What To Expect From The S&P 500 Q1 Earnings Season

One of our favorite data points to track is the weekly earnings consensus estimates from Factset. As good as the weekly predictions and outlook are, it is the trend of predictions and the outlook for future growth we're most concerned about.

With the Q1 reporting season already underway and about to hit peak season, we felt it was past time to get a grip on what to expect from the market, not only this reporting season, but for the year. Based on valuations, the S&P 500 (INDEX: SPX) is trading at 22.4X its forward earnings.

The market is as highly valued as we've ever seen it and ripe for a correction. In our view, it's only a matter of timing, depth, and duration. If the Q1 reporting season fails to impress and not just with Q1 results the timing could be sooner rather than later.

The Q1 Consensus Is Good, But There's A Catch

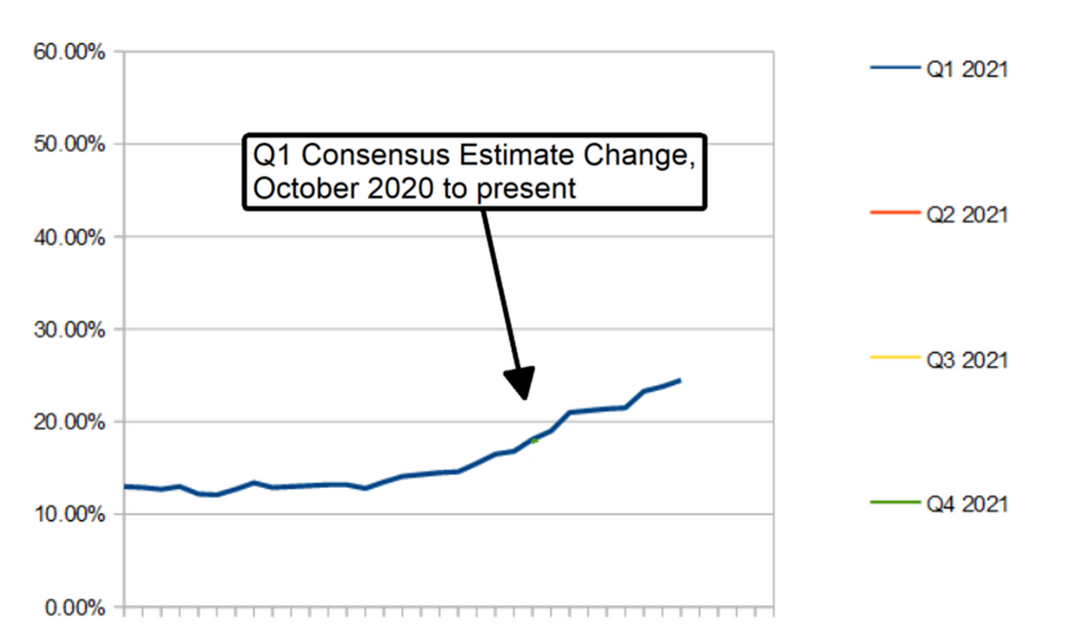

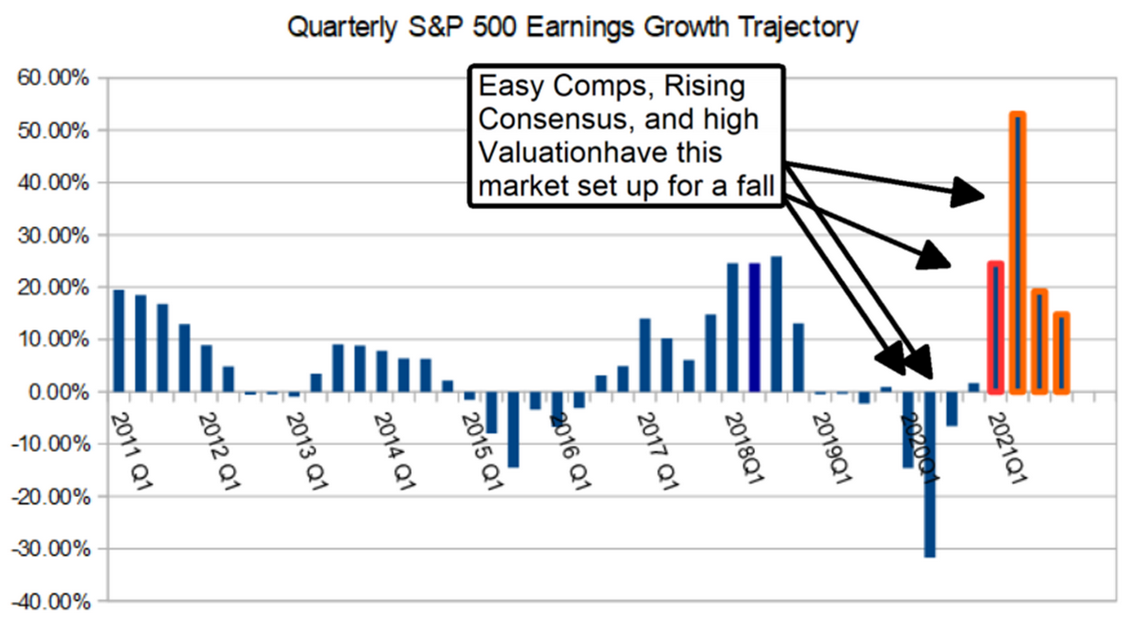

The Q1 consensus for S&P 500 earnings growth is good at 24.5% and rising. The catch is that this is the first quarter of what we will call "easy" comps, comps versus pandemically impacted quarters in 2020. In that light, the growth is still good but a paler version of itself at only 10% versus the two-year comparison. Even so, the news is good but there is a risk for the market.

With the analyst's consensus on the rise, the bar for S&P 500 companies is getting higher and higher. We still expect the average company to beat the consensus but by how much? The last two quarters saw robust double-digit outperformance vs. the consensus. We are not confident that will happen again and that has the market set up to fall. Simply meeting consensus is usually not enough to keep the market happy.

Looking forward, this problem is compounded by an increasingly easier comp. The current Q2 consensus is targeting 52.1% YOY earnings growth for the S&P 500 and that figure is on the rise.

While the upward trajectory of EPS outlook is helping to support prices in the near term, we view this data as a hurdle for the indices and one that may trip it up later in the year. Add to that an increasingly difficult comp starting with the Q3 rebound and there is a real chance the market could stall.

The comps start to get harder in the Q3 period and this will result in sharp deceleration of earnings growth. The good news is that growth is expected to remain and at a more sustainable pace. The bad news is the market will most likely experience a reset based on this outlook. At some point, the rebound stories will quit grabbing the attention and the market will have to focus on sustainability.

The Technical Outlook: S&P 500 Earnings Expectations Are In Control

The S&P 500 looks very bullish right now, but there are risks. The bullish posture is pricing in a great quarter and a great outlook that may already be priced into the market. If the average S&P 500 company fails to impress, we may see a correction that could range from a 1.0% what-was-that to a full-blown 20% bearmageddon.

We don't think the market is going to correct 20%—not now—but we do view this market as risky. Based on the data and the outlook for economic reopening the second half of the year should be strong. If that is the case, any pullback or correction we see between then and now will be a buying opportunity.

Near-term support is in the range of 4050 to 4075, firmer support is present at 3996, and strong support should be expected near 3920 or 5% below the current price action.