Stocks had a boring day on the surface; beneath, a rotating undercurrent seemed to be concentrated towards the commodity side of things. Overall, declining stocks led advancers, resulting in the number of stocks above their 50-day moving average in the S&P 500 to slip and put downward pressure on the equal weight RSP ETF.

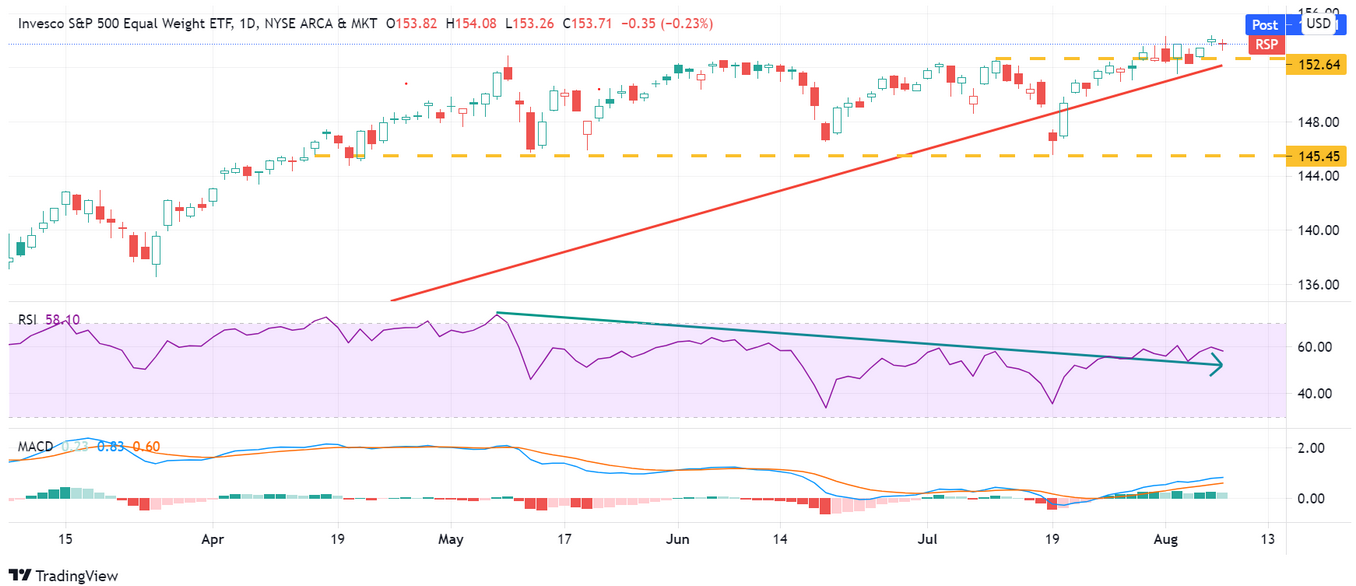

Equal Weight S&P 500

The Invesco S&P 500® Equal Weight ETF (NYSE:RSP) made a new high last week, but I still consider it range-bound. I have often seen stocks or indexes break to new highs and then a few days later break the other way. I still tend to think the RSP is in a precarious position, with a big uptrend in play. Plus, it looks like the MACD has, or is close to, an apex here and ready to turn lower.

S&P 500

Meanwhile, the tranquility of the past few days is about to end, I think. There is a rising wedge pattern that has formed in the S&P 500 cash and futures market. Additionally, this appears to be the end of a Wave 5 higher, equal to 78% of Wave 3. Once the futures break below 4400, we should confirm that wave 5 is complete and a corrective wave is coming.

Oil

Oil was down sharply Monday, falling to $66.75 by day’s end. It was as low as $65.10-ish, testing a low from previous days. While a double bottom may be in place, I think it is unlikely. Oil hasn’t even hit oversold levels yet, and I expect the dollar to strengthen further. So, could we see a pause in the sell-off? Yes. Is it the end of the move lower? Probably not.

NVIDIA

If you are an NVIDIA (NASDAQ:NVDA) bull, then you better hope the stock rallies over $210 very soon. If it doesn’t and starts making its way towards $180, the odds of a double-top pattern will increase dramatically, which will signal a much steeper decline is coming.

Apple

Apple (NASDAQ:AAPL) had a triangle pattern forming, too; I don’t think it is a bullish pattern. Apple already broke the downtrend, and we know that when the RSI gets above 80, the stock tends to not do well in the weeks that follow. A break below $145 will be a real negative for the shares, with the trendline at $130 the next likely stop.

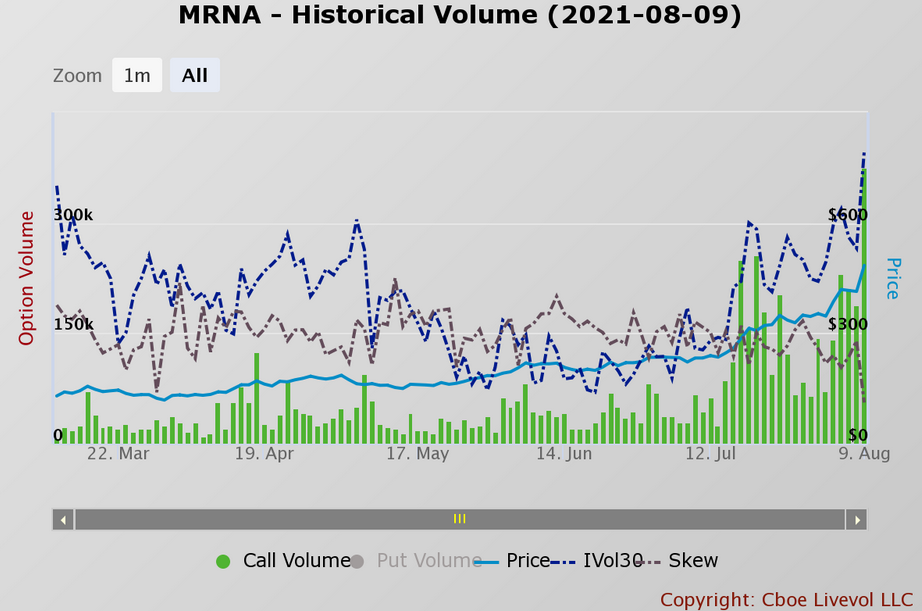

Moderna

Moderna Inc (NASDAQ:MRNA) appears to be in the middle of a giant gamma squeeze. We can tell because call option volume and implied volatility have exploded higher, while skew has collapsed. This means the run higher is like playing with fire.