World markets are facing difficulties near 2-month highs. The American S&P 500 was again under increased pressure after reaching 2980 not so far from round level 3000, that was strong resistance back in 2019. The same with gold, whose rally has stalled a couple of steps below strong resistance at $1800.

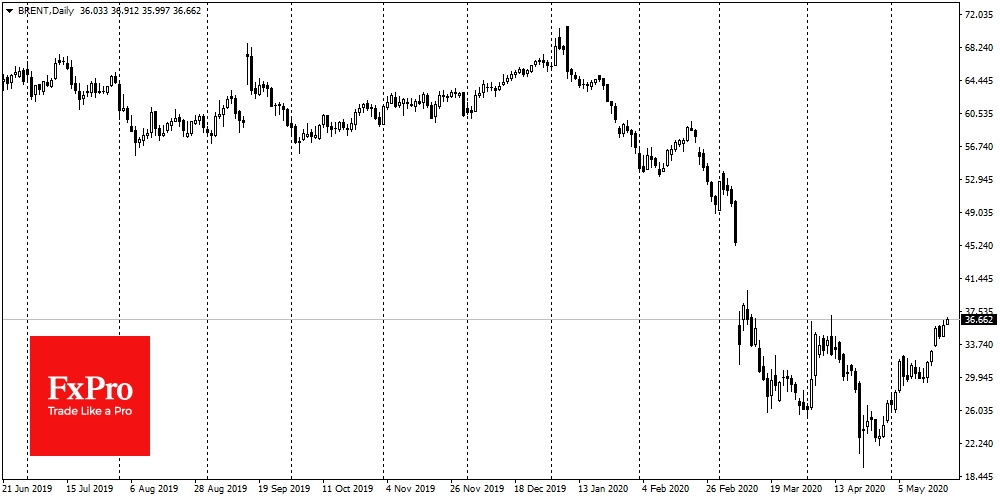

For oil alone, the situation looks more optimistic. Brent quotes continue to rise, reaching $36.91 in the morning, which is close to the peak of April at $37.05.

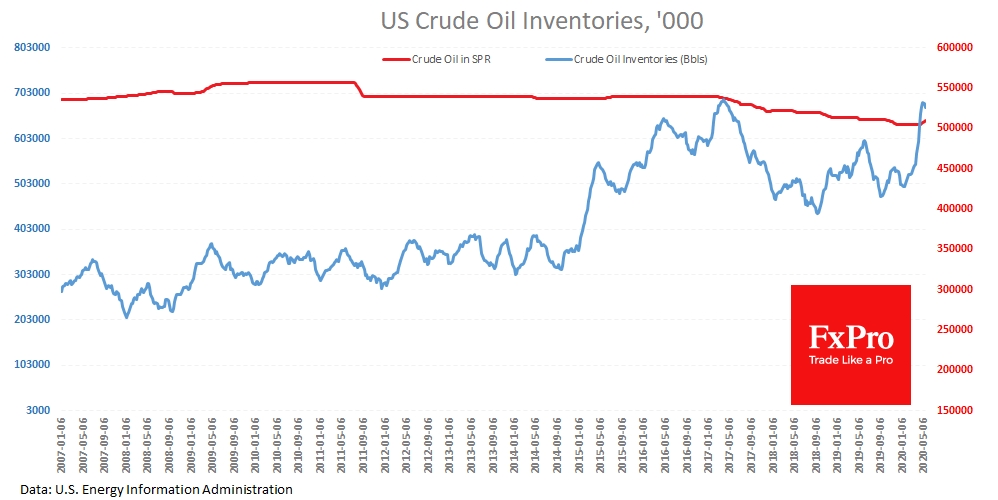

Brent received an additional growth impulse on the US stockpiles data, released on Wednesday. Last week it declined by 5 million barrels, which was the second week of decline in volumes. At the same time, the American strategic reserves continue to replenish, having increased by 1.9M barrels.

Contrary to expectations, the reserves could not update the record of 2017, having started the wave of decline two weeks ago. Seasonality seems to have played a significant role in this. The growth of this indicator often occurs in March-April. However, traditionally there is then a decline: just in time for the beginning of the active auto season. Now we are witnessing precisely this pattern, further enhanced by purchases in the strategic reserve.

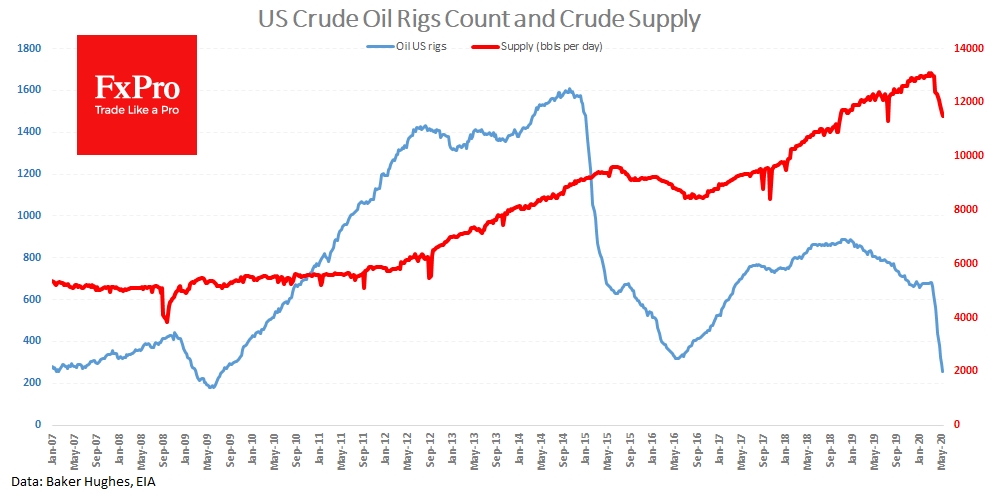

At the same time, there is a decrease in production, but it happens much slower than expected. Last week this indicator averaged 11.5M barrels per day (-0.1M for the week). In total, the decline from the March peak is 1.6M barrels per day, or slightly over 12%.

There is a big buyer in the market, which stores oil somewhere outside the US. In normal times, fuel accounts for 65% of black gold consumption, i.e. more than 8.5M barrels of 13.1M produced in March. The demand for it fell by 40%, to about 5M. Let’s assume that the amount of fuel, which is used for electricity, remained unchanged, while consumption in manufacturing decreased by 5%-10%.

It turns out that the balance in the US is slightly above 9.2M barrels per day. However, we are witnessing that even at 11.6-11.5 oil reserves are decreasing. This leads to the idea that the commodity customers are indeed significantly increasing their oil purchases near the cyclical lows. However, this is also bad news for oil prospects. The overhang from reserves will hurdle price recovery and suppress demand for raw materials in the coming months, as countries reduce their stockpiles to average levels.

The FxPro Analyst Team