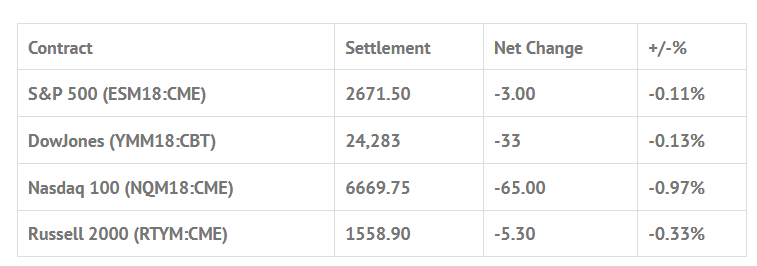

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

Today’s Economic Calendar:

Monday: Personal income, March (+0.4% expected; +0.4% previously); Personal spending, March (+0.4% expected; +0.2% previously); “Core” PCE, year-on-year, March (2% expected; 1.6% previously); Pending home sales, March (+0.5% expected; +3.1% previously); Dallas Fed manufacturing, April (25 expected; 21.4 previously).

S&P 500 Futures: Fridays #ES ‘Dip & Rips’

Thursday, the S&P 500 futures traded up to 2677.50 on Globex after Amazon (NASDAQ:AMZN) reported ‘blockbuster’ earnings, then sold off down to 2665.25 early Friday morning. On Fridays 8:30 CT futures open, the first print in the ES was 2672.50, followed by a trade up to an early high at 2676.26. From there, the futures pulled back down to 2668.50, and then made two lower highs at 2675.75 and 2673.00 at 9:17 am. After the failed move higher, the ES got hit by several small sell programs, pulling the futures down to 2657.75 going into 10:00 am.

It didn’t look good for the ES, but like I said in Friday’s view, I did not think the ES was going to go out weak, and it didn’t.

After the low was in, the futures made a series of higher lows, traded back up to 2671.00, made two more higher lows at 2662.75 and 2663.50, and then traded up to 2674.00 at 12:35. After a drop down to another higher low at 2666.50, the futures rallied up to 2673.25, had one last selloff before the close down to 2666.00 at 2:17 CT, traded 2668.00 on the 2:45 cash imbalance, 2669.00 on the 3:00 cash close, and went on to settle at 2669.25 as the MiM went from over $600 million to sell to $321 million to sell. On the 3:15 futures close, the ES traded 2671.50, down -3.00 handles, or -0.11% on the day.

In the end, all we have to say is, things went pretty much according to what we thought it would; an early selloff and bounce. In terms of the overall trade, things slowed down, as did volume.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.