Last year I penned an article discussing the “Unavoidable Pension Crisis.”

“Currently, many pension funds, like the one in Houston, are scrambling to slightly lower return rates, issue debt, raise taxes or increase contribution limits to fill some of the gaping holes of underfunded liabilities in their plans. The hope is such measures combined with an ongoing bull market, and increased participant contributions, will heal the plans in the future.

This is not likely to be the case.

This problem is not something born of the last ‘financial crisis,’ but rather the culmination of 20-plus years of financial mismanagement.

An April 2016 Moody’s analysis pegged the total 75-year unfunded liability for all state and local pension plans at $3.5 trillion. That’s the amount not covered by current fund assets, future expected contributions, and investment returns at assumed rates ranging from 3.7% to 4.1%. Another calculation from the American Enterprise Institute comes up with $5.2 trillion, presuming that long-term bond yields average 2.6%.

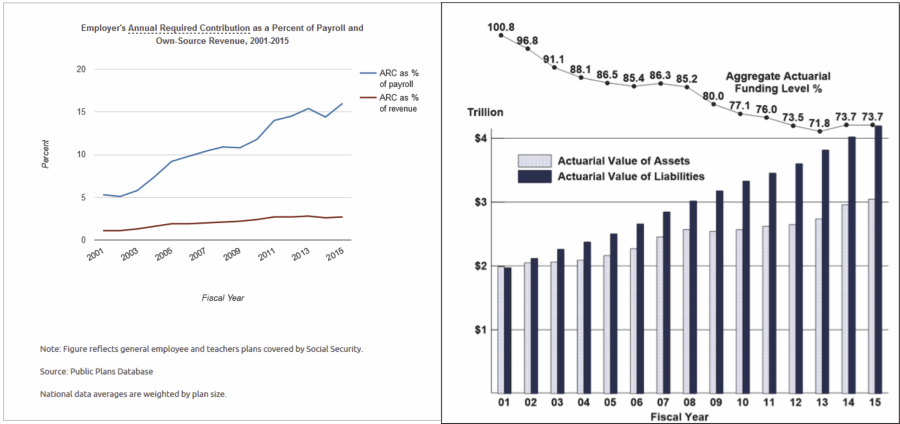

With employee contribution requirements extremely low, averaging about 15% of payroll, the need to stretch for higher rates of return have put pensions in a precarious position and increases the underfunded status of pensions.”

But it is actually worse than we originally thought as Aaron Brown recently penned:

“Today, the hard stop is five to 10 years away, within the career plans of current officials. In the next decade, and probably within five years, some large states are going to face insolvency due to pensions, absent major changes.

If we extrapolate from the past, rather than use promises in the state budget, current employees plus the state will contribute about $25 billion over those seven years, which could provide another few years before the till is empty. But it will also add around $60 billion of future liabilities to current employees. The system probably breaks down before the pension fund gets to zero, for example if assets were to fall below $30 billion while projected future liabilities exceeded $300 billion. Even the most optimistic people would have to admit the situation is unsustainable. This could happen in three years in a bad stock market, or perhaps 10 with good stock returns. But fund assets are so low relative to payouts that good returns aren’t that helpful.

The next phase of public pension reform will likely be touched off by a stock market decline that creates the real possibility of at least one state fund running out of cash within a couple of years. The math says that tax increases and spending cuts cannot do much.“

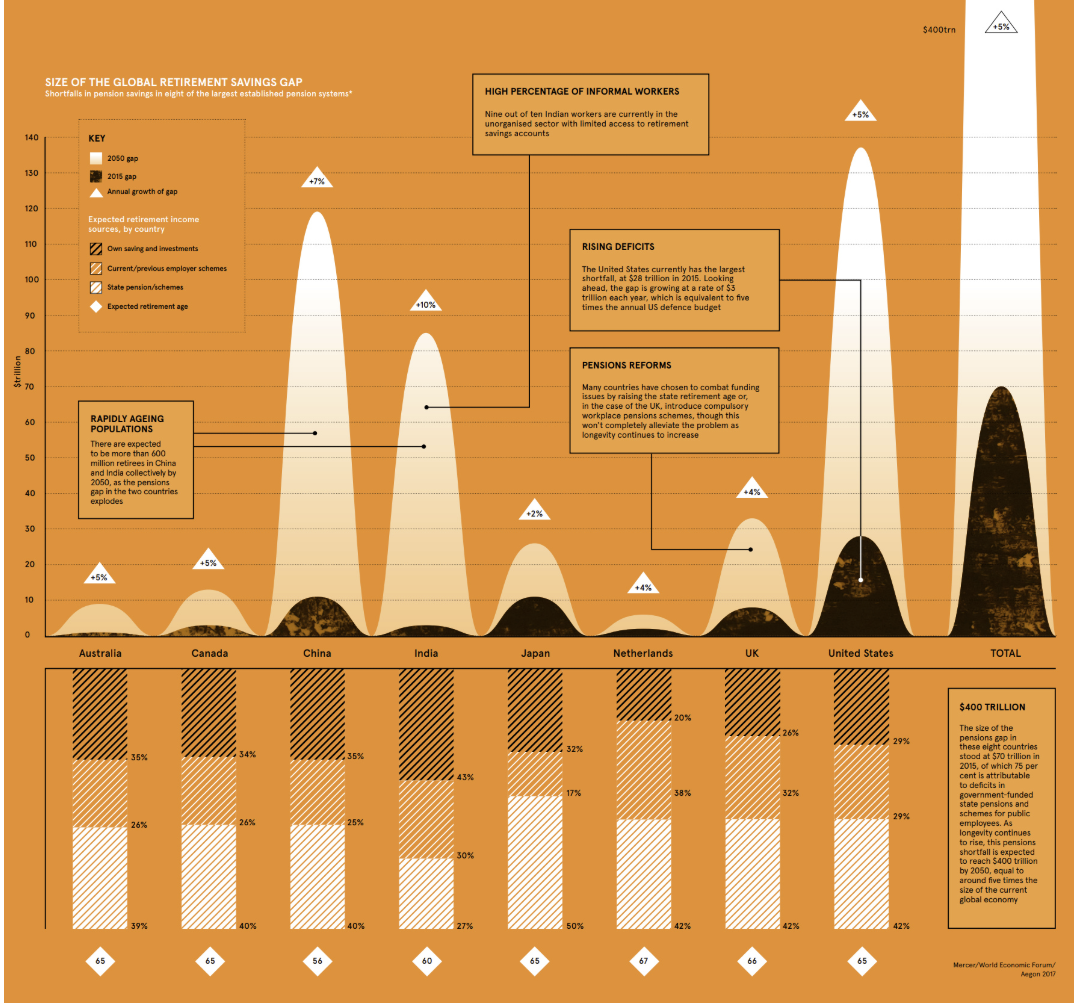

But the problem is not just in the United States, but the mismanagement of assets combined with irrational and flawed return expectations has spread globally. Visual Capitalist recently took a look at the global pension problem stating:

“According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…

The WEF says the deficit is growing by $28 billion every 24 hours – and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today.”

“The graphic illuminates a growing problem attached to an aging population (and those that will be supporting it).

Since social security programs were initially developed, the circumstances around work and retirement have shifted considerably. Life expectancy has risen by three years per decade since the 1940s, and older people are having increasingly long life spans. With the retirement age hardly changing in most economies, this longevity means that people are spending longer not working without the savings to justify it.

This problem is amplified by the size of generations and fertility rates. The population of retirees globally is expected to grow from 1.5 billion to 2.1 billion between 2017-2050, while the number of workers for each retiree is expected to halve from eight to four over the same timeframe.

The WEF has made clear that the situation is not trivial, likening the scenario to ‘financial climate change.’

Like climate change, some of the early signs of this retirement savings gap can be ‘sandbagged for the time being – but if not handled properly in the medium and long-term, the adverse effects could be overwhelming”

While we all want to ignore the problem, it is isn’t going away. More importantly, there is nothing that can, or will, change the two primary problems fueling the crisis.

Problem #1: Demographics

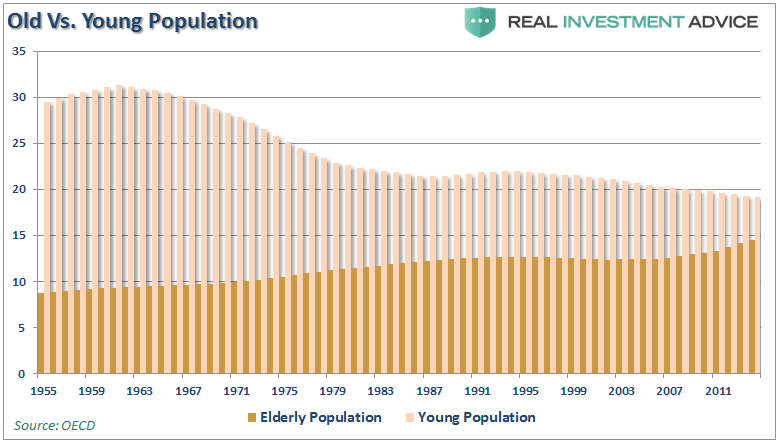

With pension funds already wrestling with largely underfunded liabilities, the shifting demographics are further complicating funding problems.

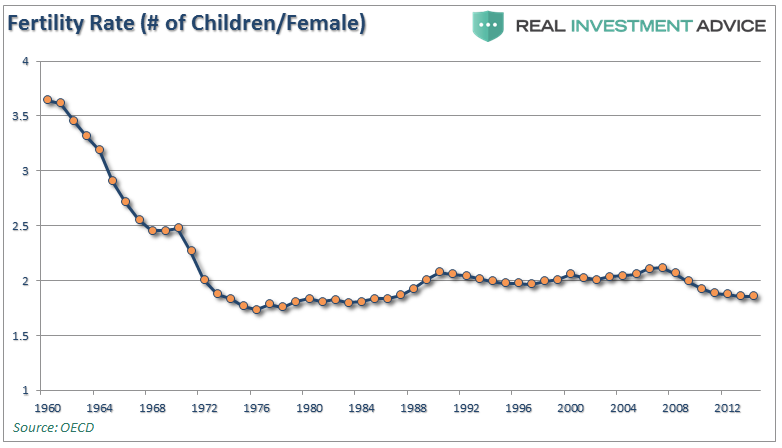

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.) However, this “support ratio” is not only declining in the U.S. but also in much of the developed world. This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate.

In 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. By 1980, the support ratio dropped to 5.1 and by 2010 it was 4.1. It is projected to reach just 2.1 by 2050.

Of course, as I have discussed previously, the problem is that while the “baby boom” generation may be heading towards retirement years, there is little indication a large majority of them will be actually retiring. As Richard Eisenberg recently noted:

“The dark, depressing and sometimes physically painful life of a tribe of men and women in their 50s and 60s who are surviving America in the twenty-first century. Not quite homeless, they are ‘houseless,’ living in secondhand RVs, trailers and vans and driving from one location to another to pick up seasonal low-wage jobs, if they can get them, with little or no benefits.

The ‘workamper’ jobs range from helping harvest sugar beets to flipping burgers at baseball spring training games to Amazon’s “CamperForce,” seasonal employees who can walk the equivalent of 15 miles a day during Christmas season pulling items off warehouse shelves and then returning to frigid campgrounds at night. Living on less than $1,000 a month, in certain cases, some have no hot showers.

Many saw their savings wiped out during the Great Recession or were foreclosure victims and, felt they’d spent too long losing a rigged game. Some were laid off from high-paying professional jobs. Few have chosen this life. Few think they can find a way out of it. They’re downwardly mobile older Americans in mobile homes.”

They, of course, are part of a large majority of individuals being dependent on the various pension systems in retirement, and the ultimate burden will fall on those next in line.

Problem #2: Markets Don’t Compound

The biggest problem, however, is the continually perpetrated “lie” that markets compound over time. Pension computations are performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables. The biggest problem, following two major bear markets, and sub-par annualized returns since the turn of the century, is the expected investment return rate.

Using faulty assumptions is the linchpin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.

It is the same problem for the average American who plans on getting 6-8% return a year on their 401k plan, so why save money? Which explains why 8-out-of-10 American’s are woefully underfunded for retirement.

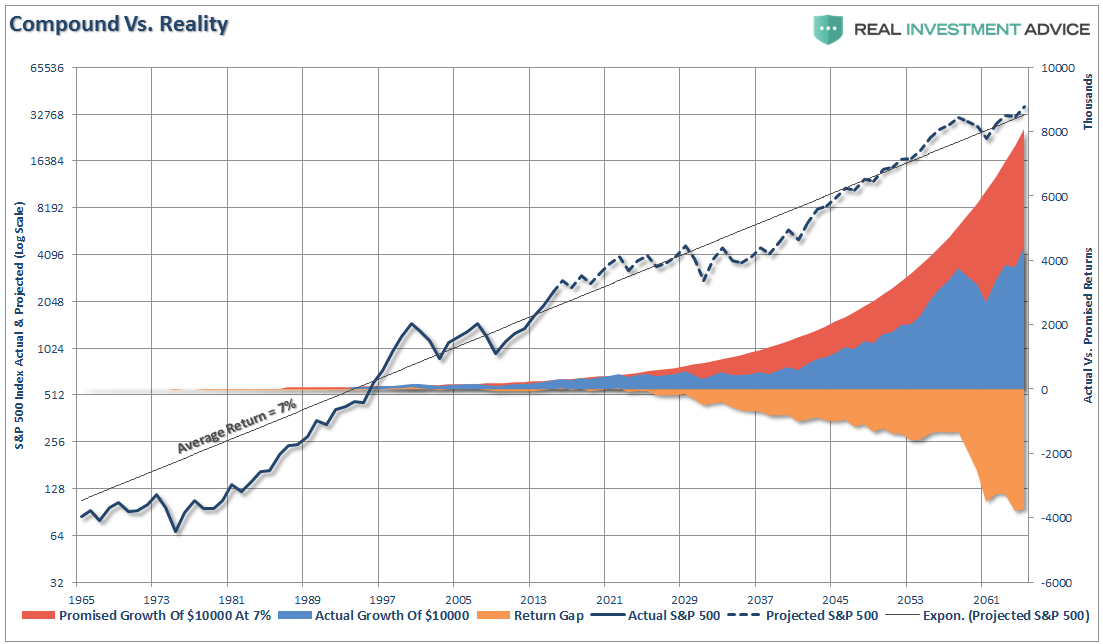

As shown in the long-term, total return, inflation-adjusted chart of the S&P 5oo below, the difference between actual and compounded (7% average annual rate) returns are two very different things. The market does NOT return an AVERAGE rate each year and one negative return compounds the future shortfall.

This is the problem that pension funds have run into and refuse to understand.

Pensions STILL have annual investment return assumptions ranging between 7–8% even after years of underperformance.

However, the reason assumptions remain high is simple. If these rates were lowered 1–2 percentage points, the required pension contributions from salaries, or via taxation, would increase dramatically. For each point reduction in the assumed rate of return would require roughly a 10% increase in contributions.

For example, if a pension program reduced its investment return rate assumption from 8% to 7%, a person contributing $100 per month to their pension would be required to contribute $110. Since, for many plan participants, particularly unionized workers, increases in contributions are a hard thing to obtain. Therefore, pension managers are pushed to sustain better-than-market return assumptions which requires them to take on more risk.

But therein lies the problem.

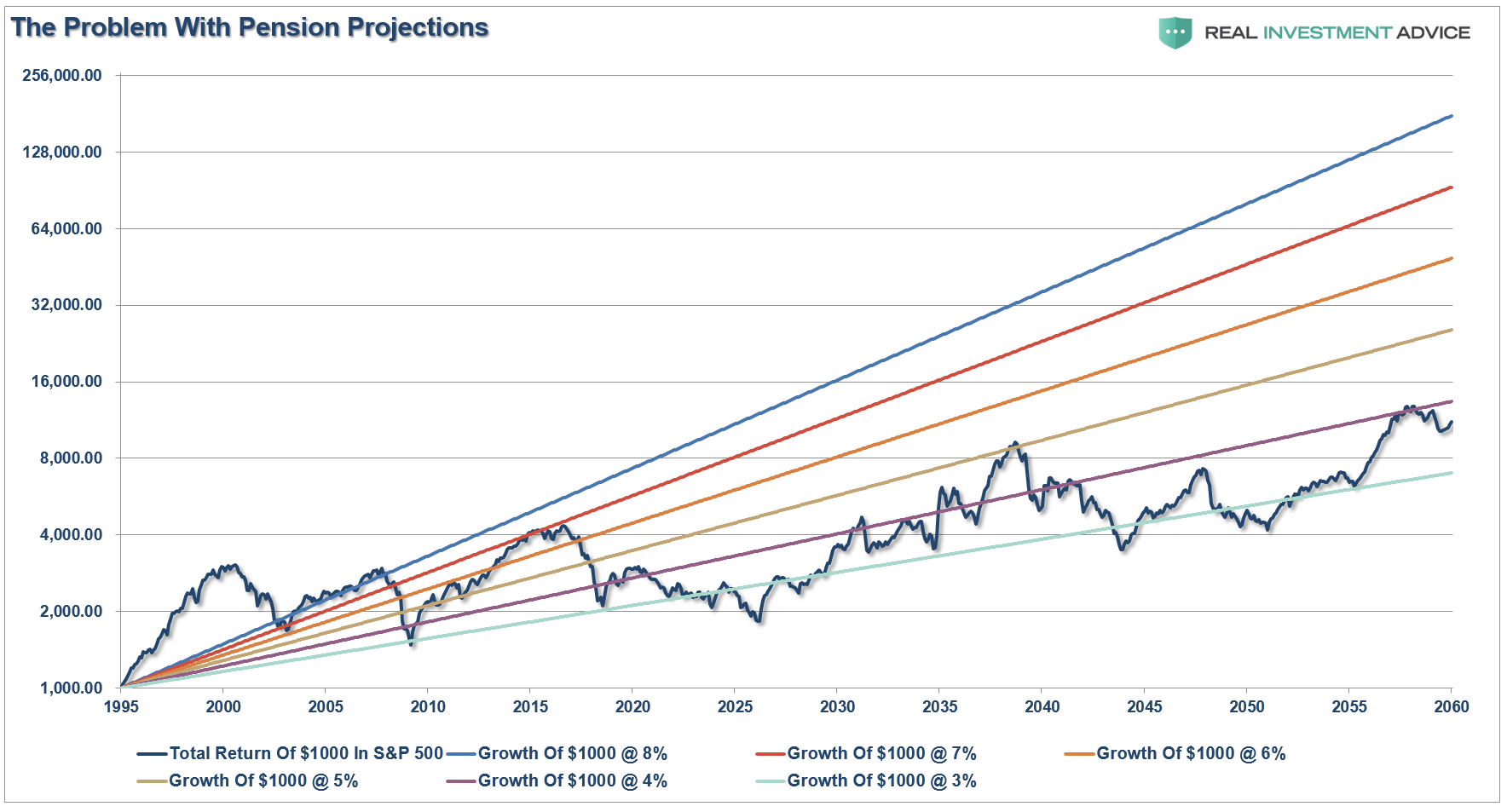

The chart below is the S&P 500 TOTAL return from 1995 to present. I have then projected for using variable rates of market returns with cycling bull and bear markets, out to 2060. I have then run projections of 8%, 7%, 6%, 5% and 4% average rates of return from 1995 out to 2060. (I have made some estimates for slightly lower forward returns due to demographic issues.)

Given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% in order to potentially meet future obligations and maintain some solvency.

They won’t make such reforms because “plan participants” won’t let them. Why? Because:

- It would require a 40% increase in contributions by plan participants which they simply can not afford.

- Given that many plan participants will retire LONG before 2060 there simply isn’t enough time to solve the issues, and;

- The next bear market, as shown, will devastate the plans abilities to meet future obligations without massive reforms immediately.

In a recent note by my friend John Mauldin, he discussed an email Rob Arnott, of Research Affiliates, sent regarding this specific issue.

“If our logic is sound, we earn 0.8% from our bonds (40% allocation x 2% return) and 2% to 3.2% from our stocks (60% x 3.3%, or 60% x 5.4%). Add up the return from stocks and the return from bonds, and we get 2.8% to 4% from our balanced portfolio.

Bottom line … US public service pensions are toast. One of three constituencies gets nailed:

- The taxpayer (keeping in mind that the affluent are mobile!),

- The current and/or future pensioners (keep in mind that private-sector pensions are now far less generous than public pensions … there’s an inequity here!), or;

- The public services that are on offer to our citizenry, net of sunk costs from servicing past generations.

Most likely, it’ll be a blend of the three.”

Exactly right, and the chart above of projected stock market returns agrees with that assumption.

We Are Out Of Time

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. And many of them are public-sector employees. In a 2015 study of public-sector organizations, nearly half of the responding organizations stated that they could lose 20% or more of their employees to retirement within the next five years. Local governments are particularly vulnerable: a full 37% of local-government employees were at least 50 years of age in 2015.

It is no surprise that public pension funds are completely overwhelmed, but they still have not come to the realization that markets do not compound at an annual return of 8% annually. This has led to a continued degradation of funding levels as liabilities continue to pile up.

If the numbers above are right, the unfunded obligations of approximately $4-$5.6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

That isn’t going to happen.

With rates pushing higher, economic growth slowing and Central Banks extracting liquidity, we are already closer to the next major bear market than not.

The next crisis won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. It will be fueled by the “run on pensions” when “fear” prevails benefits will be lost entirely.

It’s an unsolvable problem. It will happen. And it will devastate many Americans.

It is just a function of time.

“Demography, however, is destiny for entitlements, so arithmetic will do the meddling.” – George Will

Whatever amount you are saving for retirement is probably not enough.