No single variable or statistic provides clear insight into the future direction of the economy or stock market. When a data point does not fit one's narrative though, justification to eliminate it seems to be gaining among some strategists.

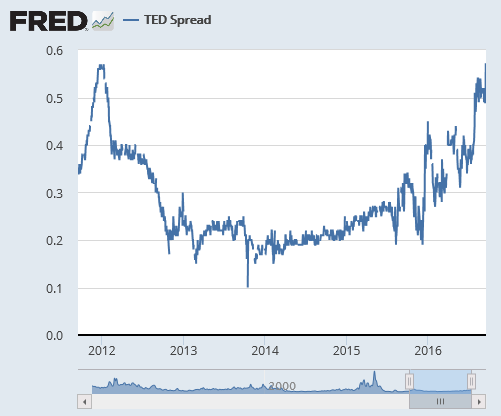

Recently, the market has seen a fairly significant spike in LIBOR and a resultant increase in the TED Spread, i.e., 3-month LIBOR minus 3-month Treasury.  '

'

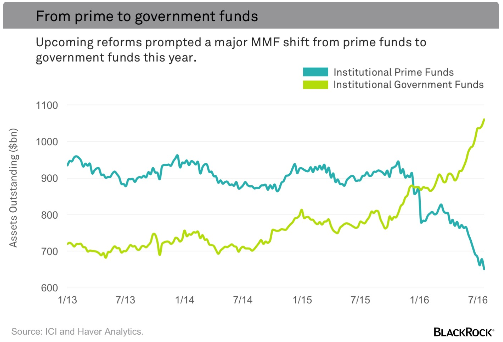

It seems—and it's probably accurate—the increase in the spread can be attributed to money market reform taking place in the U.S. effective by mid October. The reforms remove the $1 fixed net asset value for institutional prime money market funds to a floating rate structure.

In addition to a floating rate, funds will be permitted to suspend withdrawals for a period of time or assess redemption fees. The money market changes have resulted in fund redemptions in the so-called prime funds and a move to money market funds that invest in government debt.

Clearly, the new regulatory rules impacting money funds are having an impact on LIBOR as well as the TED Spread. The TED spread is a measure that provides insight into credit risk within the economy. As noted by Wikipedia,

"An increase in the TED spread is a sign that lenders believe the risk of default on interbank loans (also known as counterparty risk) is increasing. Interbank lenders, therefore, demand a higher rate of interest, or accept lower returns on safe investments such as T-bills. When the risk of bank defaults is considered to be decreasing, the TED spread decreases."

Prior to the financial crisis in 2008 the widening spread was a signal about the lack of health of the banking system. Problematic is the ease with which some are dismissing today's widening TED Spread and attributing its widening simply to the money market reform legislation.

A case in point is an article that appeared in The Wall Street Journal on Thursday suggesting the TED Spread might just be dead. Could there be more to the spread widening though?

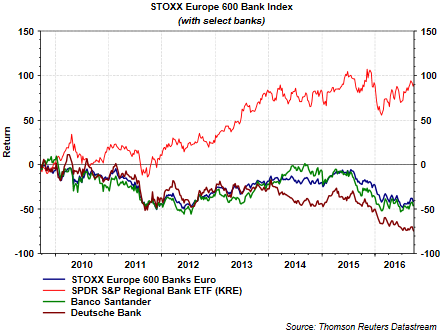

If the TED Spread widening points to issues with interbank loans and counterparty risk, one need look no further than issues facing some European banks. Most recently, the issues facing Deutsche Bank (NYSE:DB) and discussed in this article. The stock price performance of the STOXX Europe 600 Banks Index versus the SPDR Regional Bank Index (NYSE:KRE) and a couple of select banks can be seen below.

Is the European Bank Index performance signalling issues within the banking sector in Europe and thus contributing to a wider TED Spread?

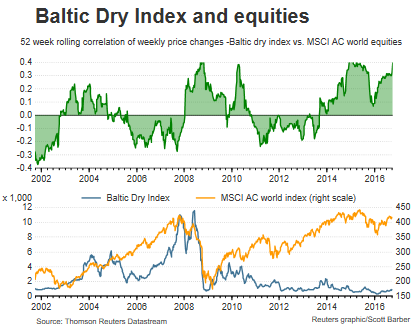

Lastly, the Wall Street Journal article link above also commented on the Baltic Dry Index no longer being useful, noting:

"It isn’t the first time an indicator of financial and economic stress has stopped being useful."

"The Baltic Dry index, which measures shipping costs for dry bulk commodities, was once used as a bellwether of conditions in trade and the world economy and successfully warned of impending crisis months before Lehman Brothers collapsed in 2008."

"More recently, it has surged and dipped so much that it no longer seems to be signaling macroeconomic events. The index fell to its lowest ever level early this year before surging again, with no noticeable boom or bust in the global economy."

In actuality, the Baltic Dry Index (BDI) may be more useful today than it was from 2011 through 2014. However, the Baltic Dry Index weakness during this period was likely due to slowing in the emerging markets and the fall-off in demand in the developing world.

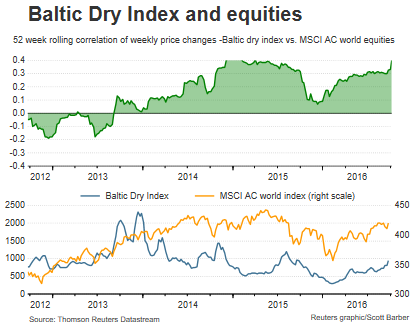

As the bottom half of the long-term chart below shows, it appears there is a disconnect between the performance of BDI and the MSCI all-country World Index since 2009. Since 2014 though, the correlation of the BDI versus the MSCI ACWI has been positive.

The second chart below is a shorter term view, and the increase in the BDI is associated with a move higher in the MSCI ACWI.

LIBOR rate setting has had issues that arose in a lead-up to the financial crisis. A timeline of these events can be viewed in this New York Times article/timeline.

Nonetheless, as with the Baltic Dry Index, relevant information continues to be projected by that index and I believe the TED Spread as well. With the TED Spread, factors beyond money market reform just might be bubbling up and contributing to the spread widening.

Dismissing the TED Spread, and the Baltic Dry Index for that matter, simply because they may not fit one's point of view, comes at one's own potential peril. Globally, the world is growing at a below-trend pace and central banks' continue to influence economies, both of which make some of the data difficult to interpret, but not factors justifying dismissing the information being provided by these two indicators.