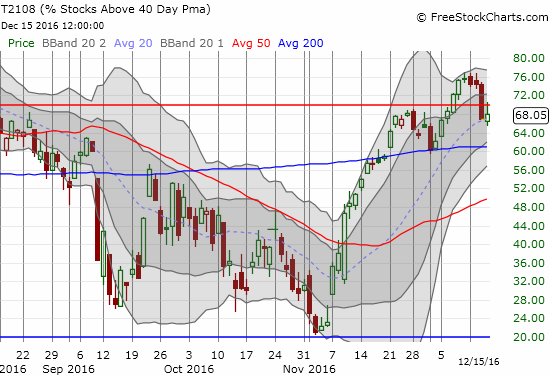

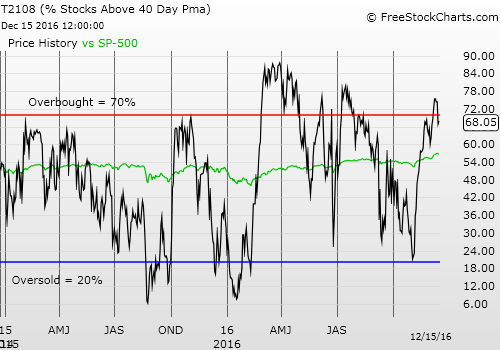

T2108 Status: 68.1% (as high as 70.5%)

T2107 Status: 63.8%

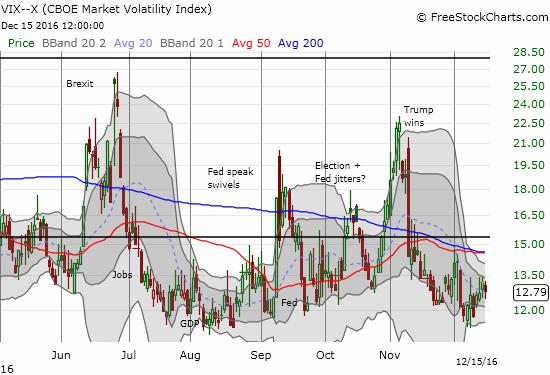

VIX Status: 12.8

General (Short-term) Trading Call: cautiously bearish

Active T2108 periods: Day #207 over 20%, Day #27 over 30%, Day #26 over 40%, Day #24 over 50%, Day #18 over 60%, Day #2 under 70%

Commentary

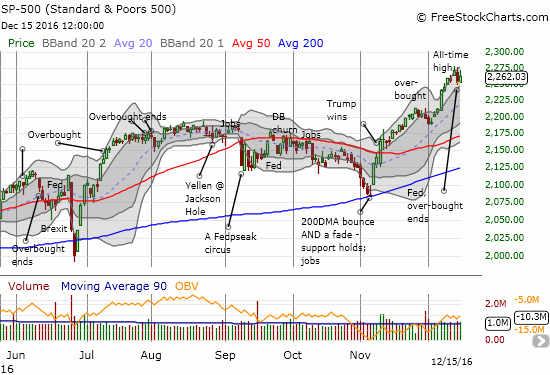

The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) made a great effort to recover the momentum and bullish feeling that it lost in the hangover from Wednesday's Federal Reserve announcement of monetary policy. At its high of the day, the index recovered all of Wednesday's loss. Sellers returned at that point to push the S&P 500 backward and a smaller 0.4% gain.

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), briefly returned to overbought conditions before the fade. This rejection adds a little more fodder to the bearish case newly staring down the stock market.

The small success of the sellers did not cause much concern in the stock market as the volatility index, the VIX, dropped for the first time in 3 days. I will call the small decline the expected post-Fed fade of volatility.

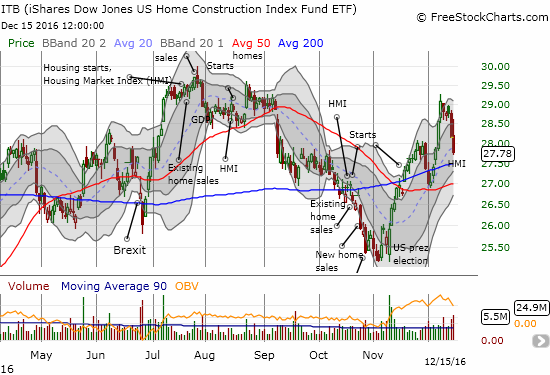

The bearish case remains subtle, but the selling in homebuilders caught my immediate attention. Just ahead of the Fed, I sold my call options on iShares US Home Construction (NYSE:ITB) as a precaution and locked in my gains. I am quite relieved I took the precautions. ITB rallied after the release of the Housing Market Index (HMI), but sellers returned with such ferocity that ITB closed with a 1.3% loss. ITB is now suffering stark underperformance just when it is supposed to experience seasonal outperformance.

The iShares US Home Construction (ITB) has sold off 4 of the last 5 trading days on high volume. Critical tests of 200 and 50DMA support are coming up.

Given I do not think the Fed’s move was particularly hawkish or damaging, I remain focused on the next buying opportunity in ITB. At some point I will buy the dip again independent of my short-term trading call. (For background on my bullishness on housing, see my latest “Housing Market Review.”)

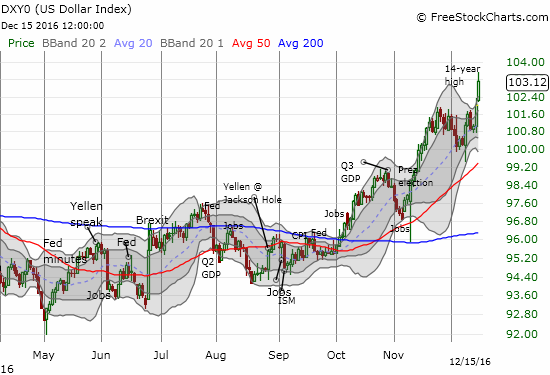

Lastly, the U.S. dollar index (DXY0) continued its surge. The dollar is definitely back in “full bull” mode with a breakout to a 14-year high. It is time for me to get back onboard after having unloaded most of my dollar longs ahead of the Fed as a matter of precaution; I was half-expecting a “sell the news” response to the Fed’s rate hike.

The U.S. dollar index (DXY0) broke out to a fresh 14-year high. The bullishness is unmistakeable again.

SPDR Gold Shares (NYSE:GLD) has suffered mightily since Trump won the Presidency, largely thanks to the strong U.S. dollar. The Fed rate hike added more insult to injury. Can GLD escape 2016 with a positive gain? For now, it looks like a beeline to where it traded after the Fed hiked a year ago.

The bottom-line: I think the case for the bears got incrementally stronger on Thursday from a technical standpoint. Surprisingly, we are yet to see the market worry much about the implications of a scorching hot U.S. dollar. Accordingly, I decided to take another bearish step by loading up on shares of ProShares UltraShort S&P500 (NYSE:SDS). I avoided put options in anticipation of what I THINK should be a relatively benign holiday trading period.

The Apple (NASDAQ:AAPL) put options I bought on Wednesday are likely going down in flames, but I reloaded with an expiration of next Friday. For a twist, I added to some call options on commodity plays in case the market goes back to rotating them upward. While a strong U.S. dollar should be a strong negative, a whole host of commodity plays have rallied in spite of dollar strength.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

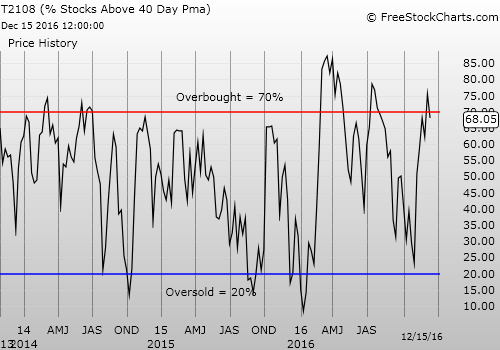

Weekly T2108

Full disclosure: long AAPL puts, mixed positions on the U.S. dollar (probably time to get net long again?!?!), long GLD