Three trading days left in 2016 and markets continue to make and flirt with all-time highs, including the Nasdaq 100. On Tuesday, Nasdaq ETF QQQ made a new all-time-high close. Many will focus on the how that high was made. A trip much higher pulled back to end the day higher, but with a long upper wick. The wick is what traders will not like as it's a failure to hold the high.

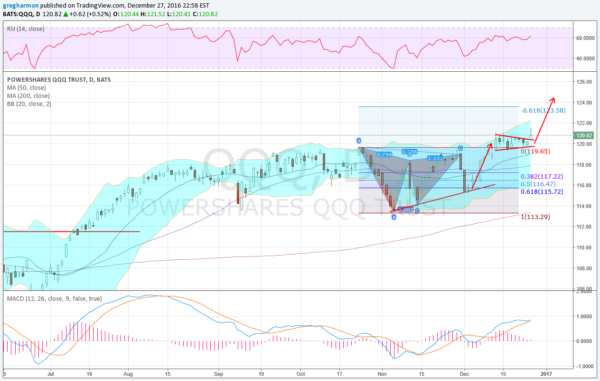

Instead, lets look at the bigger picture. From mid October, the QQQ had built a bearish Bat harmonic pattern. It reached the Potential Reversal Zone (PRZ) just after Thanksgiving and reversed lower to rising trend support -- at the 61.8% retracement of the pattern. A perfect place to start a new advance. From there, it jumped to new all-time highs in early December. It has held there since.

The consolidation took the form of a symmetrical triangle, which on Tuesday broke to the upside with the RSI in the bullish zone and turning higher. The MACD has also avoided a cross down and is moving higher. The break of the consolidation gives a target to the upside of 124.45. The weight of the evidence points higher.

So who really cares about a single candle wick?