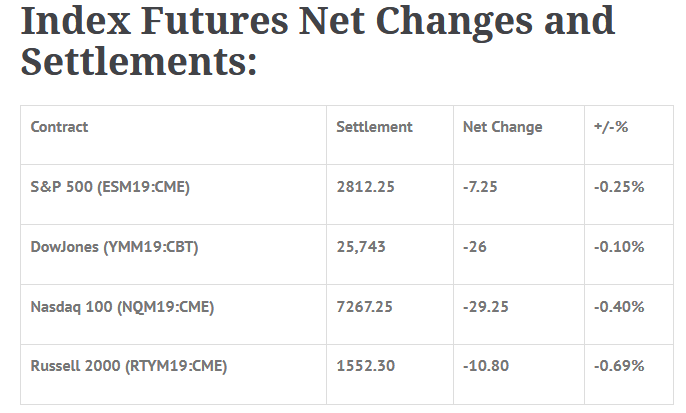

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +0.56%, Hang Seng +1.04%, Nikkei +0.77%

- In Europe 13 out of 13 markets are trading higher: CAC +0.96%, DAX +0.93%, FTSE +0.66%

- Fair Value: S&P +5.11, NASDAQ +29.14, Dow +30.07

- Total Volume: 1.2mil ESM & 1.2k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Quadruple Witching, Empire State Mfg Survey 8:30 AM ET, Industrial Production 9:15 AM ET, Consumer Sentiment 10:00 AM ET, JOLTS 10:00 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: #ES Chop & Grind

During Wednesday nights Globex session, the S&P 500 futures (ESH19:CME) printed a high of 2825.00, a low of 2811.25, and opened Thursday’s regular trading hours at 2815.50. The first move after the bell was a quick trip down to 2812.25 to test the Globex low. The initial dip was followed by a pop up to 2817.50 before a wave of selling came to knock the ESM down to a new low at 2808.50.

Once the low was in, buyers quickly picked up the pieces and started a slow grind higher that would last the rest of the morning, eventually topping out at 2820.75. Buying pressure began to back off after that, and the slow grind that pushed the ES higher reversed into a slow grind lower.

The ES went on to make a sequence of lows, making its way back down to to 2811.25, rallied up to 2814.50, and then made a low at 2811.75. The ES ‘back and filled’, then rallied up to 2817.00, traded 2815.75 as the 2:45 cash imbalance showed over $1.8 billion to buy, traded 2817.25 on the 3:00 cash close, and settled at 2812.75 on the 3:15 futures close, down -8 handles, or -0.34% on the day.

In the end, the volume was high in the first part of the day, but tapered off midday and stayed low right into the end of the day. In terms of the ES’s overall tone, the markets seems tired. At the end of the day total volume was only 1.1 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.