In today’s macro environment, changing the goalposts because you can’t score between them is NOT the answer to the ineffective nature of contemporary monetary policy.

You can’t just move the target or you may as well be shooting bubbles!

RBNZ Governor Graeme Wheeler, speaking about monetary policy challenges in turbulent times in Dunedin today, summed up the matter perfectly:

“There is nothing sacrosanct about what particular inflation band or target should be adopted as a measure of price stability. However, changing a target when times become tougher reduces the incentives on central banks to achieve earlier agreed goals.

“It could damage the central bank’s credibility – particularly if a perception develops that the central bank will continually seek to respecify goals.”

Yet more common sense from across the ditch, while in an Australian parliament lacking a substantial majority, smaller parties who are low on substance but high on rhetoric recieve the airtime.

Jacob Greber’s article on the topic in today’s Australian Financial Review is worth the read (Google) News search the headline) before we head to the charts.

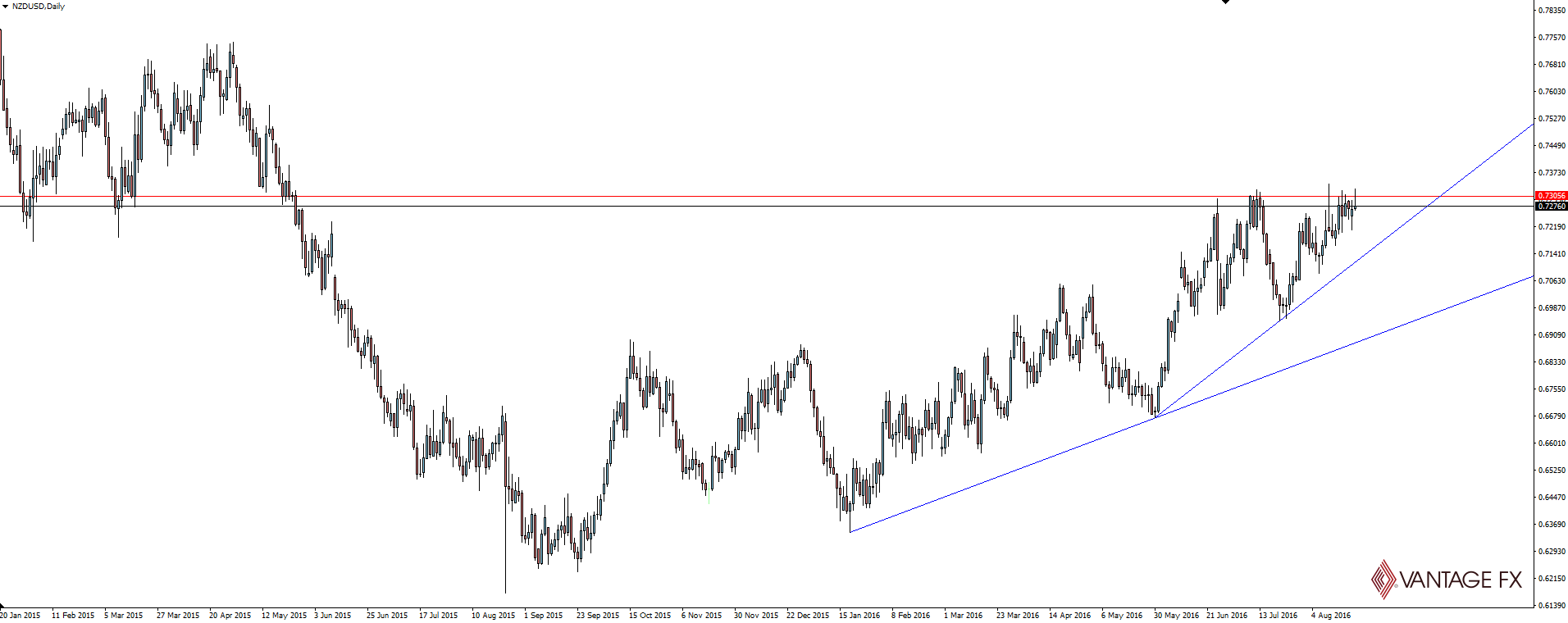

NZD/USD Daily:

Wheeler’s speech actually had a little bit in it for both the bulls and the bears. He signalled further rate cuts, but not at an unstabilizing, rapid pace that maybe the market has come to expect from an at times erratic RBNZ.

The initial bullish spike in kiwi has already all but retraced after hitting higher time frame resistance, keeping the level in play.

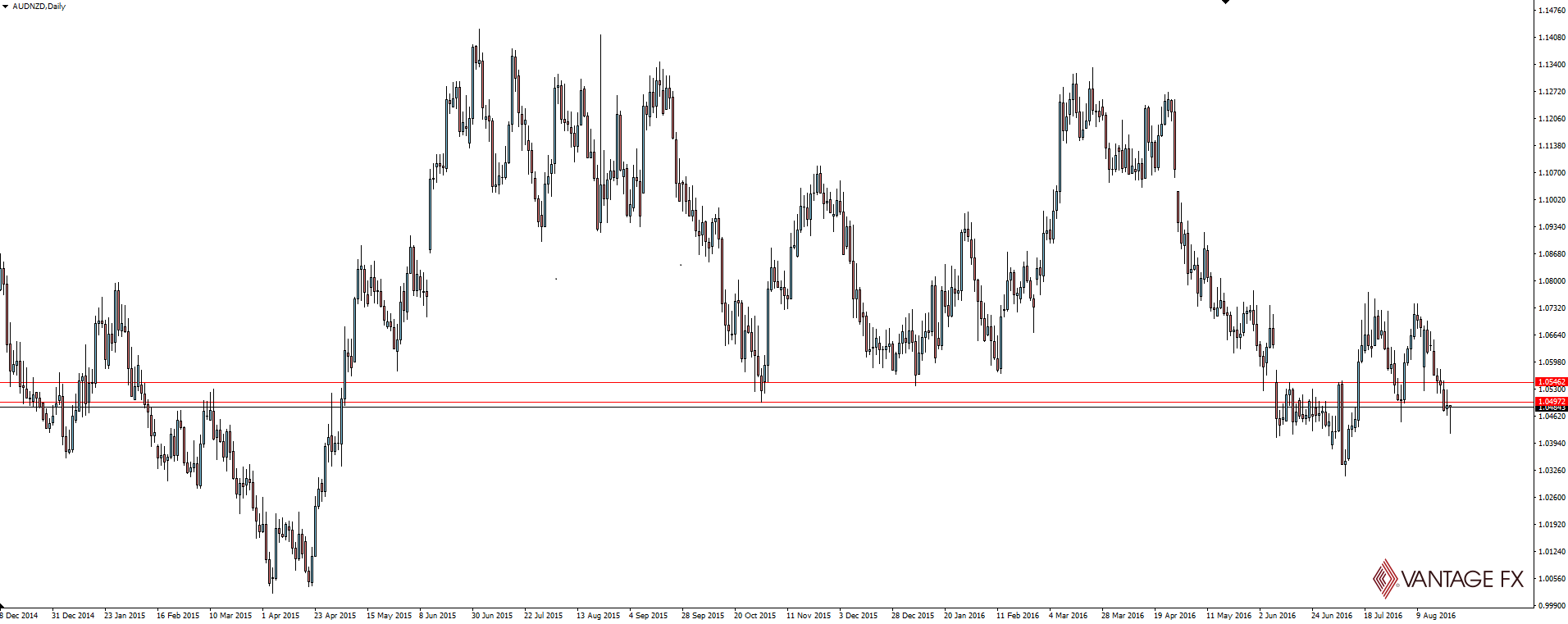

AUD/NZD Daily:

Aussie/kiwi saw a similar spike, hovering around the major support/resistance level that price had been hopping between for twelve or so months. This one is now getting a little bit too chopped up now that the fundamentals are getting involved, but it’s still worth highlighting on one of our most traded currency crosses.

At least in the southern hemisphere, common sense it seems is prevailing. Now it’s over to you America. Bring on Jackson Hole!

On the Calendar Tuesday

NZD: RBNZ Gov Wheeler Speaks

JPY: BOJ Gov Kuroda Speaks

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.