Semiconductor and semiconductor equipment-maker stocks took a hit Monday on heavy selling pressure. Leading stocks in the industry group such as Lam Research (NASDAQ:LRCX), Western Digital (NASDAQ:WDC) and Micron Technology (NASDAQ:MU) were down by more than 4.0 percent on the session. Often, the semiconductor stocks will lead the tech heavy NASDAQ Composite. Often, when the semiconductors lose their strength it can be a precursor of a possible correction in technology stocks.

Tech Proxy

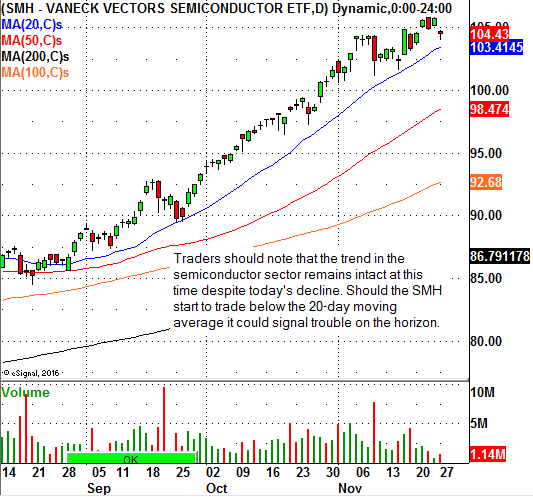

Many tech traders follow SMH) as a proxy for the semiconductor sector. SMH traded lower on Monday by $1.71 to $104.04 a share, down by nearly 1.70 percent. Traders should note that the SMH is still trading above its 20-day moving average, which means that the trend is still up for the industry group despite Monday's decline. If SMH starts to trade below its 20-day moving average, we will look for a break of the trend. But for now, the trend in the semiconductor sector remains up.