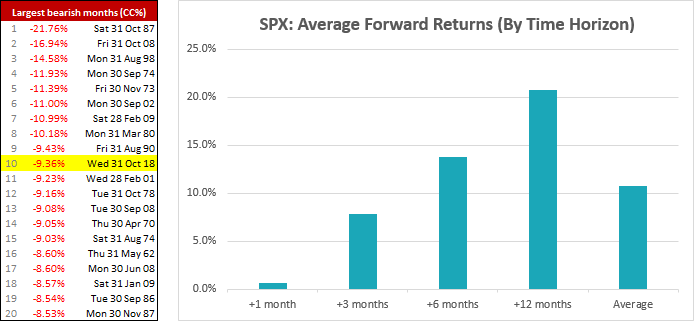

As of yesterdays close, the S&P 500 has shed -9.36% for the month of October. This puts it on track for its tenth most bearish month using data since 1960. Of course, with two trading days left in the month it could still make a comeback, but we don’t see the harm in getting ahead of the game and checking how things panned out for the other nine months.

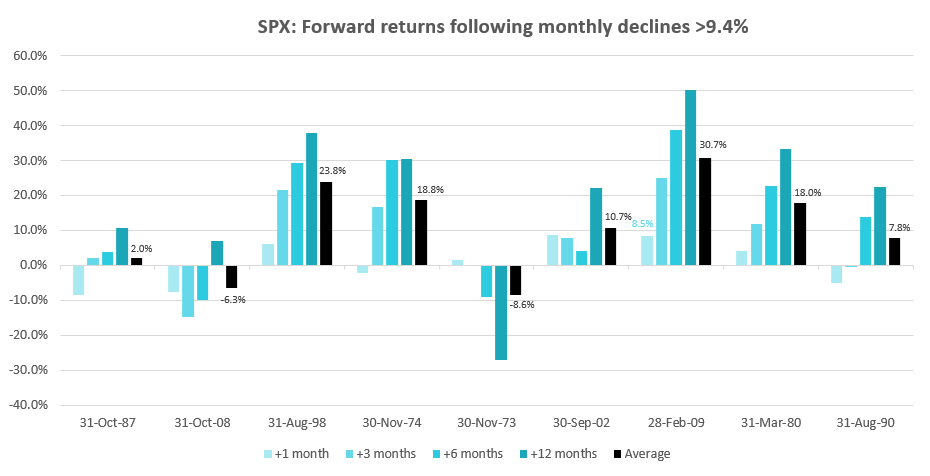

Using the monthly close in percentage terms, we’ve looked at forward returns for bearish months >9.4%. The 1987 crash takes the top spot with an eye-watering 21.8% decline, but we’re more interested in seeing what happened after these key dates.

Encouragingly we see that, on average, returns were positive the following 1, 3, 6 and 12 months. Given the long-term upwards bias of the stock market perhaps positive returns 6-12 months out should not come as a major surprise, but it’s encouraging to see none the less. Breaking it down to individual periods shows the following month appears random (4 declines, 4 gains and a flat). Although it’s interesting to note that the 11% decline in February 2009 (7th most bearish) saw an 8.5% rebound the following month, which marked the swing low of the bear market.

Still, with such a small sample size we cannot say these numbers have statistical significance, but they are something to consider as price action and scare-mongering headlines unfold.

Looking at the daily chart of the S&P500 shows it could be approaching a technical juncture. Upon first glance, the trajectory of bearish momentum is hard to ignore, we see no immediate signs of a bottom and yesterday’s bearish engulfing candle shows bears continue to rule the roost. Yet, despite this gloomy first look, we see the potential for a bounce in due course. Prices are extended beneath the lower Keltner band, a bullish RSI divergence is forming in oversold territory and it trades within proximity to three structural lows. This makes the reward to risk profile undesirable for a short position and a likely area to tempt profit taking, potentially dragging prices higher in the process.