It's 2 o'clock in the morning as I write, and the winds are howling outside, making it near impossible to sleep. Somehow that's strangely appropriate on election night, especially if you understand the implications of what I want to share with you right now.

But be warned. This isn't for everybody…

…just investors who want to make gobs of money.

Profits Trounce Politics Every Time

If you're one of millions of Americans who are worried sick that we're on the brink of political, economic, and financial chaos based on last night's outcome, you're not alone. I feel the angst, too.

This election was one of the most contentious in recorded history. Clinton and Trump pulled out all the stops in an incredible orgy of mudslinging, gossip-mongering, and just plain old nastiness that has given pause to almost every investor I've talked to.

Most people view this is a negative influence simply because it's tearing the country apart, but I think it'll prove to be one of the most significant opportunities of our lifetime.

Chaos always is.

Obviously, I don't want you to miss that – no, scratch that. I won't let you miss the huge profit potential being created as voting comes down to the wire.

Let me explain.

Prepare for Change, but Don't Fear It

Millions of investors are scared stiff when there's change in the air. Longing for the "good old days," they fear deviating from what they know because that means they'll have to change their ways.

Yet, that's actually not true.

The only change they'll have to make is in what they think they know.

That's where the big profits are hiding, and where 99 out of 100 investors go off the rails.

I joke with audiences around the world that, "We're all born with common sense. It's just 'bred' out of us as adults."

Chances are good that you already know this instinctively. I usually see a sea of heads nodding from stage when the irony of what I've just said dawns on them.

Again, you're not alone. What's more, there is a logical explanation.

Humans are much more prone to stop reaching for the stars as we get older because we've convinced ourselves that we "know better."

We can't help it – it's simply human nature. It's in our DNA.

Yet, what we want to be doing is flipping that around – at least when it comes to our money, anyway.

That's because history shows beyond any shadow of a doubt that the biggest opportunities are always created during periods of huge chaos. War, famine, political strife, financial crisis… it doesn't matter.

The key is learning to recognize that the angst that comes with each of these things is actually the signal you're looking for when it comes to lining up the huge profit potential you deserve, but which most investors will never have.

Fortunately, this isn't as difficult as you would think if you remember three "Total Wealth Principles" we talk about frequently:

- Capital is a creative force that's constantly flowing forward

- Money flows like water to where it's treated best

- Success constantly replaces failure, and there's expansion each time it does

Now it's time for the fun part, and why I couldn't wait to share this with you.

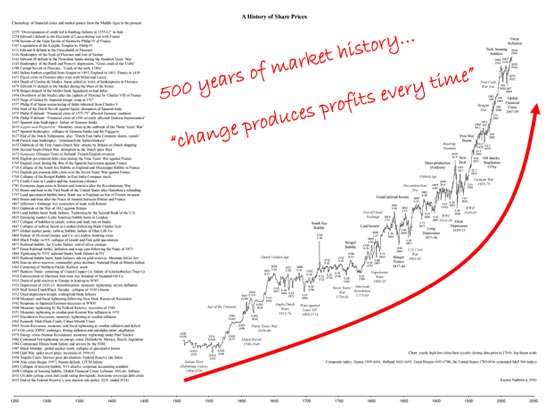

I know what comes next based on 500 years of market history. And, now, so will you…

Profits.

Not some of the time. Not part of the time. Every time.

The following chart comes from Kieron Nutbrown, who is the former head of global macro trading at First State Investments in London, and I want to share it with you because it goes a long way towards putting current conditions in perspective.

I totally understand that you probably don't have 500 years to wait… I get that a lot whenever I share this chart or one like it that brings a much larger perspective to the table.

More often than not, though, that's usually code speak for risk management, and that's an entirely different subject.

What I want you to understand is that fear of uncertainty and change always creates opportunity – which is why you've got to constantly look for it instead of trying to hide from it, like many investors are at the moment.

Keith follows these six Unstoppable Trends that have made people wealthy for centuries, and will continue to do so long into the future…

- Demographics

- Scarcity/Allocation

- Medicine

- Energy

- Technology

- War, Terrorism, and Ugliness

There's a reason why we emphasize the Unstoppable Trends that form the bedrock of our approach, because they're driven by trillions of dollars that will not stop based on who's elected… or who's not.

Every dollar you're going to make for the next 10 years is on this list: Demographics, Scarcity/Allocation, Medicine, Energy, Technology, and War/Terrorism/Ugliness…

Many of the best choices, including dozens of companies we've talked about here, have already scorched the broader markets simply because they make "must-have" products and services we cannot live without.

What's more, they will continue to do so often, moving directly against expectations everybody "knew" to be true. Only we'll know better.

Raytheon Company (NYSE:RTN), Lockheed Martin Corp (NYSE:LMT), and Northrop Grumman Corporation (NYSE:NOC), for example, have all turned in triple digits over the past eight years – 181%, 211%, and 525%, respectively – even though the bet was President Obama would eviscerate the military, and he's proven to be even more secretly hawkish than President Bush was overtly so.

Remember the 2010 Dodd-Frank legislation that was supposed to rein in big banks?

On July 21, 2010, President Obama signed the massive financial regulatory bill into law that I quickly dubbed "Dodd-Frankenstein" with the idea that the onerous regulations would not prove to be the intended roadblock everybody thought. Instead, I counseled that they'd prove to be some of the biggest profit creators of all time based, in large part, on the chart I've just shared with you.

Big banks reported a combined, record-setting $43.6 billion in profits just last quarter alone. JPMorgan Chase & Co (NYSE:JPM) has returned more than 97% with dividends reinvested versus only 3% from the S&P 500 at a time when, again, everybody expected it to crater.

Things will be no different today.

We have a new president – and a new set of opportunities made all the more profitable by the simple fact that most people will be totally unprepared to deal with them.

And it's not just me saying so.

You've got 500 years of market history on your side.

As always, I'll be with you every step of the way.

Probably just not at 2 o'clock in the morning, if my wife has anything to say about it.