This past week we saw a slew of results from media companies, which kicked off Wednesday with reports from Time Warner (NYSE:TWX), CBS Corporation (NYSE:CBS) and News Corp (NASDAQ:NWS). Both Time Warner and News Corp beat both the Wall Street consensus and the higher Estimize consensus on the top and bottom-line, while CBS surpassed the Street’s expectations, but fell short of what we were calling for here at Estimize.

Disney (NYSE:DIS) was the most anticipated release after Friday’s closing bell, and results disappointed. While EPS of $0.89 and revenues of $12.39B met the Wall Street estimates, they missed the Estimize consensus by $0.04 on the bottom-line and $59M on the top-line. Stocks fell in after hours trading.

This coming week, the retail parade begins, with Fossil Group Inc (NASDAQ:FOSL) reporting Tuesday, Macy’s (NYSE:M) on Wednesday, and Wal-Mart (NYSE:WMT), Kohl's (NYSE:KSS) and Nordstrom (NYSE:JWN) on Thursday. All five of these retailers are anticipated to post year-over-year growth for both profits and sales.

Those expected to be the biggest winners on the EPS front are Fossil and Macy’s, estimated to increase 16% and 12% from Q3 2013. On the revenue front, only Nordstrom is expecting double-digit growth of 10% for the third quarter.

Of the retail industries within the S&P 500, internet retailers came in the strongest with 25% earnings growth year-over-year; all 5 companies from that industry have reported. The next best estimate comes from the specialty retailers, anticipated to increase 14.8% this quarter, off of strength from Best Buy (NYSE:BBY) which is expected to show a profit increase of 52% when they report on November 20, and from home improvement outfits such as Home Depot (NYSE:HD) and Lowe's (NYSE:LOW) both expecting growth of over 20%.

The textiles, apparel and luxury goods industry is looking to grow 10.1%, incredible results from Michael Kors (NYSE:KORS) earlier this week helped to boost the industry. The biggest loser this quarter are the multi-line retailers, with low growth of 2.3% due to disappointing results and expectations from the discounters.

How Are We Doing?

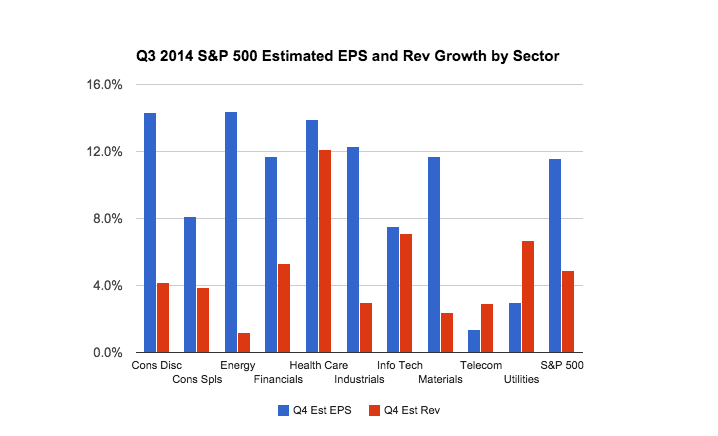

Expectations for S&P 500 earnings growth for the third quarter stand at 11.6%. Revenues are anticipated to come in with 4.9% growth. All 10 sectors are anticipated to post positive YoY growth on both the earnings and revenue front.

Leaders

Earnings:

- Energy (14.4%). Notable industry: Oil, Gas and Consumable Fuels (14.6%)

- Consumer Discretionary (14.3%). Notable industry: Internet Retailers (25.3%)

- Health Care (13.9%). Notable industry: Biotechnology (45.1%)

Revenues:

- Health Care (12.1%). Notable industry: Biotech (39.0%).

- Information Technology (7.1%). Notable industry: Software (15.7%)

Laggards

Earnings:

- Utilities (3.0%). Notable industry: Electric Utilities (0.7%).

- Telecommunication Services (1.4%): All five companies are within Diversified Telecom Services. Only Verizon (NYSE:VZ) posted yoy growth.

Revenues:

- Energy (1.2%). Notable industry: Oil, Gas and Consumable Fuels (0.5%).

- Materials (2.4%). Notable industry: Paper & Forest Products (-18.3%).

Beat/Miss/Match

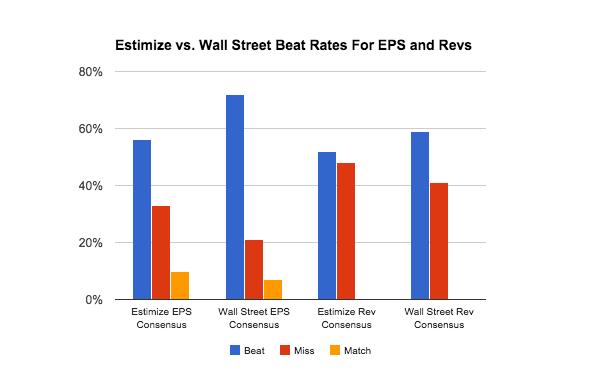

Earnings: With over 80% of the S&P 500 reporting thus far, 56% have beaten the Estimize consensus, 34% have missed and 10% have met. This is compared to Wall Street estimates, of which 72% of companies have beat on the bottom-line, 21% have missed and 7% have met.

Revenue: 52% have beaten the Estimize consensus, 48% have missed, and 0% have met. For revenues, 59% of companies have beat the Wall Street estimate, while 41% have missed.