Investing.com’s stocks of the week

Stocks had a solid finish to the day on Friday after moving sharply lower at the open finishing down just 15 bps. The day could have turned out much worse, and it does indicate to me that the bullish momentum we saw last week may be here to stay. You can find several essential points from this week that very constructive which could be setting up a strong follow through next week.

S&P 500 (SPY)

First and foremost, after seeing huge gains last week the S&P 500 managed to trade sideways. A definite sign consolidation is taking place. It tells me that the next move the equity market is likely higher. Second, the chart shows that there is a solid level of support in the S&P 500 around between 2,872 and 2,886. Third, the chart continues to show the formation of a flag, a bullish continuation pattern. The shape of it has changed some throughout the week; however, the meaning has not.

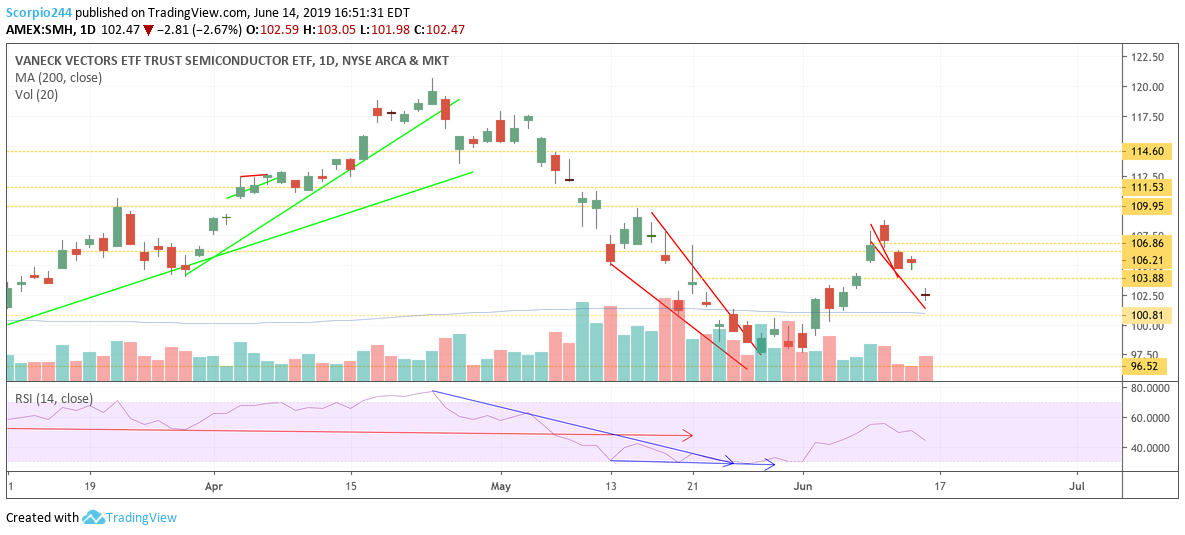

Chips Stocks (SMH)

Another positive was that Chip sector managed to find a level that held all day $102.50. Given the weak Broadcom (NASDAQ:AVGO) news the ETF could have easily been down much more than the 2.7% today. We saw much more significant declines in the middle of May on trade worries. It may be suggestings in some ways much of this was already priced into the group.

Micron (MU)

Despite knocking on the door of a significant breakdown Friday morning, MU managed to hold support around $32.50. Remember if any stock has a lot of risk over the next few weeks, it is Micron Technology Inc (NASDAQ:MU). MU reports results during the last week of June.