Mid-week market update: On the weekend (see The market's hidden message for the economy, rates and stock prices), I wrote that the short-term outlook was more difficult to call than usual.

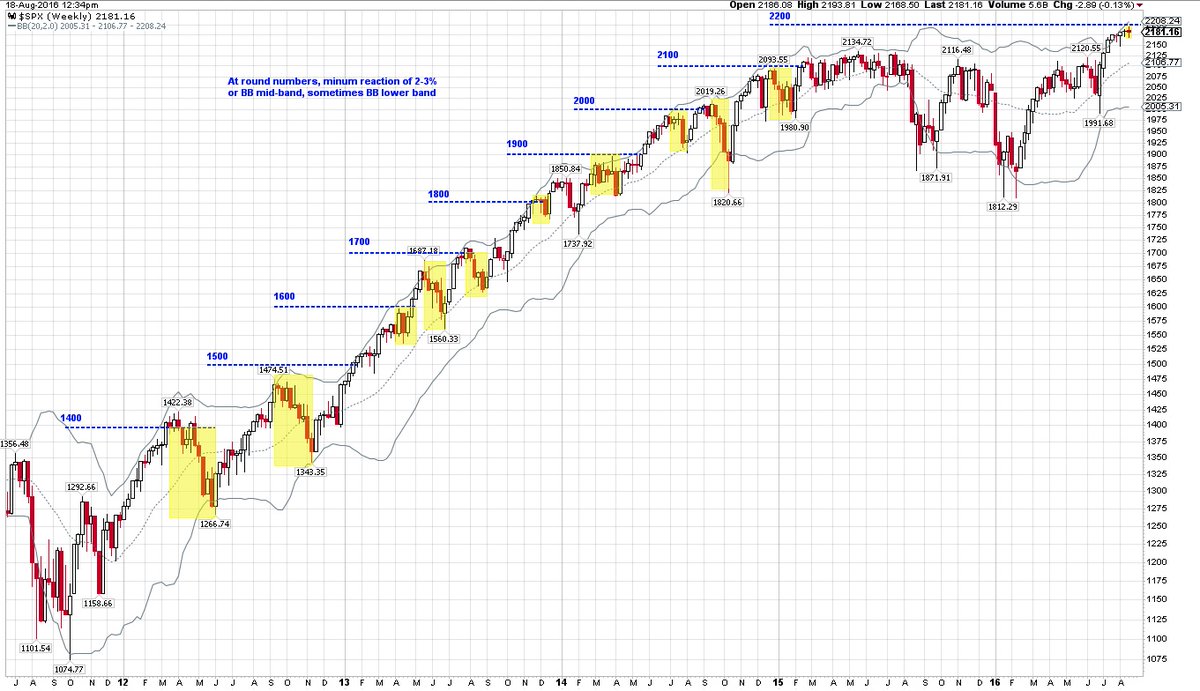

On one hand, we were seeing broad based strength, which argued for an intermediate term bullish call. On the other hand, Urban Carmel pointed out that the market has a tendency to pause when it nears a round number. In this case, the hurdle is 2200 on SPX.

The latter scenario seems to be winning out. The market is catching a case of round number-itis for the following reasons:

- Macro momentum became "overbought";

- Overly bullish short-term sentiment; and

- Deteriorating short-term breadth.

I would caution that this is purely a tactical call of a short-term SPX correction of no more than 3-5%. As I wrote two weeks ago: Be patient, it's hard to argue against the intermediate term bullish trend.

DISCLAIMER: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (""Qwest""). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest. None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui June hold or control long or short positions in the securities or instruments mentioned."