Stock markets are under moderate pressure on Monday morning. To clarify, "moderate pressure" translates into a fifth consecutive session of declines for the S&P500, dumping the index by 1.6% from record levels. Meanwhile, the sell-off in long-term bonds continues, causing yields to rise. Investors' exit from long debt securities is a reflection of investors' demand for higher yields due to inflation fears.

Such fears of inflation are a breeding ground for rising commodity prices. And there are several reasons for this, which also have strong macroeconomic underpinnings.

Firstly, the coronavirus restrictions have dealt a severe blow to services, but not to production. Industrial production has recovered to pre-coronavirus levels, but ultra-soft monetary policy, big relief packages from governments and logistical problems are pushing producers to compete for scarce resources, pushing up the price.

Secondly, traders in the markets do not have much of a choice of assets to hedge against inflation. It appears much safer to bet on standardised exchange-traded commodities than to choose individual companies. The global economy is just starting its recovery, so the uncertainty is significantly higher than the average in recent years, which can hardly be seen as dull.

Thirdly, 'cheap' money is now an opportunity to buy oil, gas, industrial metals and agricultural commodities well ahead of a full-blown return in demand. These seem like sensible stock market speculations in the current environment.

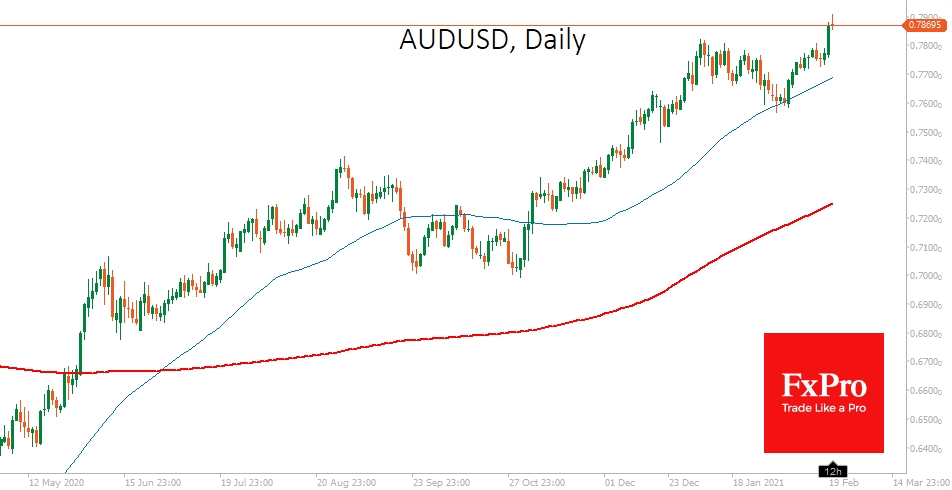

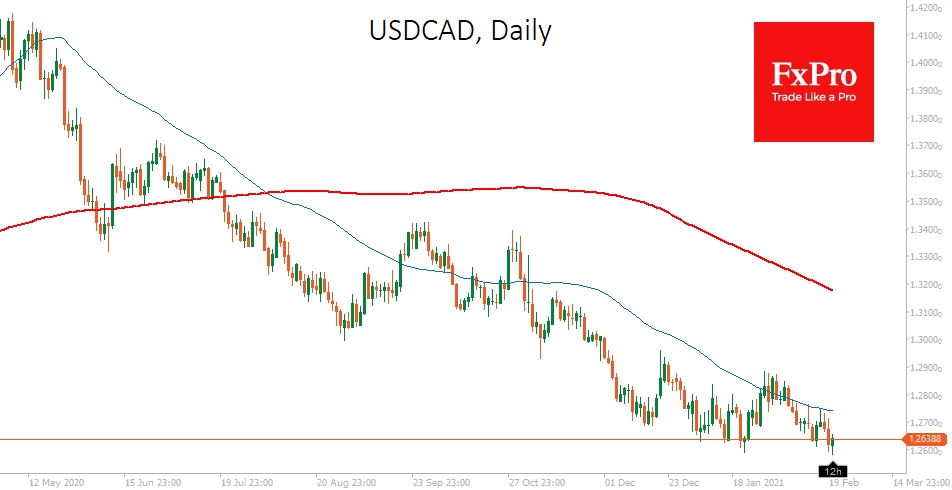

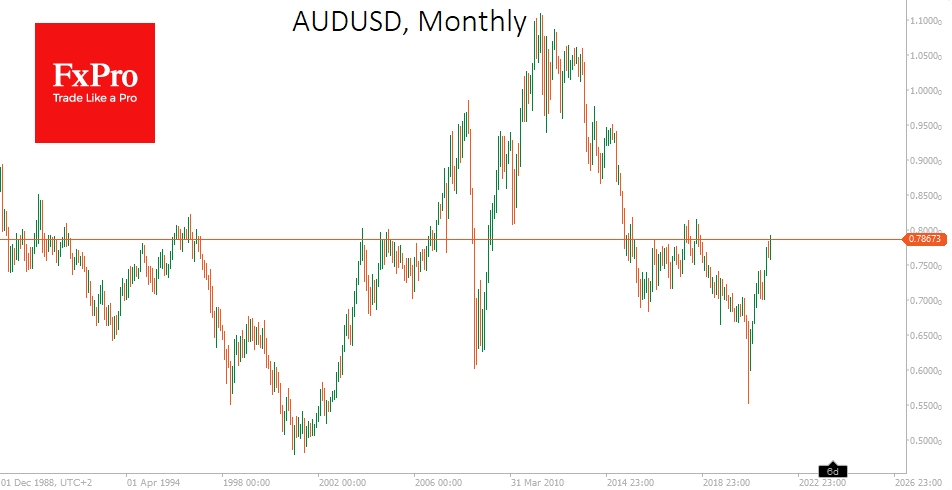

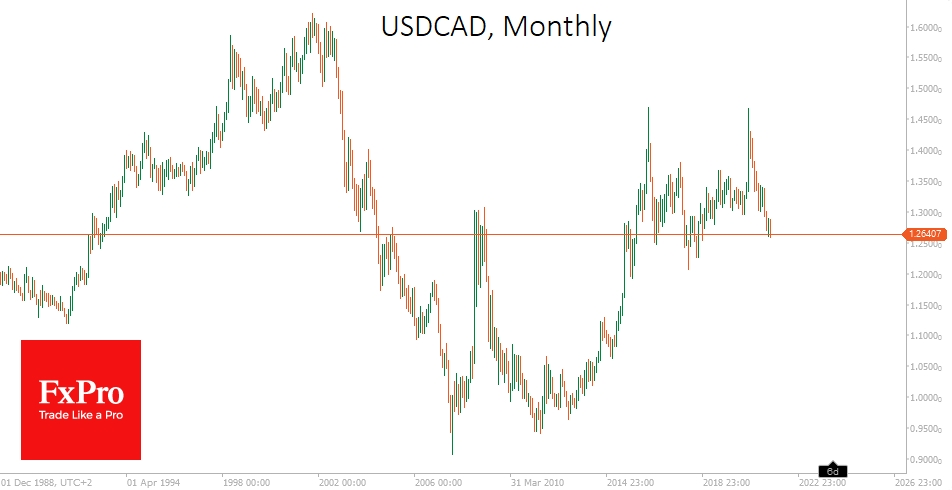

An important sign from the market is that the Australian and Canadian dollars have broken through their established trading ranges. Betting on their rise seems like a logical result of the growth in commodities. Developments in industrial metals and energy prices set the stage for a repeat of multi-year gains in AUD and CAD, which have appreciated against USD by more than 60% and 45%, respectively, through 2001-2008.

Soft monetary policies in these countries have long left investors hesitant to buy these commodity currencies. However, expectations that commodity export revenues will be the first to recover and get the economy back in shape push these currencies higher on speculation that central banks will consider policy normalisation, thanks to strong footing and trade balance surplus.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The New Rise Of The Commodities Class

Published 02/22/2021, 05:34 AM

The New Rise Of The Commodities Class

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.