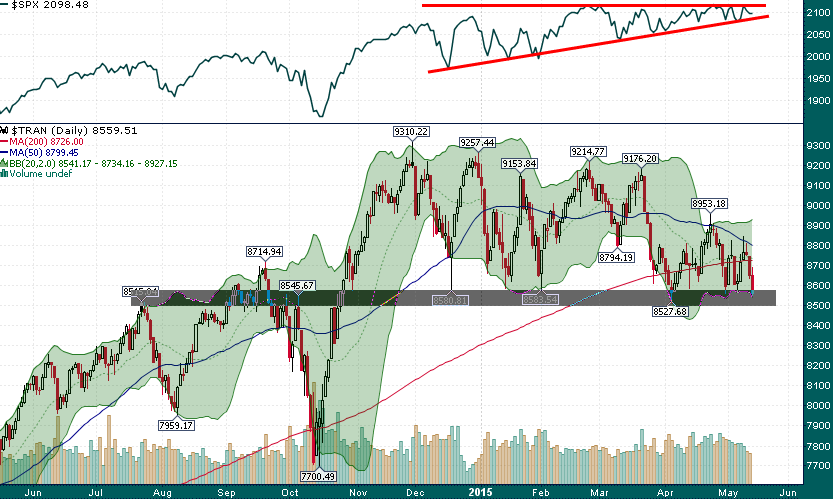

The Dow Jones Transports have been putting in a top for the last six months, ever since the parabolic rally of October/November 2014:

This is at least the 6th test of the 8500-8600 support/resistance zone since last December and the bounces off this support zone have become increasingly shallow and short lived. As we know very well, the more times a level is tested the more likely it is to break.

Most notably, as the S&P 500 has continued to wedge itself higher to fresh marginal all-time highs, the transports have continued to make lower highs and they are down ~8% since the November all-time high.

The situation is now quite clear: A breakdown below 8500 in the trannies will almost certainly have extremely bearish implications for equities as a whole. Meanwhile, the S&P 500 has important horizontal and trend support near the 2075 level – a breach of 2075 is likely to bring about a swift move lower to test the 1980-2000 support/resistance zone which has been so important during the last year.

Disclosure: First published at Energy and Gold.com