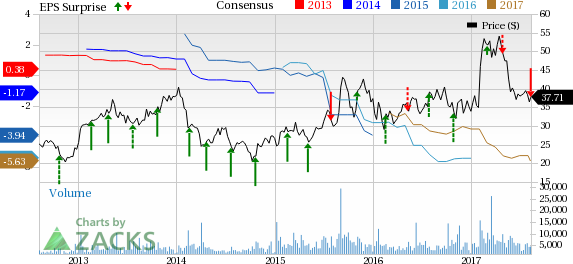

The Medicines Company (NASDAQ:MDCO) reported second-quarter 2017 loss of $5.52 per share, massively wider than the Zacks Consensus Estimate of a loss of $1.29.

However, adjusted loss per share was $1.02 (excluding the impact of share-based compensation expenses) versus a loss of 69 cents in the year-ago quarter.

Including share-based compensation expenses, adjusted loss was $1.15 per share. This reported figure widened substantially from the year-ago loss of 82 cents.

So far this year, The Medicines Company’s shares have outperformed the industry. The company’s shares have rallied 11.1% while the industry has registered an increase of 8.7%.

Quarterly revenues plunged 65.8% year over year to $18.7 million. Reported revenues also missed the Zacks Consensus Estimate of $31 million. This decrease in revenue in the reported quarter is mainly attributable to lower sales of the company’s marketed drug, Angiomax, due to the loss of exclusivity and increased generic competition. An amount of $8.2 million was also recorded in the second quarter of 2016, related to divesture of non-core cardiovascular products which had inflated the revenue in that particular quarter.

Quarter in Detail

Net revenue for the quarter included royalty revenues from the authorized generic sales of Angiomax by Novartis AG’s (NYSE:NVS) generic arm, Sandoz, and net product sales of Angiomax. Total Angiomax revenues slumped 73.4% to $10.7 million in the reported quarter.

Sales of other products like Minocin and Orbactiv were up 27% to $8 million compared with the year-ago sales of $6.3 million.

The Medicines Company’s research and development (R&D) expenses (including stock-based compensation expenses) shot up 19.6% year over year to $29.9 million owing to higher spend in support of Inclisiran.

Selling, general and administrative (SG&A) expenses (including stock-based compensation expenses) were down 19.7% to $49.9 million.

Pipeline Updates

In April, The Medicines Company and partner Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY) announced that the FDA has approved of a phase III study design for its PCSK9 synthesis inhibitor, Inclisiran. The trial will be conducted on patients with atherosclerotic cardiovascular disease (ASCVD) and familial hypercholesterolemia (FH). The company anticipates data readouts from the study during the second half of 2019.

During the quarter, the company also announced that it has received scientific advice from the European Medicines Agency (EMA) on plans for the phase III study, designed to support the submission of a new drug application (NDA) to the FDA and a marketing application in the EU for the given indication.

Apart from Inclisiran, another key candidate in the company’s portfolio is Carbavance, a fixed dose combination of meropenem-vaborbactam. Last month an independent data safety and monitoring board stopped its phase III TANGO-2 study on Carbavance based on an interim analysis.

Interim results from the study showed that Carbavance improved clinical cure rates across all infection types and reduced rate of renal adverse events compared to best available therapy. The new drug application (NDA) filing for Carbavance in February was accepted by the FDA for priority review with a response expected on Aug 29, 2017. The marketing application for the drug has also been validated by the EMA.

The Medicines Company announced that both the FDA and European regulatory authorities have accepted Vabomere as the new trade name for Carbavance.

Zacks Rank & Key Picks

The Medicines Company currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the health care sector is Enzo Biochem, Inc. (NYSE:ENZ) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018 over the last 60 days. The company came up with a positive earnings surprise in all the trailing four quarters with an average beat of 55.83%. The stock surged 67.9% so far this year.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Novartis AG (NVS): Free Stock Analysis Report

The Medicines Company (MDCO): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Alnylam Pharmaceuticals, Inc. (ALNY): Free Stock Analysis Report

Original post

Zacks Investment Research