Trade wars got you down? Business television have you cringing when you turn on the set? Financial news ruining your day while you eat breakfast? Just turn it off then. Better to be happy than to be a balled up wreck of worry all day every day. Not as easy as it sounds though, right. When stock markets are lower it is news everywhere. When new tariffs are proposed it comes up on every news channel. Can you shut out all news?

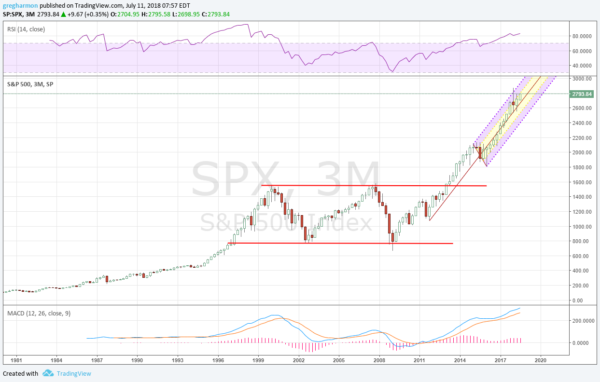

You likely do not have to go that far. As far as the financial news and the stock market are concerned just keep this chart below in your mind. It shows the S&P 500 on a quarterly basis for almost the last 40 years. Each bar, or Candlestick, represents 3 months of price action for the S&P 500 showing the open and close, high and low, for the quarter. Red bars show pullbacks and hollow bars a move higher. What does this chart tell you?

There are several things to note. First is the long term cycle. There is a nearly 20 year rise from 1980 until 2000. that was followed by 12 year consolidation period where stocks moved sideways in a broad channel. Now the uptrend has resumed. With 9 years into the move higher it still may have 11 to go to match the move into the consolidation. The doomsday crowd will note that the momentum indicators are overbought. But they will also ignore that the last time they became overbought in 1994 the market extended to the upside for 6 more years and rose 400% before it stopped.

The Andrews Pitchfork on the far right gives another show of strength, and negates even a short term worry. The S&P 500 is rising along the median line and has been doing so for 3 years. It would take a move below the Lower Median Line before even short term bearish signs show up. So for now let the news flow over you. Enjoy your breakfast and remember this longer view.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.