performance since the government shutdown temporarily disrupted business activity in October 2013.”

Markit specifically points to both sentiment and the downturn in order book back logs which “suggests there’s worst to come.”

So now that manufacturing is at it’s weakest in 7 years… the services industry is getting really soft….Markit also points out … “a significant risk of the US economy falling into contraction in the first quarter.”

Earnings and Sales

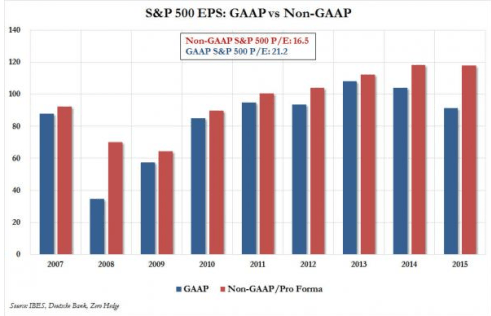

As reported by BoA/Merrill Lynch, earnings are now hitting the skids as reflected in the lowest S&P 500 GAAP earnings since 2010…

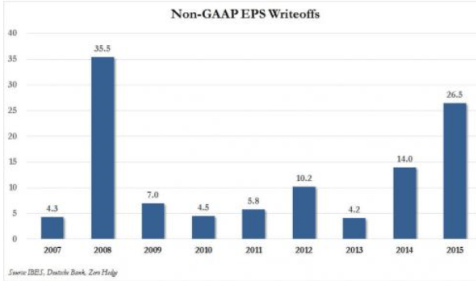

They point to write offs and pro forma adjustments hitting highs not seen since the last financial crisis.

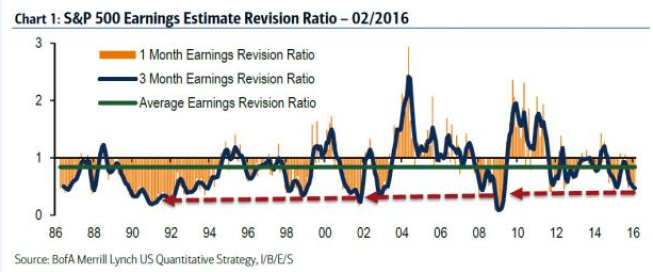

The important numbers lie in the revisions ratio which all have one thing in common … the recessionary level.

First earnings …

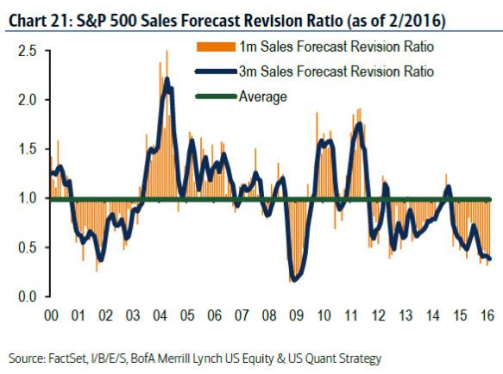

AND we all know outside of the accounting and earnings, sales are the tell when it comes to direction, trend, and level.

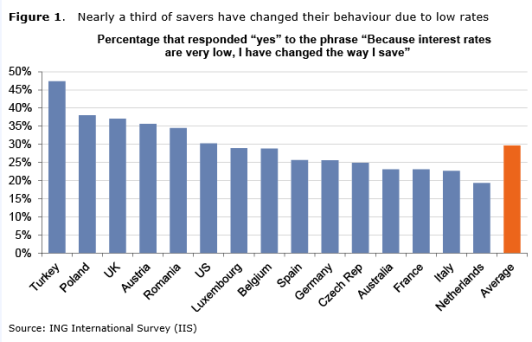

And as far as the Maestro’s concerns about NIRP and “warping behavior,” here the latest ING survey related to NIRP …

When ING asked savers if they changed their savings behavior because of low rates…

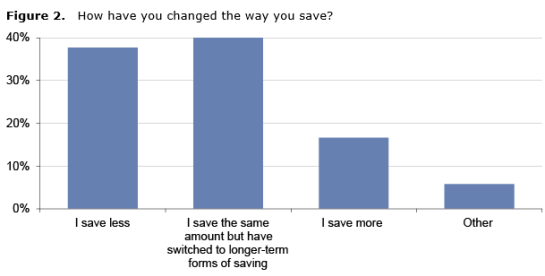

When ING asked savers how they changed their savings behavior …

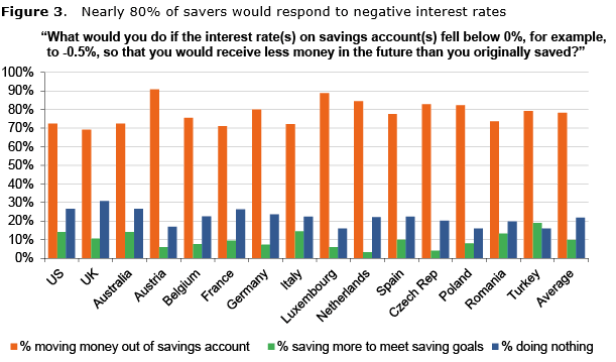

And … and this is a big AND, when it comes to the economy …

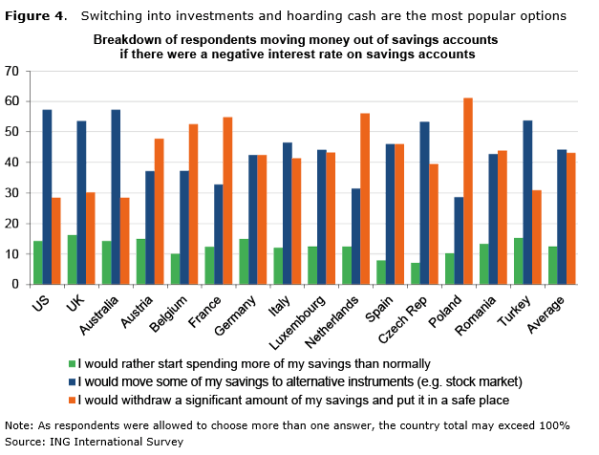

AND finally, here is what they said they would do with the money…

SORRY, BUYING STOCKS IN COMPANIES WITH WEAK FUNDAMENTALS AND/OR HOARDING CASH …

IS NOT going to save an economy.