The expected S&P 500 upswing is underway, and the early June highs have been overcome on a closing basis. Will the sprint in the final hour of regular trading carry over into today's session? Are the bulls as strong as the one-sided result of Monday's trading suggests?

That's not a foregone conclusion, because we've seen quite a shift from Friday's sectoral dynamics. In today's analysis, I'll dive into the internals and lay out the case why the bulls still enjoy the benefit of the doubt, regardless of the persisting bearish sentiment and double top talk.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The extended launching pad above the mid-June tops propelled stocks above the early June highs. The volume of the move has been relatively muted, though. On a standalone basis, that's not an issue, as rising volume can confirm higher prices in the coming days. The white body without a striking upper knot shows that the bulls are in the driver's seat—that's no sign of a reversal.

Are the credit markets in tune with the perspective of the daily S&P chart?

The Credit Markets’ Point of View

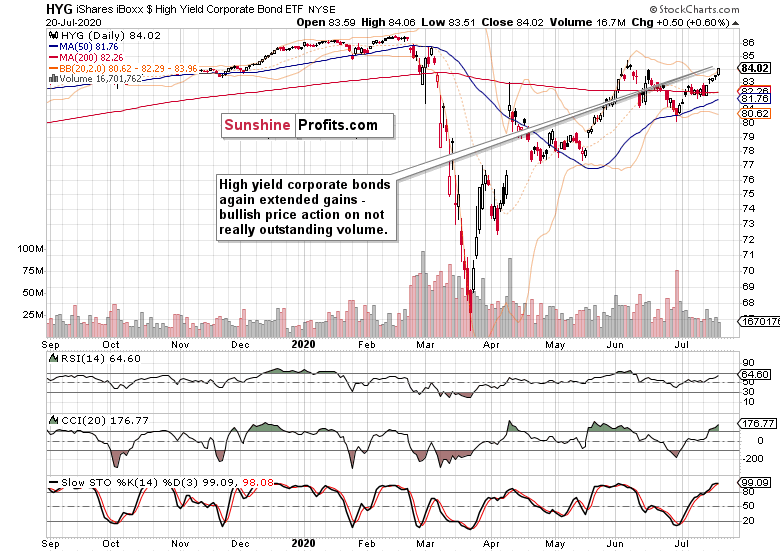

High yield corporate bonds (HYG ETF) indeed scored strong gains yesterday, but on really low volume. One day isn't a cause for a full-blown concern, but I would prefer to see it improving over the coming sessions so as to confirm the HYG price direction more convincingly.

The investment grade corporate bonds (LQD ETF) support the HYG upswing to continue—just as the HYG swing structure does.

The high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio is in tune with the overlaid S&P 500 closing prices, and both are moving higher. Stocks are already above the early June highs, while HYG:SHY has a bit more to go still. The current setup is not a screaming divergence, though—the bulls have the initiative to solve that constructively.

Spotlight on Market Breadth, Smallcaps and Emerging Markets

Both the advance-decline line and advance-decline volume have seen better days, and their readings reflect a short-term non-confirmation. Narrowing leadership is not a good omen for the bulls.

The Russell 2000 (IWM ETF) didn't rise yesterday—the small caps have paused when they instead could have risen in line with Friday's spirit of rotation into value plays. This is, as well, concerning on a short-term basis.

On the other hand, emerging markets (EEM ETF) did confirm yesterday's S&P 500 upswing, which adds weight to the bullish side of the story. It's never a good idea to act solely based on some short-term non-confirmations—instead, it pays to form as comprehensive picture as it gets, and then act on it.

The USD adds more color to the emerging markets story. There is no mad rush into dollars underway as the measured move lower attests to, which highlights no deflationary squeeze in the moment.

S&P 500 Sectors in Focus

Technology (XLK ETF) was the driver of yesterday's upswing, and its heavyweight stocks significantly gained ground. Incresing volume also lends credibility to the daily upswing.

Crucially, semiconductors (XSD ETF) outperformed again, foretelling further tech gains as being very likely indeed.

The value plays, the former laggards, disappointed yesterday, but let's discuss the sectors one by one.

Healthcare XLV ETF) treading water, materials (XLB ETF) declining on inconclusive volume, and consumer discretionaries (XLY ETF) closing at new 2020 highs. The defensive plays (utilities and consumer staples—XLU ETF, XLP ETF, respectively) took it on the chin yesterday, but their daily volumes aren't convincing enough to call the moves as reversals—daily consolidations are more probable scenarios.

Summary

Summing up, the S&P 500 made the anticipated move higher, and the bulls can deal with the very short-term non-confirmations accompanying the upswing in the coming sessions. The path of least resistance in stocks still appears to be cautiously higher as the bears aren't putting any real pressure on the bulls to prove what they're made of.