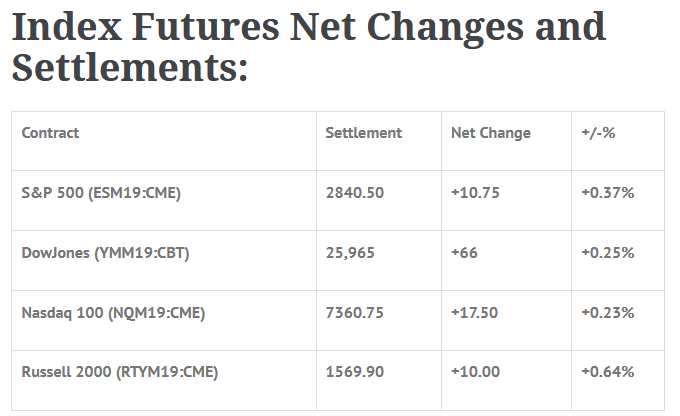

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.18%, Hang Seng +0.19%, Nikkei -0.08%

- In Europe 13 out of 13 markets are trading higher: CAC +0.48%, DAX +0.89%, FTSE +0.55%

- Fair Value: S&P +5.31, NASDAQ +28.56, Dow +30.72

- Total Volume: 1.0mil ESM & 161 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, FOMC Meeting Begins, Redbook 8:55 AM ET, and Factory Orders 10:00 AM ET.

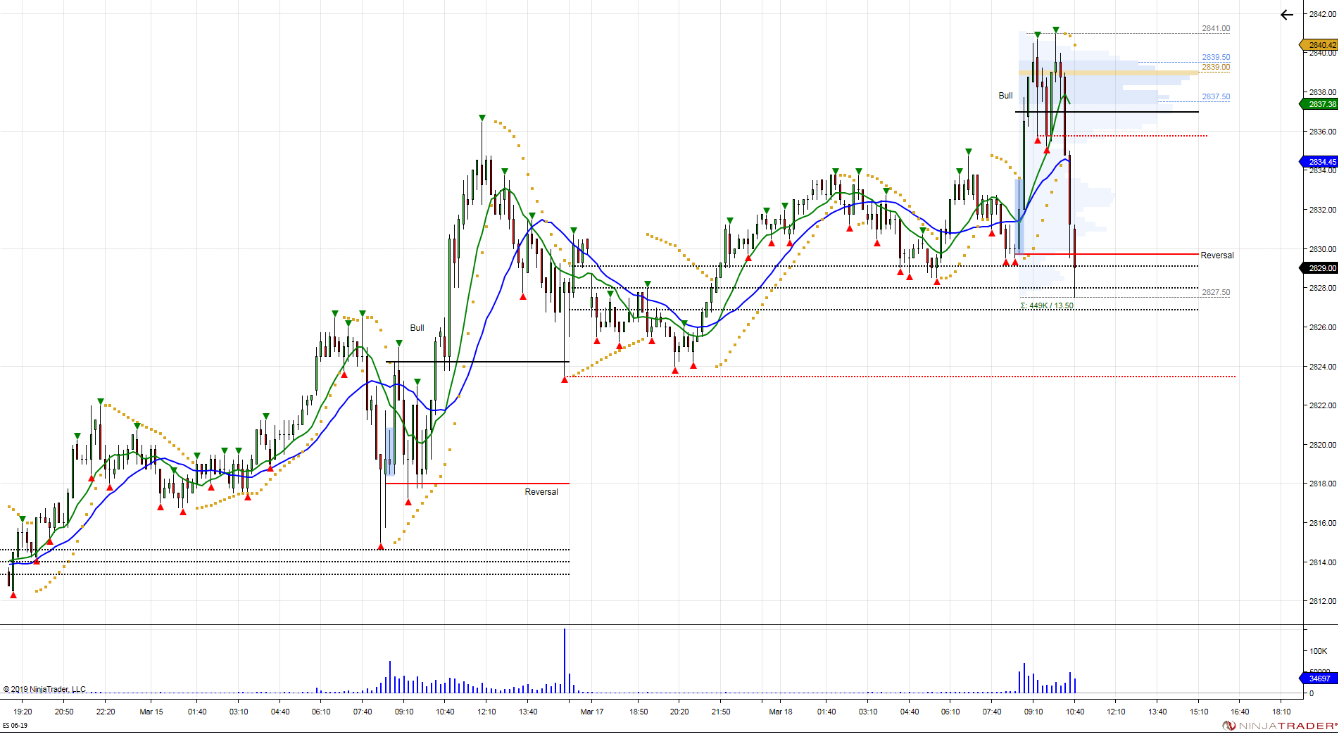

S&P 500 Futures: The Trend Is Your Friend

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Lured in buyers > upper vol window which have become trapped w MKT testing intraday Reversal window @ 29. Sell stops below Fri late low 23.5. Will there be any buyers left inside the 3D pivots after forcing to chase this morning? 35-38 new resistance for buyers to overcome.

During Sunday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2834.75, a low of 2824.00, and opened Monday’s regular trading hours at 2830.00.

The first move after the bell was a rally to 2840.75 fueled by strong buy imbalances. Once the early high was in, the ES pulled back 5 handles, then made another run up. Buying power wasn’t as strong on the second leg up, and the futures made a new high by one tick, essentially double topping at 2841.00, before heading lower.

It appeared that the bulls were trapped above the vwap, and the bears made them suffer. By 10:30am CT, just as European markets were closing, the ES had traded back down to 2827.50, up just 2 handles on the day.

Things slowed down after the RTH low was made, and a thin grind higher took the stage heading into the afternoon. As the MiM opened up showing $220 million to buy, the ES continued to inch higher, trading back up to 2837.75 just before 2:00 CT, and completing a MrTopStep 10 Handle Rule.

On the 2:45 cash imbalance reveal, the MiM showed $800 million to buy, and the futures reacted in kind, rallying up to 2840.25 going into the final minutes of trading. The ES ended the day just off its highs, printing 2838.50 on the 3:00 cash close, and 2840.50 on the 3:15 futures close.

In the end, the overall tone of the ES was firm. The futures started out strong, then turned weak in the middle of the session, and finally closed out the day strong. In terms of the days overall trade, total volume was light, with just over 1 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.