The Medicines Company (NASDAQ:MDCO) along with partner Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) announced new one-year safety and efficacy data from the ongoing ORION-1 phase II study, evaluating pipeline candidate, Inclisiran (PCSK9 Inhibitor), for the treatment of hypercholesterolemia.

This new data reaffirmed the earlier results from the ORION-1 study, demonstrating significant reductions of LDL-C (low-density lipoprotein) or “bad” cholesterol at six months and one year.

Notably, ORION-1 is a placebo-controlled, double-blinded, randomized, dose-finding phase II study. It compares and evaluates the effect of various doses of single or multiple subcutaneous injections of Inclisiran. The trial compares the effect of different doses of Inclisiran and evaluates the potential of an infrequent dosing regimen.

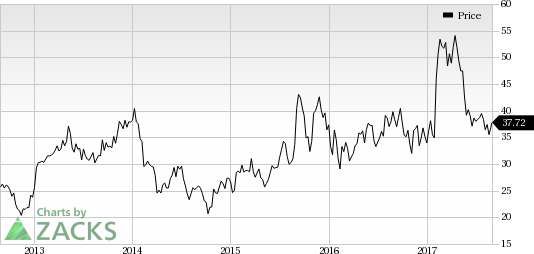

So far this year, The Medicines Company’s shares have outperformed the industry. The company’s shares have rallied 11.6% compared with the industry’s 9.4% increase.

The one-year extension study showed that the starting dose regimen of Inclisiran (300 mg injection administered on day-1 and day-90) achieved a mean LDL-C reduction of 56% and up to 51% at Day-180, and a time-adjusted mean of greater than 51% for the six-month period from Day-90 through Day-270.

Data from the study was presented at the European Society of Cardiology (ESC) Congress 2017. These robust findings underscore the selection of a six-monthly maintenance dose of 300 mg in Phase III trials, presently in advanced stages of preparation.

We remind investors that the FDA approved of a phase III study design for Inclisiran in April this year. The study will be conducted on patients with atherosclerotic cardiovascular disease (ASCVD) and familial hypercholesterolemia (FH). The company anticipates data readouts from the study during the second half of 2019.

The phase III study is designed to support the submission of a new drug application (NDA) to the FDA and a marketing application in the EU for the given indication.

Apart from Inclisiran, another key candidate in the company’s portfolio is Vabomere (formerly Carbavance), a fixed dose combination of meropenem-vaborbactam. It is currently under review in both the United States and the EU.

Going forward, we expect the investors’ focus to rest on further regulatory updates on Inclisiran and Vabomere.

Zacks Rank & Stocks to Consider

The Medicines Companycurrently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the pharma sector are Aduro Biotech, Inc. (NASDAQ:ADRO) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates reduced from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

ACADIA’s loss per share estimates narrowed from $2.82 to $2.59 for 2017 and from $2.07 to $1.92 for 2018 over the last 30 days. The company came up with positive earnings surprises in two of the last four quarters with an average beat of 7.97%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

The Medicines Company (MDCO): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Original post

Zacks Investment Research