So far there's been virtually no reaction from financial markets to the most recent provocations from North Korea.

On the other hand, the crypto markets are moving a mile a minute on news that is far less apocalyptic.

Looks like most of the volatility traders have already moved over.

Today's Highlights

[Not] Reacting to North Korea

Watch the Won

Massive Crypto Pullback

Not as it should

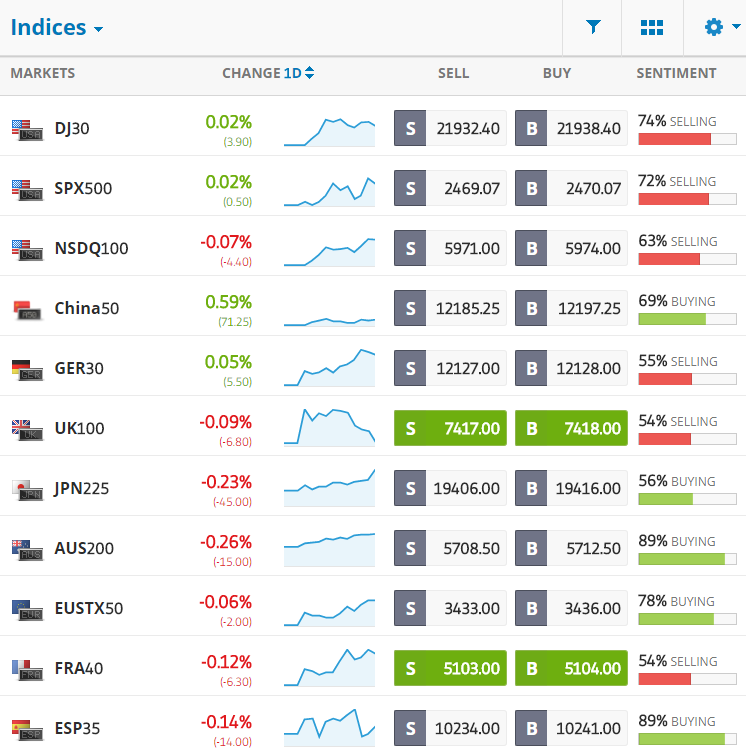

The Yanks have an excuse. Their markets were closed yesterday for a holiday but stocks from the rest of the world are only falling mildly and the China 50 is inexplicably high.

This isn't exactly what you'd expect after a 6.3 magnitude nuclear test by the world's most unstable country followed by taunts from said country's leader that he can pretty much blow up any city in the world.

The US dollar traditionally acts as a safe haven in panicked markets. So watching the US dollar fall over the past few months as all of this drama has been building up is quite puzzling.

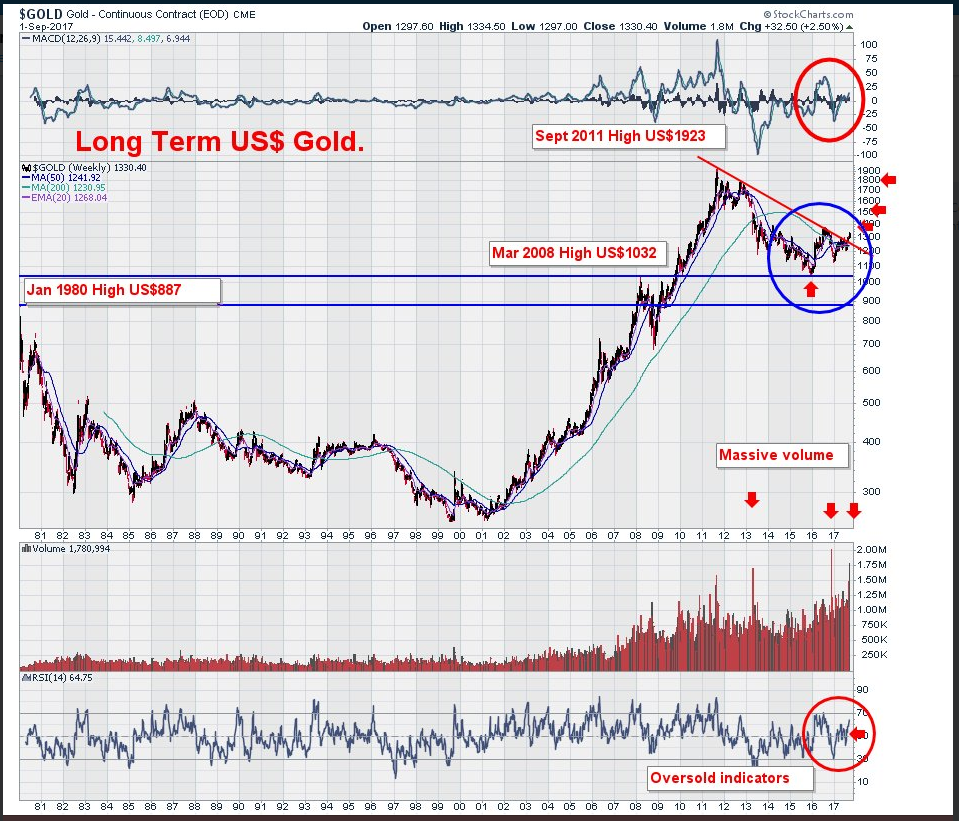

The only semblance of sanity is coming from the world's original form of money.

Gold has been rising steadily higher since the beginning of the year and over the last few days has been pushing new highs.

Of course, some are arguing that even this move is unconnected to UN and that gold is simply following a bigger picture, long term cycle.

The following long term (close to 40 years back) analysis was recently posted by @Dawespoint on Twitter.

It seems that investors simply don't believe Kim's claims. Either that, or they are ready to act only if things escalate further. This of course begs the question, what would have to happen to illicit a reaction from the financial markets?

Well, let's hope we never find out. But one thing that could be a good signal is the Korean markets. South Korea has been dealing with their northern neighbor for decades so they might be the first to react when and if anything really hits the fan.

For the time being the KRW is remarkably stable.

Thought KOSPI has shown some signs of weakness in the past few weeks, it's far from any sort of panic reaction.

So what is moving?

The Crypto markets are moving.

Due to the nature of this new asset class volatility in this market has been steadily extreme since mid-December.

About 24 hours, the People's Bank of China announced that they are putting a ban on all ICO activity effective immediately. Meaning, that Chinese citizens will no longer be able to take place in the multi-billion Dollar industry of creating new crypto currencies.

Our Market Analyst in China had this to say:

This is a good thing, which means the development of Crypto has aroused great attention of the Chinese government. At the same time, many ICO projects from China are filled with high risks such as Ponzi scheme. Ban ICO is the right decision for Chinese financial security. I believe that soon the Chinese government will accelerate the regulation of ICO, and protect the real ICO.

@Macygogogo eToro,

China Analyst

So let's tally up the damage.

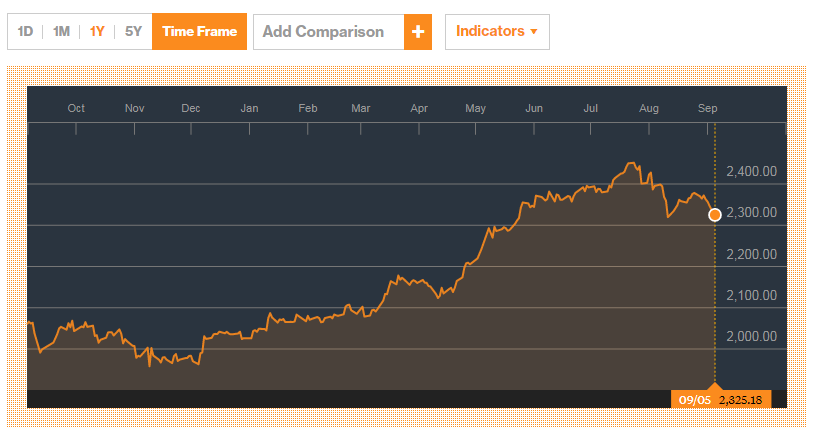

The world's favorite cryp to currency bitcoin has seen prices coming down from its all time high of $5000 on Friday almost touching $4000 this morning. A pullback of approximately 20%.

For Ethereum, which many of the ICOs are done on, the damage was more severe. On Friday (white circle), Ether prices were trying hard to break the $400 resistance point. The prices this morning are almost 30% lower.

To be completely fair, the cryptos were already in a pullback a good 24 hours before the China regulatory news even broke but there's no doubt that this particular headline convinced some traders to sell.

Of course, there's no indication that the pullback is completely over yet but some of our larger clients have already begun buying in lightly at the discounted prices, ready to go in more heavily should things come down further.

Let's have an amazing day.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.