Economic Summary

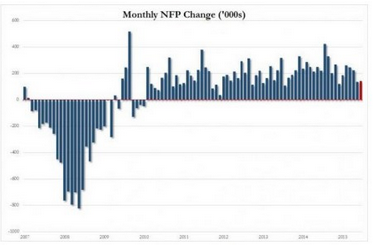

Employment – just 142k non-farm jobs were added, 60k below estimates and much lower revisions, year over year trend: flat

Housing – for the 5th month in a row, home prices missed expectations and dropped 0.2%, year over year trend: flat

Confidence – for the second month in a row, US Consumer Confidence soared to just shy of the Jan. ’87 high, year over year trend: advancing

Manufacturing – manufacturing PMI and ISM are at 2 year lows, year over year trend: receding

Factory Orders – for the 10th month in a row, factory orders dropped year over year (the longest streak outside of a recession in history), year over year trend: receding

Q3 GDP Forecast – 0.9 %, down from 1.8%, year over year trend: receding

Employment

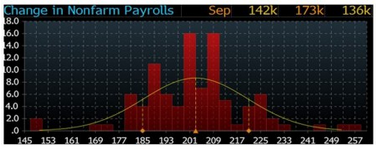

142K jobs were added this past week, 60K below the consensus estimate.

Unfortunately, the August print was revised far lower from 173K to 136K.

Putting it into perspective, in 2015 job growth has averaged 198,000 per month, compared with an average monthly gain of 260,000 in 2014.

The unemployment rate came in at 5.1% as expected.

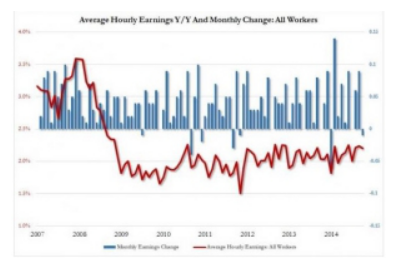

Unfortunately, average hourly wages stayed flat at 0.0%, also below the expected 0.2%.

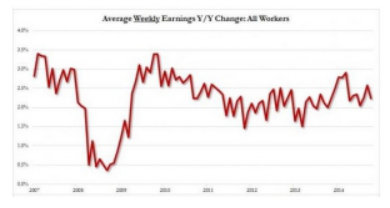

Actually, if one zooms in, the change was not 0.0%, it was negative, while weekly earnings actually declined from $868.46 to $865.61.

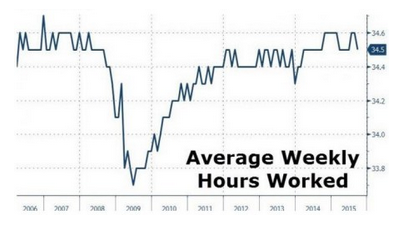

Not only were workers paid less, they worked less, as the average hourly week to week hours declined from 34.6 hours to 34.5.

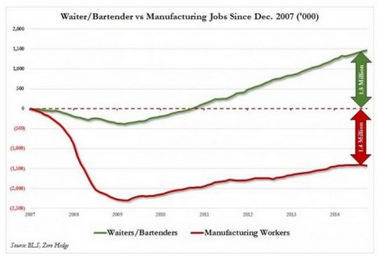

In September, the US economy added 21,000 waiters and bartenders and lost another 9,000 manufacturing workers.

Since Dec ’07, the US economy has added 1.5 million waiters and bartenders and lost 1.4 million manufacturing workers.

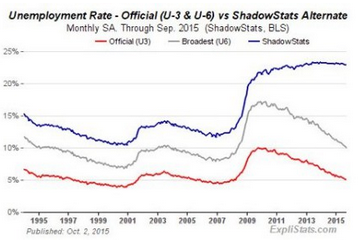

According to John Williams of Shadow Stats, if we were to calculate unemployment using the same metrics as we did during the 1930s, or even the 1980s, we’d already be in Great Depression territory. Williams, who utilizes a reporting methodology that accounts for “long-term discouraged workers who were defined out of official existence in 1994,” notes that the real unemployment rate is near 25%.

Housing

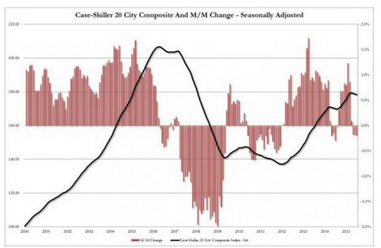

For the 5th month in a row, Case-Shiller home prices missed expectations and dropped 0.2% MoM in July (the biggest drop since July 2014).

Year-over-year, home prices have been stable around a 5% increase for 6 months which seems oddly linear and seasonally-smoothed, but broad price gains YoY also disappointed again, rising 4.7% (against 5.2% expectations).

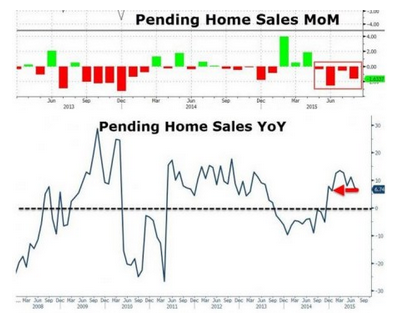

August pending home sales dropped -1.4%, on expectations of a 0.4% increase, and down from a 0.5% jump the month before.

Confidence

For the second month in a row, US Consumer Confidence (according to The Conference Board) soared in September. Printing 103.00 (smashing expectations of 96.8) in September, this is just shy of January’s high going back to August 2007.

Manufacturing

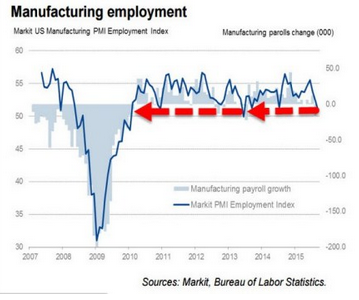

US Manufacturing PMI has stagnated for the last 2 months at 2 year lows (printing 53.1 final vs 53.0 prelim). Worst still, and confirming even further the demise of the US manufacturing “renaissance,” the Employment sub-index dropped to 50.8 – the lowest since June 2013.

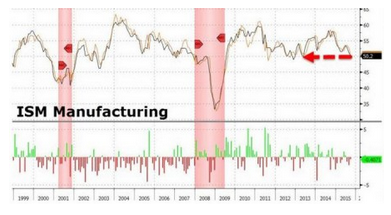

ISM printed 50.2 (the 3rd miss in a row, the 9th miss in the past 11 months, and lowest since May 2013). Under the surface was a disaster with New Orders collapsing (un-adjusted are weakest since before 2013) with just 22% saying New Orders are better (the lowest since August 2012), and greater than respondents saying “Worse” for the first time since December 2012.

Factory Orders

For the 10th month in a row, US Factory Orders dropped year-over-year – the longest streak outside of a recession in history. Against expectations of a 1.2% decline MoM, August dropped 1.7% which is the worst MoM drop since Dec 2014, with a 24% drop MoM in defense new orders and capital goods. Most worrying, however, is the rise in the inventories-to-shipments ratio once again to cycle highs after a hopeful dip lower in July.

GDP Q3 Forecast

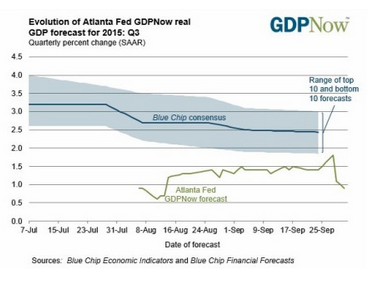

The Federal Reserve’s GDPNow forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2015 is 0.9 percent on October 1, down from 1.8 percent on September 28.

Asset Allocation Summary

Global Major Asset Class Allocations – 5% Stocks, 75% Bonds, 20% Cash

Developed Country Stock Allocations – 2.5% – Germany/France/Italy

Emerging Country Stock Allocations – 2.5% – Mexico/Indonesia/India

US Bond Allocation – 62.5%

Int’l Developed Bond Allocation – 2.5%

Int’l Emerging Bond Allocation – 10%

Int’l Developed Stock Trend – bearish

Int’l Emerging Stock Trend – bearish

US Bond Trend – neutral (previously bearish)

Int’l Developed Bond Trend – neutral (previously bearish)

Int’l Emerging Bond Trend – bearish

US dollar – neutral

Euro – neutral

Emerging Markets Currencies – bearish

OVERALL RECOMMENDATION – hold existing allocations / no new allocation commitments (based on trends)

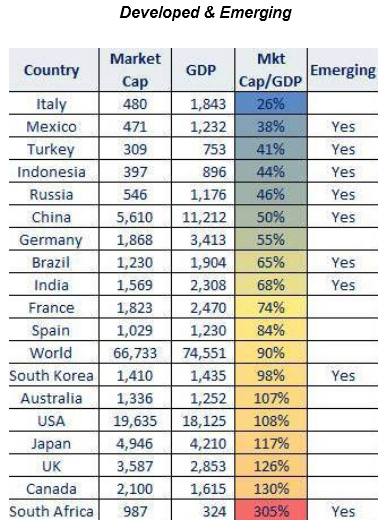

Country Stock Fundamentals – Market Cap/GDP ratios (April)

Emerging market stocks (Brazil Russia India China particularly) offer the best value.

Note: International Monetary Fund GDP numbers come out in April and October.

Developed and Emerging

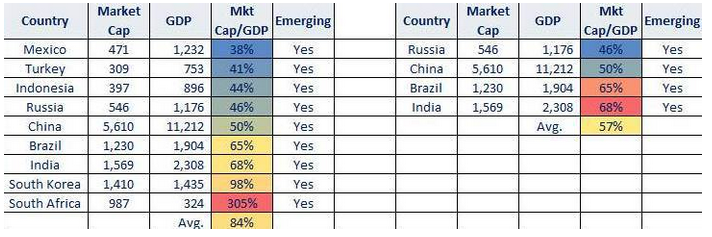

Emerging and BRIC

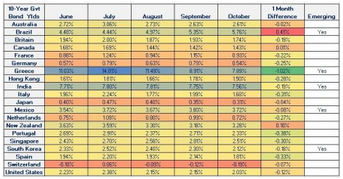

Yields

Bond yields are falling across almost economies.

The one major exception is Brazil, which is experiencing both political and economic turmoil.

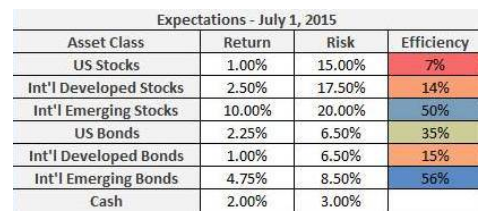

Dynamic Asset Class Expectations

Shiller’s 10 Yr. CAPE Ratio translates into a 1% 10 Yr. expected return on US stocks.

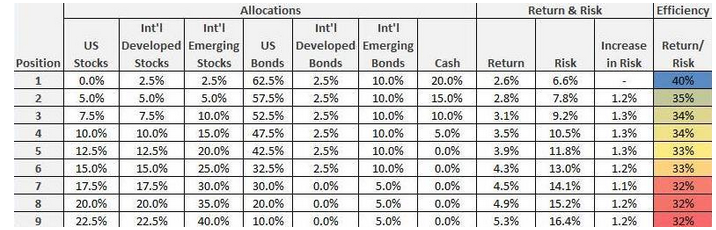

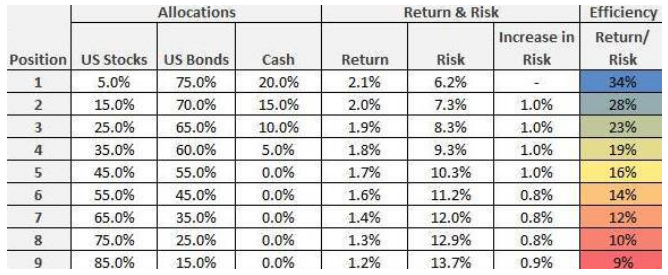

Dynamic Asset Allocation

Based on efficiency, the most attractive mix is position 1.

US + International Allocations

US Only Allocations

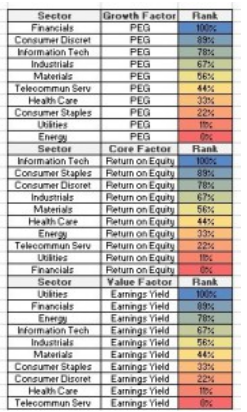

US Stock Sector – Fundamentals

Rank

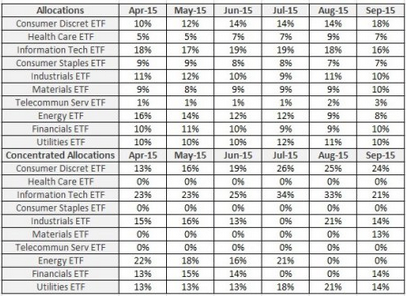

US Stock Sector – Allocations

September Allocations

International Stock Allocations

When we look at Market Cap/GDP/Volatility (April), our most attractive countries are mostly emerging.

To ensure allocations are higher quality means considering the elimination of countries with high volatility including – Russia, Turkey, and Brazil

Trends – Trade Execution – Utilizing Monthly Price Trends (and US Volatility)

The following cyclical tables get to the heart of timing and when the trend in prices is optimal (bull) for buying.

US Stocks and Bonds

Stocks topped in July.

Bearish price / volatility trend is currently in place.

For bonds, the trend is neutral.

International Stocks

The trend for Developed and Emerging remains bearish.

International Bonds

Developed bonds have turned neutral and Emerging remain bearish.

Currencies

The US dollar is neutral, the euro is neutral and Emerging Markets currency remains bearish.

Disclaimer: This is neither an offer to sell nor the solicitation of an offer to purchase any interest in or any other investments discussed. The ETFs identified in the report are utilized as asset class and currency proxies and are not intended as recommendations to buy or sell. This publication is for informational purposes only; it is not intended to be a solicitation, offering, or recommendation of any product, security, transaction, or service. It should not in any way be interpreted as investment, financial, tax, or legal advice. All data herein was obtained from publicly available information and/or sources, internally developed data, and other sources believed to be reliable. Except as otherwise stated, Mr. Grennon has not sought to independently verify information obtained from public or third party sources and makes no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of such information. Hypothetical and forward looking statements should not be taken as an indication or guarantee of any future performance, analysis, forecast, or prediction.