For weeks there has been debate about whether the S&P 500 was topping or just consolidating to regain strength for a new move higher. That debate has been answered as the S&P 500 moved higher out of a nearly 4 month range. But that wont stop the ‘buts’ from coming, keeping many on the sidelines.

I find it incredibly crazy that as the market makes new all-time high levels the bullish investor sentiment (as measured by the AAII) is holding at low levels. What is more, money is supposedly flowing out of the market.

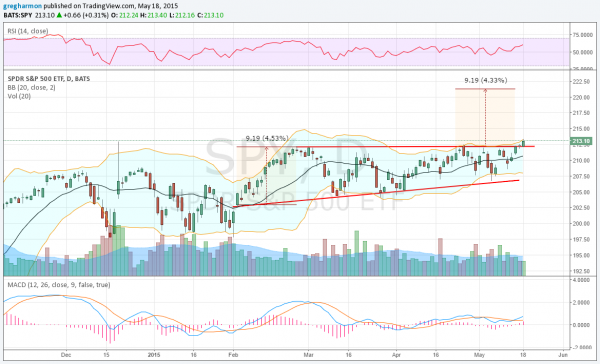

The chart of the price action above is very bullish. First the price itself broke the consolidation area. But as it did that the Bollinger Bands® started to open higher to allow it to move up. The momentum indicators also moved positively. The RSI is making a higher high in the bullish zone as it rises and the MACD is crossed up and rising. This chart suggest that the break out could continue to 221 or more.

So why are there so many naysayers and investors sitting in cash waiting for a correction? Well you can create any number of bearish looking indicators. From the fundamental side companies reported beating on earnings this past quarter but did not do as well on sales. The macro picture suggests sluggish growth of less that 2.5% for 2015. And even the technicians will say that the move higher has happened on declining volume or breadth or whatever indicator they found to justify a bear case (disclosure: I am a technician).

I take all of these arguments and statistics in the totally opposite view. Money flowing out of stocks and sentiment at lows means there is a huge potential if those in that situation flush with cash decide to chase performance. Low and moving lower earnings and sales expectations are setting the bar to beat ever lower. This will make it easier next quarter to beat.

But in the end, it does not matter what I think. For every argument for more upside pundits and pros can come up with 2 or more for the downside. What matter though is that the S&P 500 is moving higher. You can have your view whichever way you want to spin it. But if you are not invested as the market is rising then does it really matter if you are right or wrong?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.