I’m annoyed with this bubbly stock market. It’s making it nearly impossible for regular people to find decent dividends.

Sure, we’ll always take upside, and despite overdone drops due to the coronavirus, the market has handed us a 4% total return since the New Year, building on the 31% it delivered last year.

But where the heck do we invest our gains?

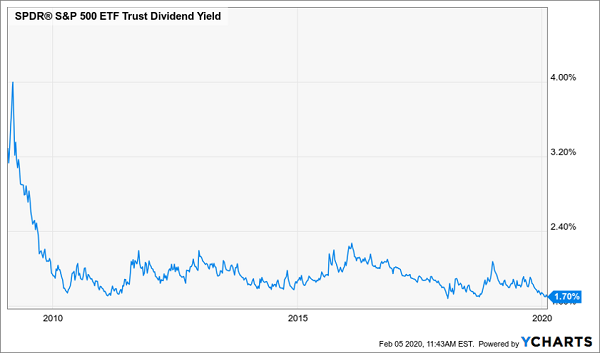

Truth is, if you want to deploy cash into higher payers, you’re in for a tough slog: the S&P 500 yields just 1.7% today, a low we’ve only seen a couple times since the financial crisis.

US Stocks Rarely Pay so Little

Treasuries? The 10-year is a shade worse, yielding just a hair under 1.7%. And we can thank folks outside America’s borders for that.

With $11 trillion of bonds paying negative yields around the world, foreign investors think a 1.7% payout looks good! So money is moving into US Treasuries, driving up prices, cutting yields and leaving American retirees (and near-retirees) in the cold.

It’s an infuriating situation, when all we really want are:

- Reliable companies: I know you don’t want to spend your golden years poring over quarterly reports from tough-to-value firms like business development companies (BDCs), guessing if your payouts are safe.And you sure don’t want to be forced to bet on outrageous dividends, like the 9.7% paid by Macy’s (NYSE:M). Right now, the retailer pays 113% of its cash flow in dividends! That’s a dividend cut waiting to happen.

We want to pull our 7%+ payouts from steady cash generators we know well.

So let’s go ahead and do that.

Here’s the twist: we’re going to do it while adding some huge international dividends to our portfolios.

I know that sounds like a contradiction, but hear me out, because American companies are giving investors a raw deal in the dividend department. Payouts here are pathetic compared to what investors in other countries get.

In the UK, for example, investors are bagging a 4.6% average dividend. French investors are getting 3%. Even Canadians are getting 2.9% from their companies, nearly double what S&P 500 firms dribble out.

Luckily, there’s an easy way for us to tap these same huge international cash payouts—and better still, we’re going to double them.

And no, you won’t have to jet off to Paris, London or Toronto to do it. You can grab these big cash payouts (I’m talking 7% average yields here) right from your brokerage account! What I’m going to show you is exactly the same as buying shares of Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) or Amazon.com (NASDAQ:AMZN) (save for the 7% dividend, of course!).

Think of it as turning the tables on those international bond investors I mentioned earlier. While they’re contenting themselves with a 1.7% yield, we’ll be grabbing 7%+ payouts from their best companies.

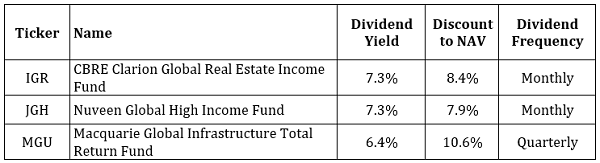

To show you how, I’m going to roll into the three investments I want to tell you about today. All are closed-end funds (CEFs) run by management firms that are big names in the CEF space.

3 Global CEFs With 7% Average Yields

Global CEF No. 1: A 7.3% Dividend With Deep US Roots

Let’s start with the CBRE Clarion Global Real Estate Income Fund (NYSE:IGR), managed in Pennsylvania by CBRE Clarion, which has been investing in real estate for 36 years.

IGR holds real estate investment trusts (REITs), which boast high yields—REIT benchmark Vanguard Real Estate ETF (NYSE:VNQ) pays 3.3%, nearly double the S&P 500 average.

The nice thing about IGR is that it gives us global diversification and a strong base in the US, with 49% of its portfolio in American REITs. Top US holdings include cell-tower owner Crown Castle (NYSE:CCI), warehouse operator Prologis (PLD) and data-center landlord Equinix (NASDAQ:EQIX). Globally, we’ve got Australian diversified REIT Mirvac, UK office REIT Segro and Japan’s Mitsui Fudosan, owner of offices, warehouses and malls.

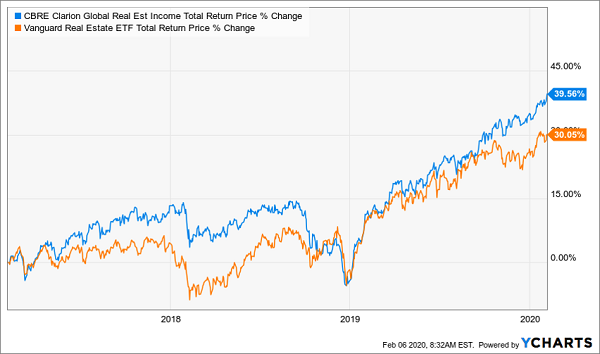

This global approach has paid off in the last three years, with IGR clobbering VNQ and delivering most of its gain in cash, too, thanks to its gaudy 7.3% dividend:

IGR Beats the REIT Competition—in Cash

The best part: the fund’s 8.4% discount and the likelihood of lower interest rates—tonic for REITs—set us up for more upside in the months ahead.

Global CEF No. 2: A Diversified Bond Play With a 7.3% Payout

Chicago-based Nuveen one of the world’s biggest—and oldest—investment firms, with $1 trillion under management and roots stretching back to 1898.

Its Nuveen Global High Income Fund (NYSE:JGH) holds corporate bonds, with at least 65% of its portfolio rated below investment grade. That’s where the highest yields live, and Nuveen gives us an extra margin of safety by holding 320 different bonds, so even if a handful were to run into trouble, the portfolio wouldn’t suffer.

And even that’s not very likely, given that corporate-bond default rates are low—around 3% in the US, according to Moody’s. That leaves us to enjoy JGH’s 7.3% payout and potential upside, thanks to its 7.9% discount.

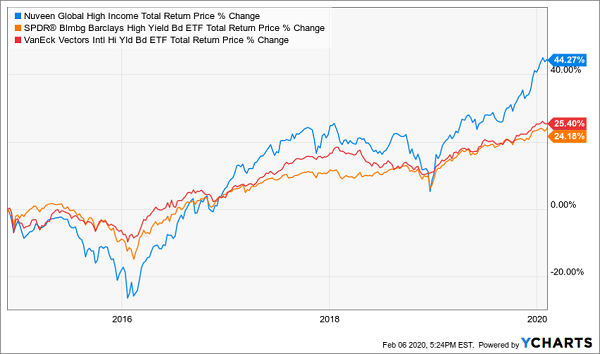

JGH is young, launched in November 2014, but it’s beaten both the corporate-bond benchmark SPDR Bloomberg Barclays High Yield Bond ETF (NYSE:JNK), in red below, and the VanEck Vectors International High Yield Bond ETF (NYSE:IHY), in orange.

JGH Beats the ETF Competition

Finally, let’s move on to …

Global CEF No. 3: A Surging 6.4% Dividend From Down Under

For our final play, we’ll add another high-yield sector—utilities—through the Macquarie Global Infrastructure Total Return Fund (NYSE:MGU).

MGU also gives us a base in North America, with top holdings like utility NextEra Energy (NYSE:NEE) and pipeline operators TC Energy (TSX:TRP) and Enbridge (NYSE:ENB), plus global cash generators like Sydney Airport (as in Sydney, Australia), the UK’s National Grid (LON:NG) and toll-road operator Transurban Group, also out of Australia.

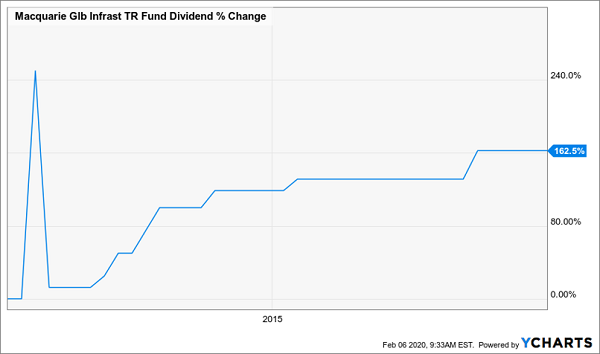

The first number that pops out with MGU is 10.6%, the fund’s discount to NAV. It’s completely ridiculous when you consider that MGU’s 6.4% dividend is surging:

A 6.4% Dividend That Doubles

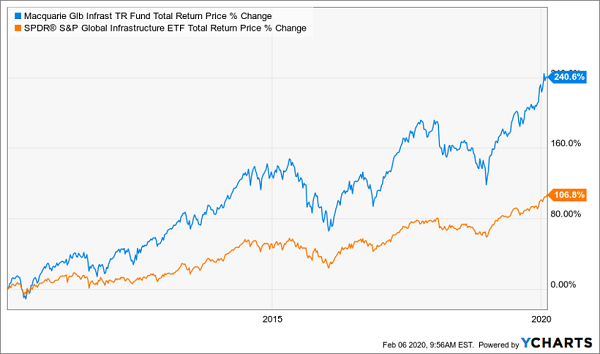

And yes, this fund, too, has outrun the comparable ETF, more than doubling the SPDR S&P Global (NYSE:SPGI) Infrastructure ETF (NYSE:GII) over the last decade:

Another Global Outperformer

Add in the 10.6% discount and the insatiable need for more and better infrastructure, and we can expect even more upside from MGU in 2020.

This Turns a $10,000 Income Stream Into $40,000—Instantly!

A 7% dividend is great, but what if I told you I’d found a proven way to boost that yield to a growing 8%+ payout?

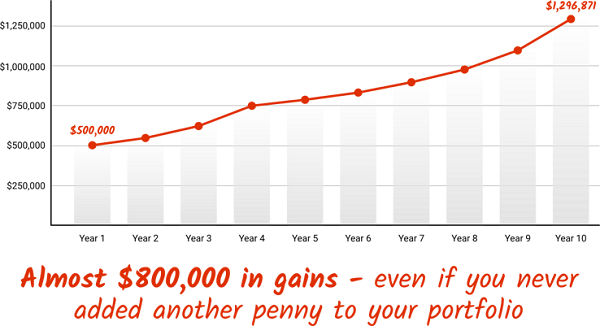

That’s no small jump! It means going from $35,000 in income on a $500K nest egg to more than $40,000.

And if you’re like most folks, even a 7% dividend is a pipe dream. You’re probably scraping by on 2% (or less) in income from your portfolio. If that sounds familiar, what I’m going to show you now could increase your dividend stream 4 TIMES.

So under our $500K example, your $10,000 in dividends becomes $40,000!

Got more? Great! A $750K investment gives you $60,000 in dividend income. A mil? How does $80,000 in yearly dividend cash sound? With this kind of income, you can live on dividends alone, without having to sell a single share in retirement.

You’ll find everything you need to make this dream scenario a reality in my new “Perfect Income Portfolio.”

And we haven’t even talked about the upside yet. If you followed the simple strategy behind this breakthrough portfolio, here’s what would have happened to your cash in the last decade:

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."