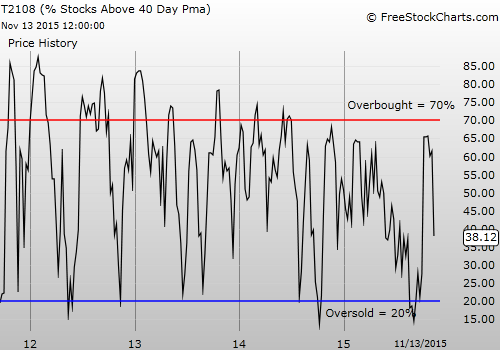

T2108 Status: 38.1%

T2107 Status: 25.5%

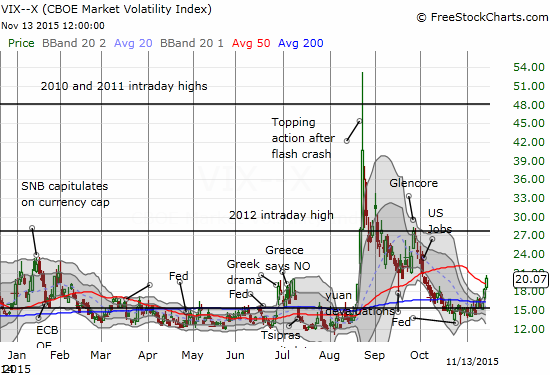

VIX Status: 20.1

General (Short-term) Trading Call: bearish

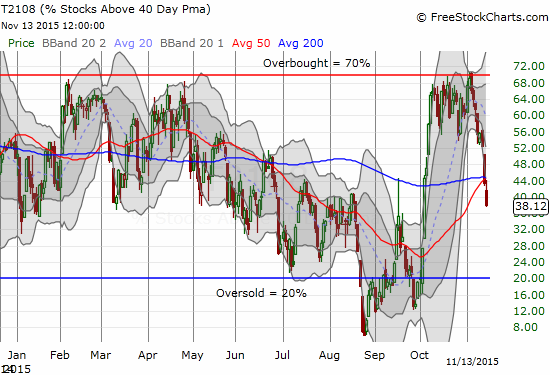

Active T2108 periods: Day #30 over 20%, Day #29 over 30%, Day #1 under 40% (ending 28 days over 40%) (underperiod), Day #2 below 50%, Day #4 under 60%, Day #344 under 70%

Commentary

I am keeping this update short given the tragic terrorist attack in Paris Friday night, November 13th. It is very possible that the nature and tenor of trading change as a result. I visited Paris for the first time last year. Although it was a quick day trip in the middle of a layover, I thoroughly enjoyed myself and still look forward to visiting again one day soon. My prayers go out to everyone impacted by this atrocity.

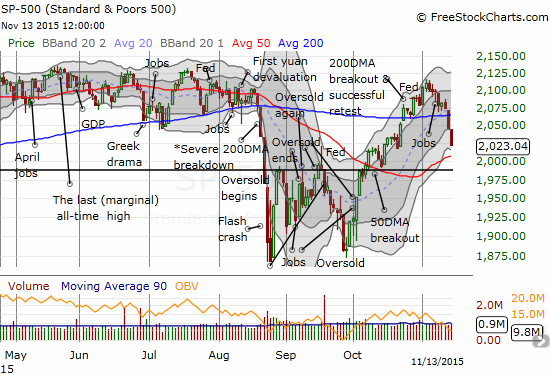

The S&P 500 (N:SPY) lost 1.1% on the day, and finished the week with a 3.6% loss. It was a week the began ominously; the selling validated the alarm bells I rang to start the week.

An important test of support at the 50-day moving average (DMA) looms for the S&P 500.

The 50-day moving average (DMA) is trending upward, so a test of this support is very critical for the S&P 500. The potential test comes with T2108 plunging from 61.7% to start the week to 38.1% to close the week.

T2108 plunges out of the trading range that defined its behavior for a month just below overbought status.

Once T2108 drops into the 30s, I start to think about oversold trading conditions. In recent years, the low 30s have served as “close enough” to trigger a (short-term) bottom in the trading action. In this case, I am more interested in fading volatility than playing the S&P 500. I strongly suspect that any bounce in the S&P 500 will be short-lived and capped by its 200DMA. The volatility index, the VIX, is reaching “elevated” status at 20.1. I would target a return to the 15.35 pivot on a fade and make the trade a quick flip on shares of ProShares Short VIX Short-Term Futures (N:SVXY).

The volatility index is making a move

For trading, I unloaded a lot of put options Thursday and Friday. These were positions primarily on stocks I featured in various charts during the week. I was glad to have them convert so quickly. I dabbled in some call options on select positions.

One small sign that things could soon turn for the buyers and bulls is Caterpillar (N:CAT). It made a very bearish breakdown with a gap down below its 50DMA on Thursday, but on Friday the stock showed very surprising relative strength. CAT managed to rally while most of the market was selling off.

Caterpillar (CAT) manages a surprising bounce the day after a very bearish breakdown

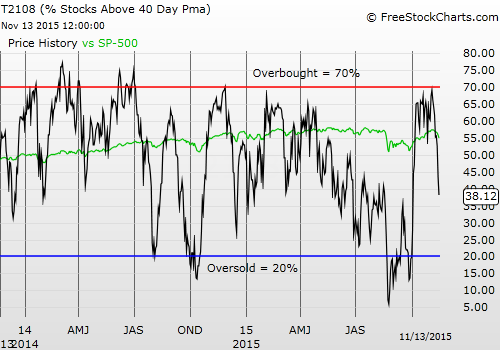

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: short CAT