Assets that have shown great performance last year, have again went through another strong decline.

Yesterday, Nikkei fell by 2.2%, back to 7-month lows. On Tuesday, Dow Jones Industrial Average had lost more than 2%, subsequent to the decline of the shares of the energy sector, throwing the index back to October’s lows. It seems that for the last month, positive drivers are struggling to push the market to a sustainable trend for growth.

Crude Oil experienced a sharp and unexpected reversal to a decline on Tuesday. Intraday Brent Crude Oil dropped by 6.5% while American WTI lost 7% on Tuesday, exactly the same percentage as one week ago. Markets are fearing that the slowdown in the world economy will slow the growth of oil consumption, nevertheless production is significantly increasing. Oil drilling in the United States is growing, and thus the American WTI is experiencing a great deal of pressure, falling to lows seen back in November 2017, while Brent is at 8-months lows.

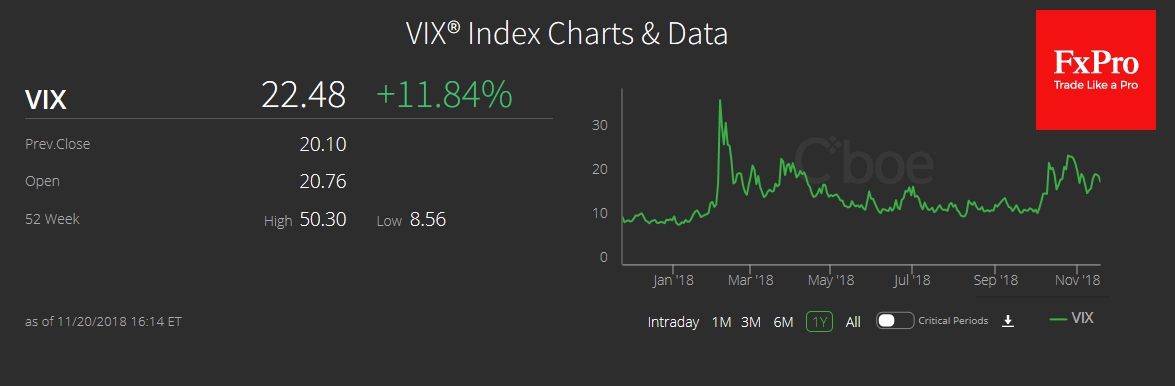

But there are a few things that allow us to remain optimistic about the stock markets, at least for a while. The “Fear Index” VIX has been fluctuating around 20, for over a month now. The new wave of declining markets, instigated on November 09, has not affected the fear of market participants.

The stability of gold prices illustrates the same. Since early October, the gold’s price fluctuations mirror the dynamics of the dollar. Yesterday’s market decline occurred amid the weakening of gold.

The Chinese yuan retains its strength, showing increase since the beginning of the day, which in turn allows us to talk about a partial drawdown of the market, in which some assets have been declining but others have retained their strength.

On the one hand, such selective pressure may be the first phase of a full-blown correction, and the currently affected assets are the canary in the coal mine of large-scale problems in regard to the growth of the world economy.

On the other hand, regulators still have the time and experience (we hope so) to make the right decisions in this situation, and in turn resulting in better estimations for the upcoming data. Among the important points to pay attention to, is the slowdown of the U.S. housing market as well as the impact of tariffs on China's growth rates. Data that has been already published force us to think about the risks, but yet does not allow us to talk about the imminent onset of recession.

Alexander Kuptsikevich, the FxPro analyst