The S&P 500 has declined over 14% since the start of October as fearful investors have been selling, in many cases indiscriminately. Fear mongering media narratives are usually based, in part, on some truths, such as tariffs, declining oil prices and the fed.

We like to reduce our risks by prudently diversifying our investment portfolios across various attractive investment categories. This article focuses on contrarian high yielders in which we allocate some of our investment dollars opportunistically, like when fear is higher and prices are lower, as is increasingly the case right now. Without further ado, here are our top 10 big yields worth considering:

1. Main Street Capital (MAIN), Yield: 6.9%

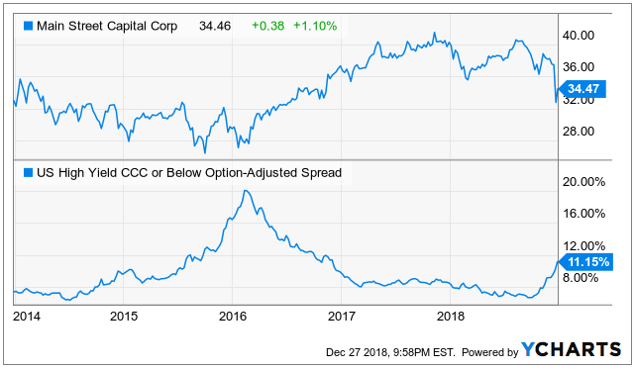

Main Street Capital Corporation (NYSE:MAIN) is a Houston-based Business Development Company (BDC”) that is becoming increasingly attractive, in our view, as the share price has predictably declined as credit spreads have widened.

With over $4.0 billion of investments under its management, Main Street invests mainly in the debt (and some equity) of middle-market companies (i.e. companies with annual revenue between $10 million and $150 million). Its objective is to maximize total returns by generating current income and capital appreciation. A few of Main’s attractive qualities include its growing Net Asset Value (“NAV”), its growing Distributable Net Investment Income (“DNII”), its relatively low debt to equity ratio (this gives the company safety and buying power), and its strong internal management team. We wrote in detail about Main Street last month where we described its big risks to include its energy sector exposure, the threat of low credit spreads widening, and its relatively high price to book value. All of these risks have caused the price of Main Street to decline significantly in recent trading sessions, but the company remains healthy, in our view. And at this point, the more the share price falls, the more attractive Main Street becomes as an investment.

2. PermRock Trust (PRT), Yield: 18.0%

PermRock Royalty Trust (NYSE:PRT)’s main asset is an 80% net profit interest (“NPI”) in oil and natural gas producing properties in the Permian Basin of West Texas. And not surprisingly, as energy prices have fallen in recent months, PRT’s price has crashed.

However, considering PRT was created simply to collect NPI to be used to pay monthly distributions to investors, it presents a tempting high-yield investment opportunity for income-focused investors. It pays monthly, there is no K-1 statement, and the valuation is attractive (the caveat being, of course, that no one really knows where energy prices are headed).

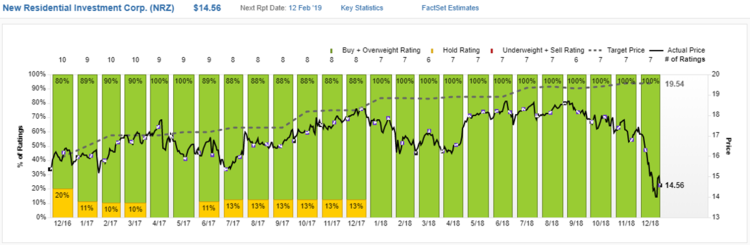

3. New Residential (NYSE:NRZ), Yield: 13.4%

This big dividend REIT, which focuses on investments related to residential real estate, has sold off hard. It now trades at an attractive discount to book value (0.86x, and that doesn’t even count clean uprights, which flow through to earnings). Further, Wall Street analyst is bullish, with 100% buy ratings (among the 7 analysts that cover it), and a price target of $19.54 (giving the shares around 34% upside).

4. Triton International (TRTN), Yield: 6.8%

Triton International Group Inc (NYSE:TRTN) yields 6.8% and the shares are currently on sale.

If you don’t know, Triton is the world's largest lessor of intermodal containers (the large standardized steel boxes used to transport freight by ship, rail or truck). The shares have been facing increased investor fear with regards to international tariffs, however, the business isn’t going away, and the valuation is attractive. You can read our full write-up on Triton here…

5. Energy Transfer (ET), Yield: 9.4%

Energy Transfer Equity LP (NYSE:ET) offers a big 9.4% yield, and it trades at a very attractive EV-to-EBITDA relative to peers. However, if you’re going to invest, you may want first want to consider the big risks ET is currently facing (i.e. the price is low and the yield is high for a reason). You can read our full Energy Transfer write-up, including an overview, the big risks, and a few additional important considerations.