The stock market is displaying certain conditions, or symptoms, that are commonly seen before meltdowns.

Here’s a look at some of those symptoms and why the diagnosis reveals a 34% probability of a market crash.

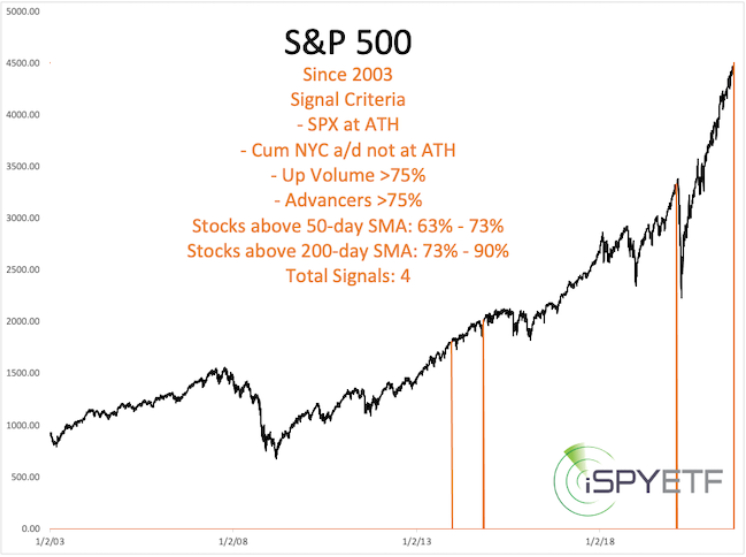

Symptom: Market Breadth In August

On Aug. 29, the S&P 500 closed at an all-time high with good breadth readings. But, the market showed some symptoms of a market crash on Aug. 29:

- 83% of stocks advanced.

- 83% of the volume went into advancing stocks.

- 70% of stocks traded above their 50-day SMA.

- 83% of stocks traded above their 200-day SMA.

The Diagnosis

A similar constellation occurred only three other times, with one of them right before the 2020 crash.

Meltdown risk: 33%.

Symptom: Market Breadth In September

In the third week of September, the stock market suffered a 90% down volume day (where 90% of NYSE trading volume went into declining stocks) followed by two >80% up volume days.

The Diagnosis

Something similar happened 12 other times, with 3 of 12 signals being followed by significant selloffs.

Meltdown risk: 25%.

Symptom: Fear Spike In September

On Sept. 20, the S&P 500 lost 1.7%, while the VIX spiked 21.43%.

The Diagnosis

There were nine other times when the S&P dropped 1.5% - 3%, while the VIX spiked 20% - 30% when the S&P was still within 4% of an all-time high. 4 of the nine signals led to a nasty correction or bear market.

Meltdown risk: 44%.

Symptom: Fear Creeps Up Even More In September

On Sept. 10, the S&P 500 edged 0.77% lower, but the VIX closed 11.44% higher.

The Diagnosis

The VIX spiked 10% - 15% while trading between 16 and 24 when the S&P fell 0.5% - 1.0% only nine other times (with only 6 of 9 signals before 2021). Three of 9 times were followed by meltdowns (including 2000 and 2007 bear markets).

Meltdown risk: 33%.

Conclusion

Based on the above studies, the stock market meltdown risk is 33.75%. As any Doctor will tell you, not all symptoms are conclusive, but here is one certainty: A meltdown can only happen if price falls (and stays) below support.

Here are some critical support levels for the major stock index ETFs:

SPDR® S&P 500 (NYSE:SPY): 422.50

SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA): 333

Invesco QQQ Trust (NASDAQ:QQQ): 345 - 343

iShares Russell 2000 ETF (NYSE:IWM): 208