Another fun day in the land of make believe, with the S&P 500 rising by 35 bps. Most of the gains came in the final few minutes of trading, essentially the opposite of what we saw on Friday. Meanwhile, the most shorted index soared by over 2.2%. The index has taken on a life of its own; it is really rather stunning.

The S&P 500 failed to take out Friday’s highs. At this point, it could mean something. Depending on what happens tomorrow, there are potentially three lower highs on the intraday chart. Ideally, the bulls need to see today’s high taken out tomorrow.

We can also see that the move higher is starting to tighten up, meaning the range is growing small, creating a rising wedge pattern. Additionally, the RSI has not confirmed the new highs with a new high of its own, and the Advance/Decline has now, potentially, stalled. A break of that lower trend could result in a steep pullback back to 3,200.

The VIX had a pretty big day rising by 5%, despite the S&P 500 climbing. If you think that is strange, well, it is. That isn’t supposed to be what happens, but it does every once in a while. String a couple of days like that together, along with the S&P 500 rising at the same time, and you probably have a situation where the market is ready for a pullback; at least that has been the “tell” in recent months.

Square

Square (NYSE:SQ) did not have a good day, with the shares falling almost 3%, and is down about 12.5% from its peak. For now, it is still holding on to support around $216and has tested this level a couple of times. It likely breaks that support level, as the RSI shows a lot of momentum being lost and that lower prices are likely coming.

PayPal

PayPal (NASDAQ:PYPL) also appears to have a bearish pattern forming in it. With a potential rising wedge, along with an RSI that appears to be suggesting a decline to around $215.

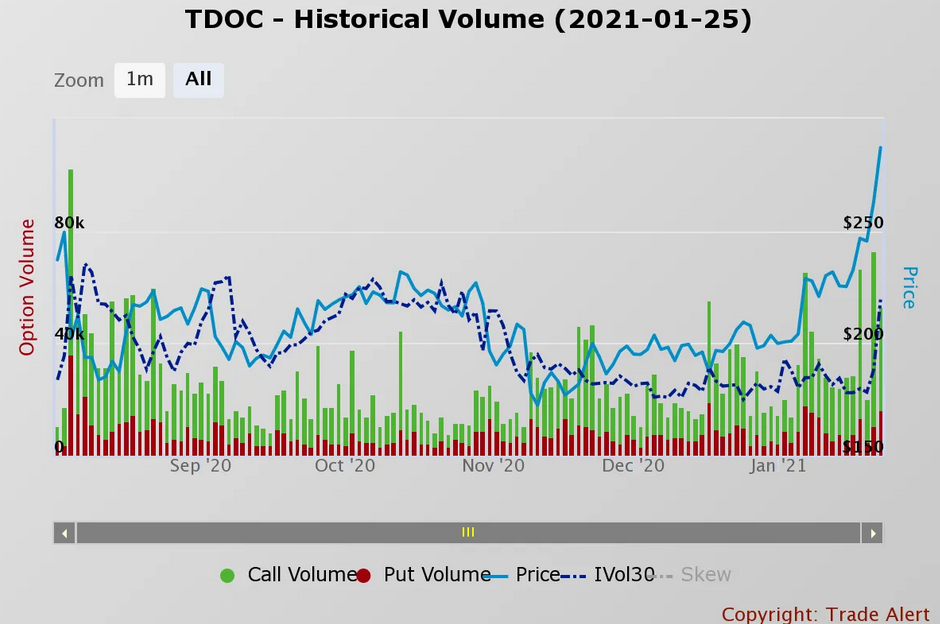

Teladoc

Teladoc (NYSE:TDOC) looks to be in the middle of a convexity/gamma squeeze. All the signs are there. Option volume exploding, implied volatility rising with the stock. It probably means a reversal lower in TDOC is around the corner.

That’s it