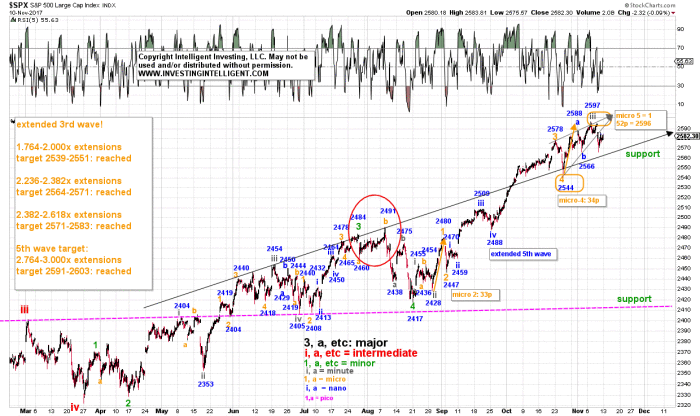

Once S&P 500 2544 was reached on October 25th, that same day I showed my premium members in my regular daily update I was looking for S&P 500 2596 (see attached file) as that is where (orange) micro-5 would equal micro-1, after a standard micro-4 = micro-2 (34p vs 33p) setup. See hourly S&P chart below for details.

Last Tuesday the S&P topped at S&P 500 2597, only 1p above my projection, after having formed an Ending Diagonal Triangle, and has since declined in the typical fashion: a fast drop lower. This strongly suggests minute-iii has topped. That said, and staying within the flexible, open, mind-set, it is in fact possible for the S&P to have topped in minor-3 instead of minute-iii. See daily chart below.

Regardless, I still expect the S&P to revisit the S&P 500 2540s region before embarking on a final rally. If the alternate count shown is operative than a standard 5=1 relationship off the 76.4% retrace (typical for a 4th wave) then targets the 176.4% extension (typical for a 5th wave) at around S&P 500 2705… However, this doesn’t mean we should turn a blind eye to the preferred count, which has tracked so well for many months showing S&P 500 2610+/-10 could become a larger top from which we can expect a ~200p decline in the S&P. But, in that case we do need to see price drop below SP2540 first to be certain. Until then, it’s a Bull market where surprises are to the upside and the market should be treated as such until it (and not the media!) tells differently.