It’s a dangerous trend that’s costing many investors a shot at true financial liberty.

Last week, we dove into the idea that the average stock is being held for less and less time with each passing year. In fact, in the span of a generation, the average holding period has dropped from four years to just 17 weeks.

This in-and-out trading is hurting the average investor.

I concluded my last column with a simple strategy that effectively allows you to avoid this dangerous trend. We also promised a twist in the tale... the only reason The Oxford Club tells Members to break one of our cardinal rules.

We’ve long said in-and-out trading can be risky business. But there’s a critical caveat that all investors must understand. It’s quite simple. Short-term trades are great ways to build wealth... as long as you have a solid foundation.

Very few of us would ever climb a mountain without a rope around our waist.

Just the same, we shouldn’t get in the trading game without a strong long-term strategy working to properly balance our portfolio.

It all comes down to a key variable... time.

As we’ve said many times, the length of time you invest is one of the most important factors in your success. It’s even more important than how well you invest.

For example...

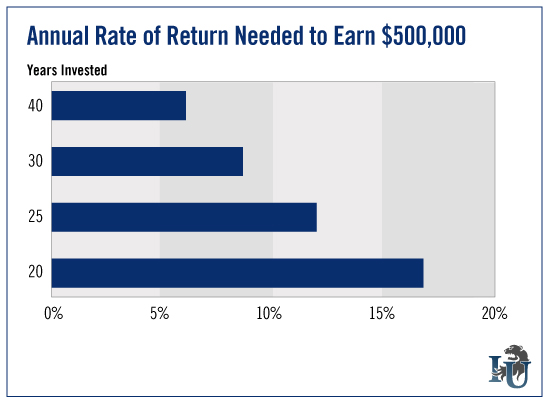

If a person invests $3,000 in the stock market each year for 40 years and achieves a 6% annual return (underperforming the historic return of most asset classes), he will wind up with $500,000.

That same investor who invests for only 30 years would need to achieve a 9.5% annual return to have the same outcome. That’s a required return of over 50% higher than the 40-year investor.

Cut the time down to 25 years, and the investor needs to earn about 12.5% per year, which is now exceeding the historic return on all but the strongest asset classes.

And if the investor has only 20 years in the market, he’ll need to earn 17.5% per year, a very difficult feat, indeed.

As you can see, time is a vital factor.

The problem is most folks don’t think they have the time. They hit their late 50s and realize they have a fraction of what’s needed to comfortably retire. They panic. Then they gamble.

It’s dangerous.

But here’s the thing. If you have a base portfolio that is properly allocated to a variety of noncorrelated assets and strictly follows the simple rule we outlined last Sunday, you can virtually remove the variable of time.

It’s the proven idea behind the Oxford Wealth Pyramid, a unique strategy we unveiled - to a great response from Members - in The Oxford Communiqué earlier this year.

The idea is that with a strong base acting as a balance within your portfolio, you can implement a variety of diversified strategies with an array of time horizons.

For example, some of the strategies we outline in the Wealth Pyramid - and offer to our Oxford Club Members - reward us with short-term gains with higher risk. Others offer short-term gains with virtually no risk. Or you could invest for the long term with high risk and high reward... or just the opposite - you could invest quite conservatively for the long haul.

The point is, none of this is possible without first creating a long-term, steady-growing base portfolio. Without that critical safety net, the risk of some of the faster-moving strategies that are required to properly “time diversify” does not justify the real-world returns.

Sorry. A lot of folks don’t like to hear they can’t jump right into a high-risk, high-reward strategy. But it’s the truth.

So how do you know when you have an adequate base portfolio and are ready to take advantage of the idea of time diversification?

There are a few simple rules to follow.

First, if you have outstanding credit card debt, high-interest car loans or student debt, pay them off before moving into any higher-risk trading strategies. By eradicating a loan with a 6% interest rate, you’re automatically up 6%... guaranteed.

Next, good news, you don’t need a huge base portfolio to start making faster trades.

In fact, I argue you don’t even need a six-digit portfolio. As long as your base remains at least double the size of the stake you are investing in time-diversifying strategies, you’re good to go.

For example, if your base portfolio is worth $50,000, you can put as much as $25,000 into these strategies.

Again, that’s a rough rule. But it should keep you out of trouble.

The bottom line is if you’re just starting out, don’t panic. Don’t make investing decisions that will cost you your shot at success. Instead, stick with the rule we discussed last week. And once you have an adequate foundation built, focus on the idea of time diversification.

Stick to the rules and you’ll be amazed at how fast your portfolio grows.