Trading is off to a rough start in the new year. China kicked off the fireworks for 2016 with a trading halt. From CNBC (emphasis mine):

“Chinese stocks plunged Monday, spurring a trading halt for the rest of the session, and leading stock markets in Asia Pacific lower after feeble manufacturing surveys revived concerns over the mainland’s economic slowdown.

The Shanghai Composite tumbled 6.85 percent to 3296.66 and the Shenzhen Composite plunged 8.1 percent. The CSI 300 briefly plummeted 7.02 percent; when that index rises or falls 7 percent, a trading halt in China’s markets is triggered for the rest of the session.

Hong Kong’s Hang Seng index was also down 2.48 percent at 21,370.62. Stocks in Australia, Japan, South Korea and India also fell. Energy plays, however, saw some gains after oil prices bounced during Asian trading hours.”

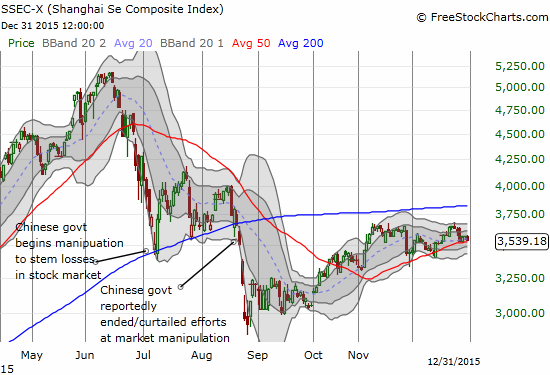

The Shanghai Composite has been relatively quiet for months now. The chart below is updated through the end of 2015. It shows how the 200-day moving average (DMA) has loomed over a gentle and steady recovery from the August crash lows for SSEC.

The Shanghai Composite Index (SSEC) ended 2015 with a very supportive 50-day moving average. The new year looks to shatter the peace…

Source: FreeStockCharts.com

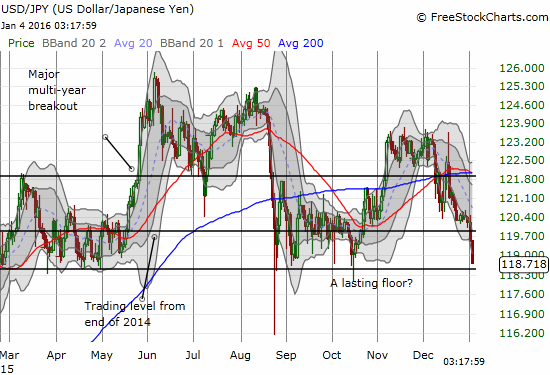

I mention the Chinese trading action as a backdrop to movements in the currency market. The Japanese yen (N:FXY) is an early beneficiary of this sudden wake-up call. The yen is a traditional “safe haven” currency for panicked currency traders and hedgers. So the yen’s strength in the context of a massive sell-off in China is a big sign flashing red for 2016. The yen’s surge is an immediate challenge to my recent claim that the U.S. dollar could continue to occupy center stage for the foreseeable future. In my earlier piece I made a quick reference to one extreme analyst who expects USD/JPY to return to 100 this year. Looks like USD/JPY is off to a decent start for that target…

The Japanese yen is making an early challenge to support for USD/JPY

As I noted earlier, if the yen cracks presumed support shown above, I will take the 100 target a lot more seriously.

In the meantime, the yen is marking some important milestones and signals against other major currencies. All these signals point to the higher potential of major changes underway.

First and foremost, the yen has finally completed a roundtrip against the euro (N:FXE). It took a month for the yen to reverse the massive gain on EUR/JPY from the “Draghi Drubbing.”

The downtrend in EUR/JPY looks set to resume with the gains from the Draghi Drubbing now wiped out.

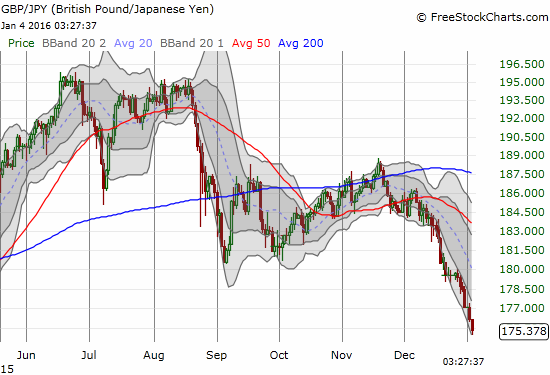

The British pound (N:FXB) has experienced a bout of weakness that accelerated in December. As a result, GBP/JPY has sharply slid over the past month. Such a well-defined trading channel is a treasure to find. I regret that I am only now catching on (at the time of writing, I just closed out my first trade on this channel).

The Japanese yen is now forcing a retest of the 2015 lows for GBP/JPY (not shown here).

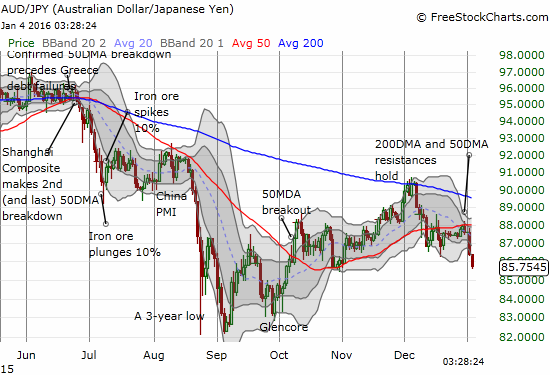

The Australian dollar (N:FXA) versus the Japanese yen serves as an important indicator of market sentiment. After failing to break through resistance at its 200DMA, AUD/JPY next broke down below 50DMA support. The last two trading days have confirmed the 50DMA is now firm resistance. AUD/JPY held up admirably just long enough to help support last month’s Santa Claus rally.

The Japanese yen is dragging AUD/JPY down through multiple warning signs.

The Japanese yen is even beating out the Swiss franc (FXF). The franc has also served as a traditional safe haven currency. That status was tarnished after the Swiss National Bank (SNB) spectacularly capitulated on its floor against the euro almost a year ago.

Traders have consistently preferred the Japanese yen over the Swiss franc since June, 2015.

Markets are moving fast. Even as I quickly finish this piece, a strong relief rally against the Japanese yen is already underway. It is strong enough to setup my next fade on GBP/JPY. Traders of forex and stocks will do very well to pay heed to the message in the Japanese yen. It is flashing red for 2016 and making me inclined to bias bearish until AUD/JPY can at least recover its large losses from the last two trading days.

Be careful out there!

Full disclosure: long and short various currencies against the Japanese yen