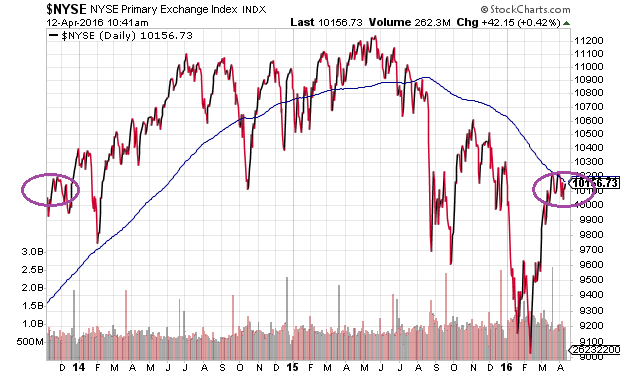

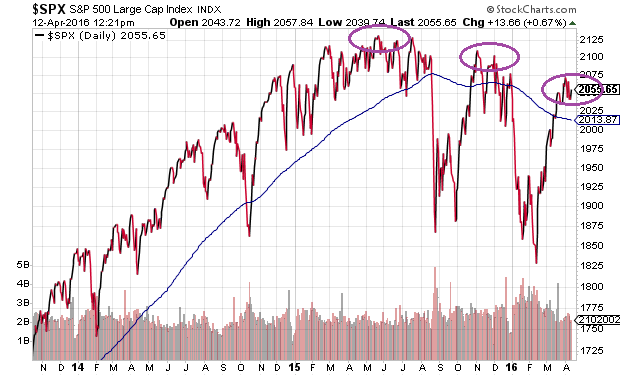

There may be 525,600 minutes in a normal calendar year. However, there have been 788,400 minutes since the S&P 500 first hit 2050 in November of 2014; there have been 1,314,000 minutes since the NYSE Composite Index rose above the 10,000 level in November of 2013. In other words, lost in the narrative that “there is no alternative,” stocks have not gained significant ground in a very long time.

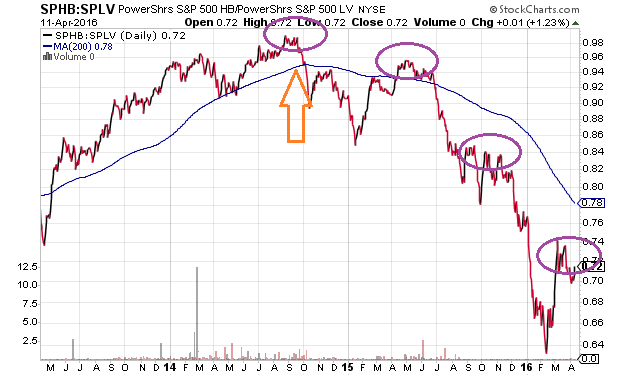

Equally worthy of note, defensive stocks have been far more impressive than their rivals since the S&P 500 first hit 2050 in November of 2014. Consider the Powershares S&P 500 High Beta Portfolio (NYSE:SPHB): Powershares S&P 500 Low Volatility Portfolio (NYSE:SPLV) price ratio. In a true bullish uptrend, riskier growth-oriented stocks in SPHB outperform less volatile dividend producers in SPLV. As a bull market reaches maturity, that relationship begins to change. SPHB:SPLV begins to wane.

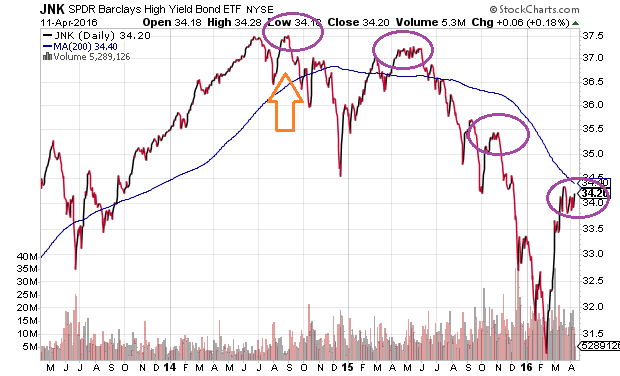

There’s another important trend in the relationship between the above-mentioned ETFs. SPHB:SPLV hit a peak in late summer of 2014. The same is true for European stocks via Vanguard FTSE Europe (NYSE:VGK), emerging market equities via Vanguard Emerging Markets (VWO) as well as high yield bonds via SPDR Barclays (LON:BARC) High Yield Bond (NYSE:JNK). In essence, speculative asset classes all began charting a similar pattern at approximately the same moment in time.

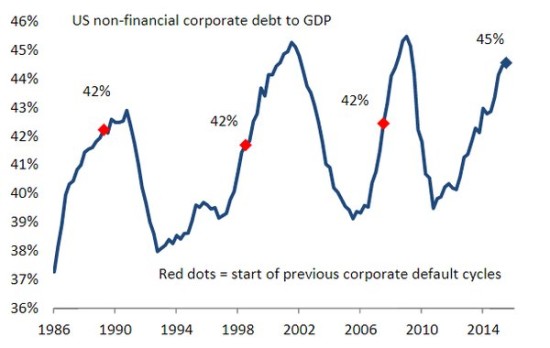

Granted, there are plenty of perma-bulls who dismiss the idea that risk assets have anything to worry about. The downward slope of the 200-day moving average on virtually every major stock index and high yield bond index? Technical nonsense. A GAAP P/E ratio of 24 on the S&P 500? Fundamental overvaluation will be remedied in a second-half profit recovery. US corporate debt as a percent of GDP pushing an all-time high, logging similar over-leveraged ratios seen at the top of the tech wreck in 2001 and at the top of the financial crisis in 2008? Low rates make it easy for companies to service their obligations.

It is almost as if the excuse-makers willfully ignore lessons in history. The long-term moving averages (200-day) for “risk-off” assets (e.g., treasuries, muni bonds, investment grade bonds, etc.) are sloping upwards, whereas long-term moving averages for “risk-on” assets are sloping downwards. Meanwhile, every reliable measure of S&P 500 valuation — price-to-earnings, price-to-sales, PE10, market-cap-to-GDP, household equity as a percentage of total assets, average investor equity allocation, Tobin’s Q — scream “severely overvalued.” Perhaps most telling of all? The build-up of debt in every nook and cranny of the world’s finances, from households to corporations to governments. Sooner or later, regardless of central bank rate shenanigans, debtors struggle to pay and they go broke.

It is true that the S&P 500 as well as the Dow Jones Industrials, while trading at the same place as they traded in November of 2014, went on to set all-time records in May of 2015. Yet that marginally higher milestone only serves to reinforce the corrective activity and volatility that has occurred across all risk assets since May of 2015. Indeed, the high-water mark that the S&P 500 registered 10 1/2 months ago has followed the same path as other risk assets since that all-time pinnacle.

Moreover, ten-plus months without a new high has only transpired 11 times in history. In eight of those occurrences? The index succumbed to a bearish top-to-bottom decline of 20%. In fact, even the 2011 euro-zone crisis – a summer of discontent that witnessed a 19%-plus decimation of faith – managed to reclaim new highs well within the 10 month period.

No matter how one slices and dices, whether one evaluates risk preferences across asset types or the devastating slide in corporate profits or stall-speed economic growth, the SPDR S&P 500 (NYSE:SPY) is a low-reward, high-risk prospect in the near-term. Better opportunities will exist when a correction in the large-cap index tracker does not rally back prior to bearish depreciation of 20%, 25%, 30% or more. It is not that I look forward to the inevitable downside to come; rather, I recognize the enormous potential of “buying low” in a new bullish uptrend.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.