Historically, the stock market has proven to be one of the best ways to protect and grow your wealth. When you look past short-term ups and downs, the market steadily moves in only one direction: up.

And yet, there’s been a significant decline in market participation since the 2008 financial crisis.

Sixty-five percent of adults in the U.S. were invested in stocks right before the market crash. Today, that percentage is down to 55%.

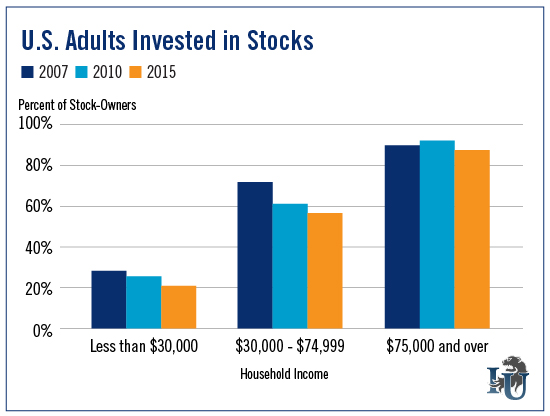

When we break it down further by income, as shown in the above chart, we see that the most significant drop occurred among households earning less than $30,000 annually. The number of lower-income investors declined by 25%.

The number of investors in households making between $30,000 and $74,999 dropped 22%.

But as last week’s chart asserted, stocks are simply too good of an opportunity to pass up for wealthier individuals. That’s why the number of investors in households earning $75,000 and over declined by only 2% since 2007.

Clearly, investor confidence has yet to fully recover. Fear of loss is a powerful emotional driver of behavior. Yet the best investors have learned to overcome their fear... to maintain an opportunistic attitude even in a crisis.

This is precisely what our Chief Investment Strategist Alexander Green counseled in his recent column, “Where You Can Find Cash in a Market Sell-Off.”

At time of writing, the S&P 500 is up 259% since its low in 2009. Yet, out of fear, some folks would rather settle for the pitiful annual interest rate offered by their savings account...

That’s a real shame.

P.S. Imagine logging into your bank account and finding a seven-figure balance. You’d be overjoyed, right? This isn’t an unattainable goal. Fact is, there’s a simple and direct route to financial independence. And if you can commit just a few minutes a day, Alex can show you how to build a multimillion-dollar portfolio starting with zero.