Investing.com’s stocks of the week

I do not think the market cares much about the trade deal. The market prioritizes the health of the US economy and even more the Fed. At least that is what the price action suggests. $150 billion in taxes doesn’t seem like such a big deal in a $20 trillion US economy.

I mean even the 10-Year fell only 2 bps. It tells us that bond investors aren’t so scared either.

Russell 2000 (IWM)

The Russell 2000 had an incredibly important day, and it could not have worked out any better. The index fell right to support around 1,590 and never looked back. The good news is that I believe the reversal was more than an algo driven gap fill because the index finished up on the day.

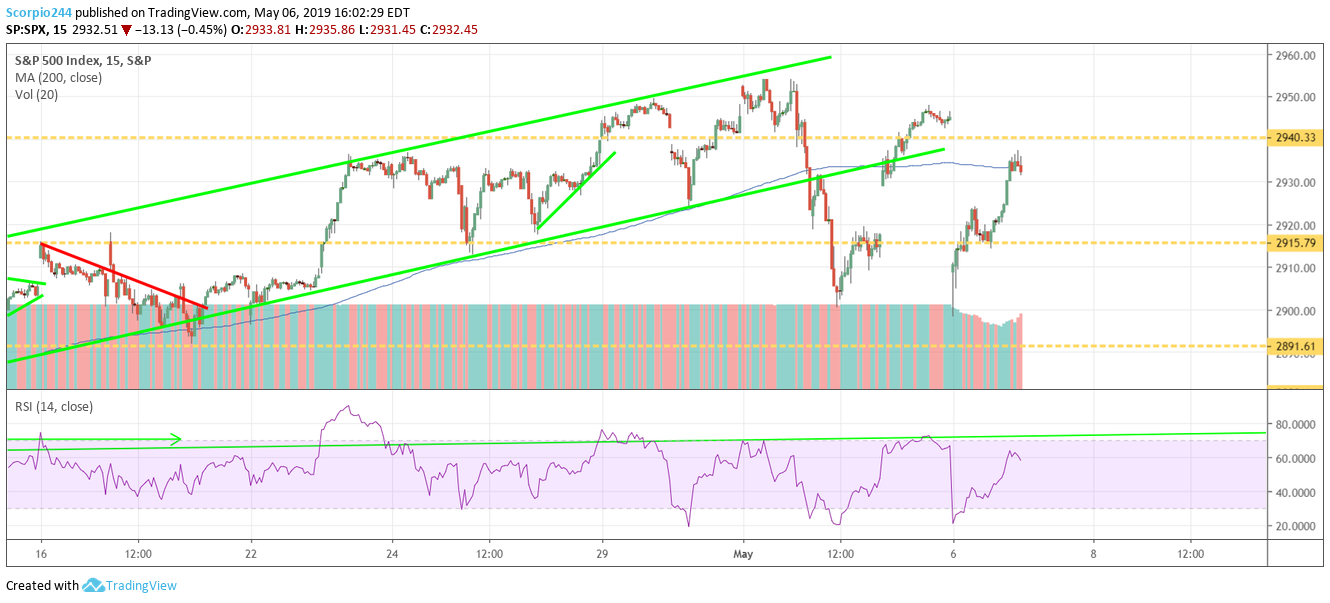

S&P 500 (SPY)

The S&P 500 also had an incredibly sharp come back falling around 50 basis points on the day. It even retested last’s week lows of 2898. That is a big come back. The gap hasn’t been filled yet, but it likely will be Tuesday.

Biotech (XBI)

How about the Biotech XBI ETF, up over 1.5% and is looking more and more like a double has been put into place. The ETF is likely on its way back to $90.

Apple (AAPL)

Apple (NASDAQ:AAPL) did fall today, and it is one of those stocks that does have exposure to China, so it does seem right. However, the good news is that an uptrend has formed and it seems to have kept the stocks decline from becoming a disaster. I think the stock will be fine, and will likely rise back above $209 and back towards $217.

Amazon (AMZN)

Amazon.com Inc (NASDAQ:AMZN) tested support to at $1900, bounced and recovered most of its losses too. I still think this one is heading towards $2025.

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is down some, probably because of all that business in China they have. Oh wait –they don’t have any business in China. Who cares that is was down a little, you have to love that it continues to hold around $378 like a champ.

AMD (AMD)

Advanced Micro Devices Inc (NASDAQ:AMD) has gone nowhere recently, but that sure is better than going down. I still think $31 is in the stock’s future.

Alibaba (BABA)

Things were looking pretty bleak for Alibaba Group Holdings Ltd (NYSE:BABA) earlier today but the stock bounced where it should, and I think $200 is still in the cards.

JD (JD)

There was a lot of damage done to Jd.Com Inc Adr (NASDAQ:JD)’s chart, so I don’t know what happens next. The stock needs to get over $29.50 to keep the trend rising.

Square (SQ)

Square (NYSE:SQ) reached support today at $65.50 and bounced. The upside, for now, is limited to around $71 at the moment.

Disclaimer: Michael Kramer and clients of Mott Capital own Netflix and Apple.