Key US and European stock indices are under moderate pressure on Wednesday, while tensions are rising in emerging markets.

The FTSE China A50 and China H-Shares futures indices have lost 1.5% and 2.5% so far today, reflecting a U-turn in global investor sentiment against risk.

The Russell 2000 index of US small-cap companies lost 3.5% overnight, confirming that the sell-off extends far beyond EM's individual stories (China, Turkey or Russia). Investors are locking in gains in risky assets, concentrating purchases in the most liquid companies, which explains the very moderate decline in the S&P500 or DJIA.

The currency market this week is also marked by a classic risk-off dynamic. The pairs with yen have started to go downhill, with the dollar, euro, and pound stepping down after a steep rise since the start of November.

It may well be that the markets are now balancing portfolios from this move of the last few months. It has been most pronounced in some asset classes (oil, equity indices). It has been less directional in the FX market.

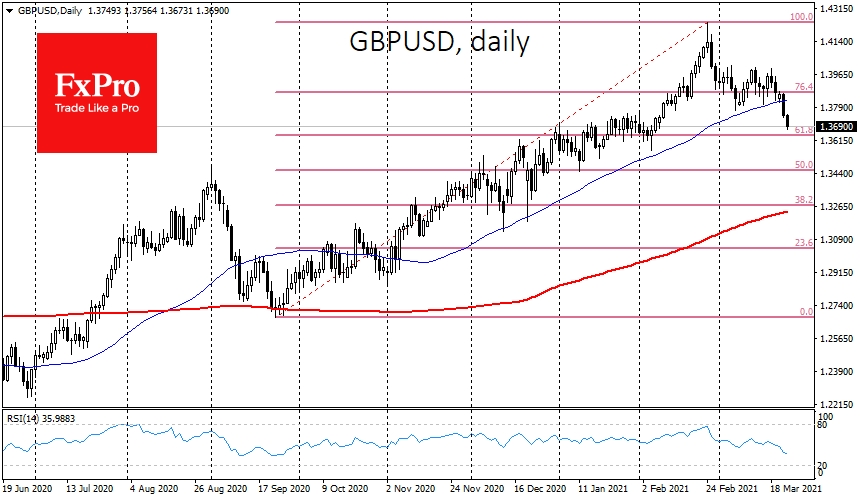

GBP/USD was already above the 50 SMA in November and increased steadily. Yesterday, the pair fell under this line, reflecting a breakdown in the recent trend.

The nearest target for the technical correction is 1.3650, the area of the previous consolidation. There is also support at 61.8% of the last rally.

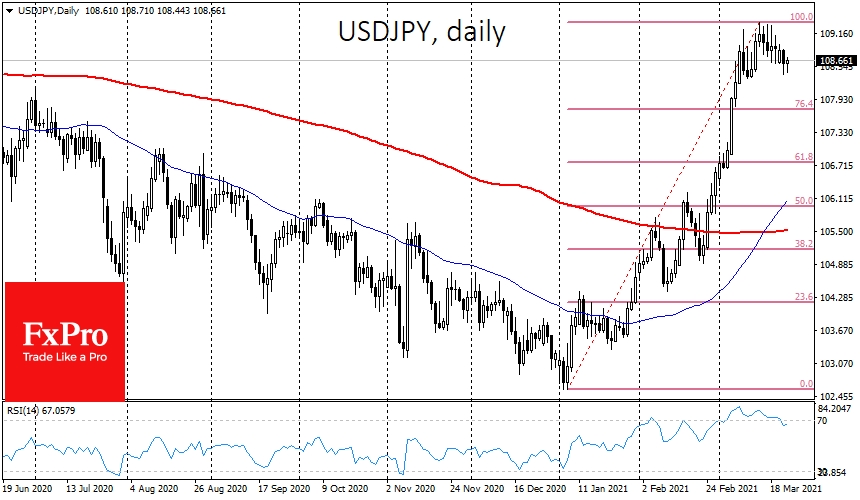

The movement against the yen started only this year, though it was pretty aggressive and caused a 7% drop. The nearest target for a pullback from that rally is 107.7 (76.4% of the rally from 102.5 to 109.4).

For EUR/JPY, the upside impulse, which started at 121.2 in November and depleted at 130.70, the first retracement level at 76.4% of the rally is currently being tested. If successful, the bearish target might be the 127.2 area (former resistance and 61.8% retracement level from the rally).

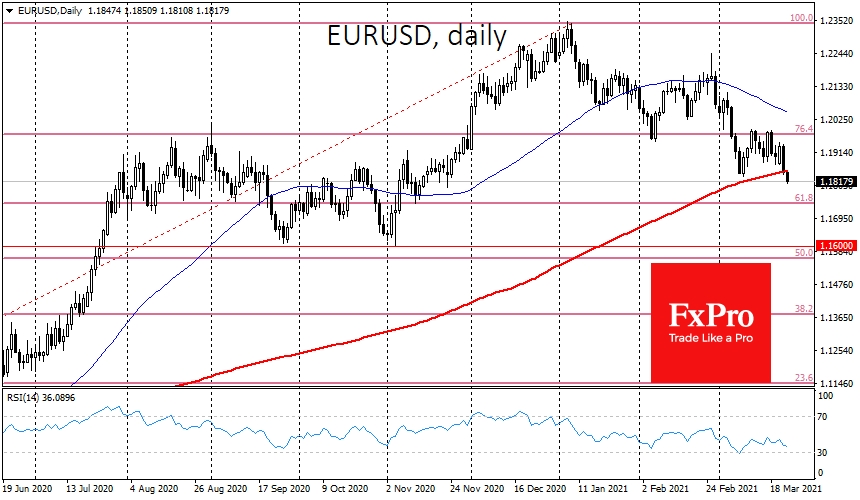

EUR/USD looks the heaviest, having closed under the 200 SMA at 1.1850 on Tuesday. Potentially, the bears might not loosen their grip until the slide to 1.1600, the support area of October and November, giving away about half of the rise from 1.08, the very start of the euro rally last year, to a 1.2350 peak in January.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Risk-Off On Markets Is Classic Yet Soft

Published 03/24/2021, 06:30 AM

The Risk-Off On Markets Is Classic Yet Soft

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.