What an incredible shift in sentiment in just 4 days. I am not talking about sentiment indicators or even things like the put/call ratio. But the shift in what traders and pundits are talking about. Noted Bear Marc Faber says the markets could drop at least 40%. I guess Nouriel Roubini and Nassim Taleb will be on television talking disaster tomorrow.

Just 4 days ago the S&P 500 made a new all-time high. Where was the S&P 6 days before that? Right where it is now. It may turn out to be the start of a correction, but haven’t you had enough of every 15 or more down day being declared the start of a 20% or more move lower? Give me a break!

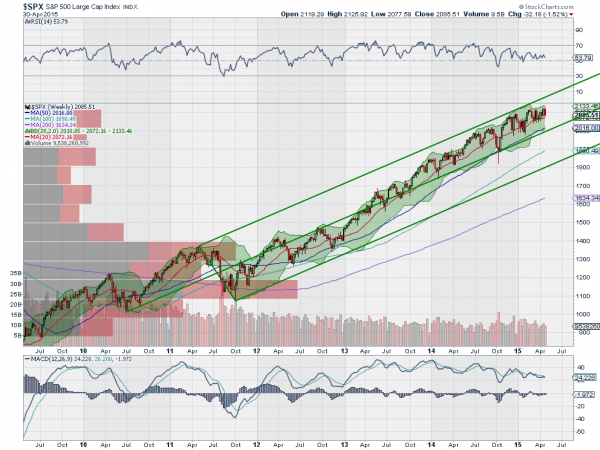

Below is a good way to look at the price trend in the S&P 500. The chart shows the Andrew’s Pitchfork tool applied since the 2010 pullback low. It shows nothing but a solid uptrend and in between the Median and Upper Median Lines since mid 2013. The S&P 500 could pullback to 2000 and still be in the top half of the uptrend, with no damage at all. Take a look at the Moving Average lines. Nearly parallel, rising, just a beautiful uptrend.

What it also shows is the RSI and MACD are positive. These momentum indicators will be a source of controversy I’m sure. The RSI is trending lower since July last year and the MACD is making lower lows. But both are still in bullish ranges. In fact if you consider the scale on the MACD it has been almost a sideways consolidation, while the RSI has also continued to bounce off of support at the mid line. I would argue that if you do not understand this then you should be removing the RSI and MACD from your charts as they are the only thing to get you the slightest bit nervous here.

Professionals as well as novices will always find data to support their view. Even in a bull market. The media model of selling eyeballs encourages wild and stunning predictions, making it even harder to shut out noise and think objectively. Please give it a try though. Ask yourself simple questions. Does it really make sense to move from new highs to a bearish market view in 4 days? I will wait for evidence.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.