While yesterday’s statement on the conduct of monetary policy by the Australian Treasurer and the Governor of the Reserve Bank isn’t the type of release which instantly moves markets, the long term implications are certainly worth taking a note of.

So what exactly did we get?

From the statement on the conduct of monetary policy by Australian Treasurer Scott Morrison and new RBA Governor Philip Lowe:

Both the Reserve Bank and the government agree that a flexible medium-term inflation target is the appropriate framework for achieving medium-term price stability. They agree that an appropriate goal is to keep consumer price inflation between 2 and 3 per cent, on average, over time.

This formulation allows for the natural short-run variation in inflation over the economic cycle and the medium-term focus provides the flexibility for the Reserve Bank to set its policy so as best to achieve its broad objectives, including financial stability.”

I’ve made it clear that in my opinion moving inflation targets is not the answer, no matter how broken the system in today’s low inflation/low rate global environment actually is, but this rewording of the 2013 agreement to some extent does just that.

By adding the words ‘over time’ to their 2-3% on average target, the RBA has essentially removed a key part of the mandate that all but sealed the last rate cut. While the 2-3% target remains, the RBA can now view the inflation target as a longer term goal, giving Lowe much more flexibility than his predecessor had.

The addition of ‘over time’ should make the quarterly CPI numbers a little less market sensitive as they may not have the same weight on the following interest rate decision than they previously did.

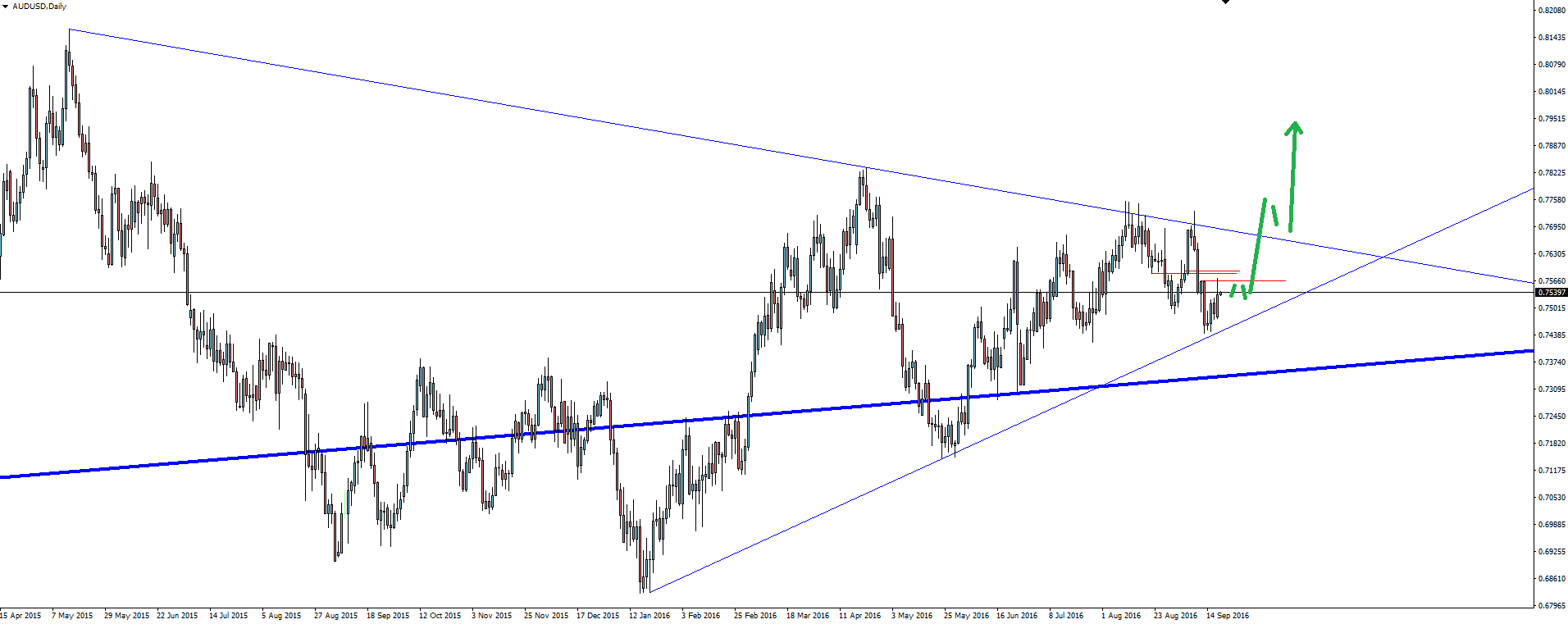

Now looking at the AUD/USD chart, making the RBA that little less trigger happy when it comes to cutting rates fits in nicely with yesterday’s discussion around possible US dollar weakness or disappointment heading into/following Thursday’s FOMC meeting.

Possible AUD/USD Daily Scenario:

With AUD/USD itching to break-out of the triangle that price has been coiled up inside, we have a few short term levels of resistance we’re coming into, but once that goes, it might not take long to hit the top.

In the near term from here, it will be all about what the Fed decides to do.

We wait.

On the Calendar Tuesday:

AUD Monetary Policy Meeting Minutes

USD Building Permits

NZD GDT Price Index

CAD BOC Gov Poloz Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.