The precious-metals market continues to be one of the most schizophrenic trades of the year that has confounded both bulls and bears. Every rally attempt is fierce and short-lived, while ever decline seems to overshoot rational boundaries. Some love it, while others have given up on it long ago. Nevertheless, speculation over the future price action of gold and silver continually garners headlines as investors look for clues to a rebound from this multi-year malaise.

One word of caution that I always like to instill is that investing in precious metals via an exchange-traded fund is much different than that of a hard asset investor. Buying or selling physical gold has inherent opportunities and risks, along with a psychological mindset that includes the notion of owning property with intrinsic value.

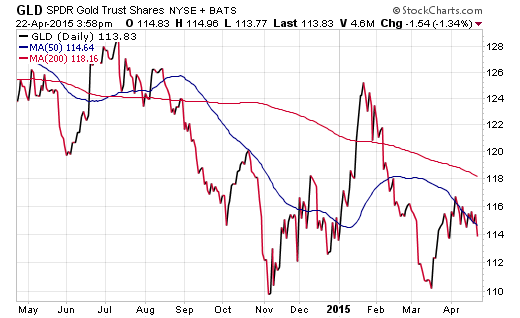

Investors who purchase the SPDR Gold Shares ETF (ARCA:GLD) in their brokerage account should be doing so with the clear understanding that this is a pure price play. You are participating in the daily direction of gold prices, rather than the ability to leverage it as a store of value.

GLD is essentially flat so far in 2015 and down more than 8% over the last 52-weeks, yet that certainly doesn’t tell the entire story. The extreme price swings from November to March resulted in a round trip with little net gain. As a result, the long and intermediate-term moving averages continue their downward sloping decent and the $110 level has been established as key support.

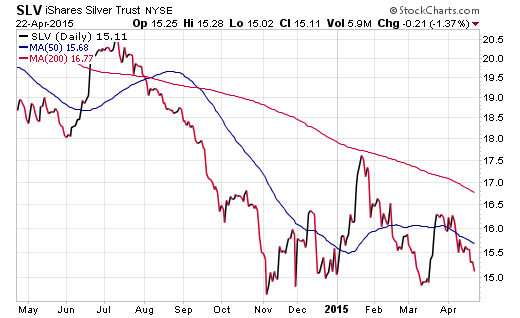

The price action in the iShares Silver Trust (ARCA:SLV) hasn’t shown much more confidence either. This exchange-traded fund tracks the daily price movement of silver bullion and is currently much closer to its late-2014 and early-2015 lows. A break of those levels would almost certainly lead to additional follow through on the downside. Silver appears to be in rough shape here despite the illusion of price support levels in place.

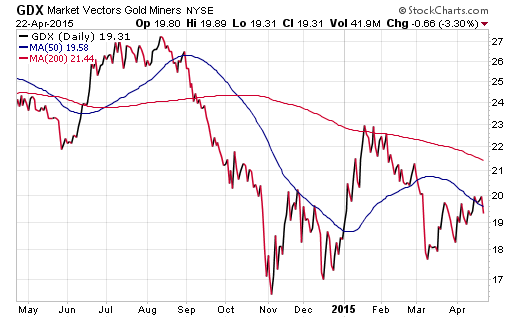

One area that appears to be carving out a sounder technical pattern has been gold mining stocks. The Market Vectors Gold Miners ETF (ARCA:GDX) tracks 40 global companies engaged in mining, refinement, and related precious metals activities.

Since bottoming in November, this ETF has carved out higher lows in December and March. This may be a precursor to additional upside if gold bullion prices can stabilize and the broader stock market remains accommodative. The one thing I will note is that gold mining stocks are traditionally much more volatile than gold bullion and can be susceptible to greater risk. Of course, those risks work in both directions.

There are many factors driving the global precious metals theme which include: conventional supply and demand forces, global central bank measures, asset flows to traditional investments (stocks & bonds), and of course currency trends. Each of these forces has played or will play a role in the direction of this physical asset.

From a short-term perspective, many bullish calls for gold or silver are likely based on a fear-induced “safe haven” trade. However, those have proven in the past to be short lived as fear is worked off and investors return to stocks or other areas with a greater perceived reward opportunity.

In order to generate staying power, precious metals are going to need to be observed as a long-term solution to a persistent problem such as rising interest rates or currency fluctuations. For the moment, I am continuing to watch from the sidelines without any participation in this arena for myself or clients. In my opinion, the absence of consistent price action, downward sloping trend lines, and overall instability don’t warrant a sufficient risk-to-reward profile.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Original post