The Medicines Company (NASDAQ:MDCO) announced that the FDA has granted accelerated approval to its experimental antibiotic, Vabomere, a combination of meropenem and vaborbactam, for treating complicated urinary tract infections (cUTI), including the pyelonephritis.

The company expects to make Vabomere available in the market in fourth-quarter 2017. It filed a new drug application (NDA) for the antibiotic in February, currently under review in the EU.

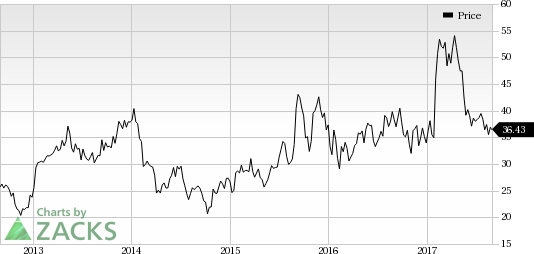

Shares of The Medicines Company have outperformed the industry year to date. The stock has rallied 14.2% compared with the industry’s 9.7% gain during the period.

The NDA was supported by positive data from a phase III (TANGO-1) multi-center, randomized, double-blind, double-dummy study. The study (n=550) was designed to evaluate the efficacy, safety and tolerability of Vabomere in patients with cUTIs or acute pyelonephritis compared with Pfizer Inc.’s (NYSE:PFE) Zosyn (piperacillin/tazobactam).

Data from this trial showed that Vabomere achieved statistical superiority over Zosyn with successful results obtained from 98.4% of patients treated with Vabomere compared with 94.3% administered with Zosyn.

We remind investors that in July, an independent data safety and monitoring board stopped the phase III TANGO-2 study on Vabomere based on an interim analysis. Interim results from the study showed that Vabomere improved clinical cure rates across all infection types and reduced rate of renal adverse events in comparison to the best available therapy.

Vabomere has been designated as a Qualified Infectious Disease Product by the FDA. Antibiotic resistance, especially to carbapenems, is a rapidly growing problem in the medicine sector. In fact, carbapenem-resistant enterobacteriaceae (CRE) infections are one of the deadliest diseases, given its 40% mortality rate. As a result, there is an urgent need for antimicrobials like Vabomere to effectively treat CRE and other resistant organisms.

Successful commercialization of Vabomere is expected to boost the company’s top line, considering the lucrative market that it targets.

Zacks Rank & Stocks to Consider

The Medicines Company currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the pharma sector are Aduro Biotech, Inc. (NASDAQ:ADRO) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates reduced from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

ACADIA’s loss per share estimates narrowed from $2.82 to $2.59 for 2017 and from $2.07 to $1.92 for 2018 over the last 30 days. The company came up with positive earnings surprises in two of the last four quarters with an average beat of 7.97%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Pfizer, Inc. (PFE): Free Stock Analysis Report

The Medicines Company (MDCO): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Original post

Zacks Investment Research