What is the January Effect?

The January Effect, a term coined to describe the rise in stock prices typically seen in January, has intrigued market participants for decades. This phenomenon is thought to be influenced by a mix of investor behavior patterns, tax considerations, and a collective psychological reset as the calendar flips to a new year.

Below, we analyze this trend through the lens of both the S&P 500 and Dow Jones Industrial Average to evaluate how reliable it is…and whether traders should trust it moving forward.

The January Effect: Potential Explanations

There are multiple compelling explanations for a general rally in stocks in the first month of a new year.

The practice of tax-loss harvesting—where investors sell losing stocks in December to offset capital gains tax, followed by a rebound in buying during January—has been a significant factor. Add to this the injection of year-end bonuses and new investment resolutions, and you have a potent mix fueling early-year market activity. Moreover, the strategic 'window dressing' by mutual fund managers, aiming to polish their portfolios by year-end, might also amplify January's performance figures.

These factors suggest that January's market behavior is a composite of calculated financial moves and investor psychology.

A Historical Glimpse of January's Market Moves

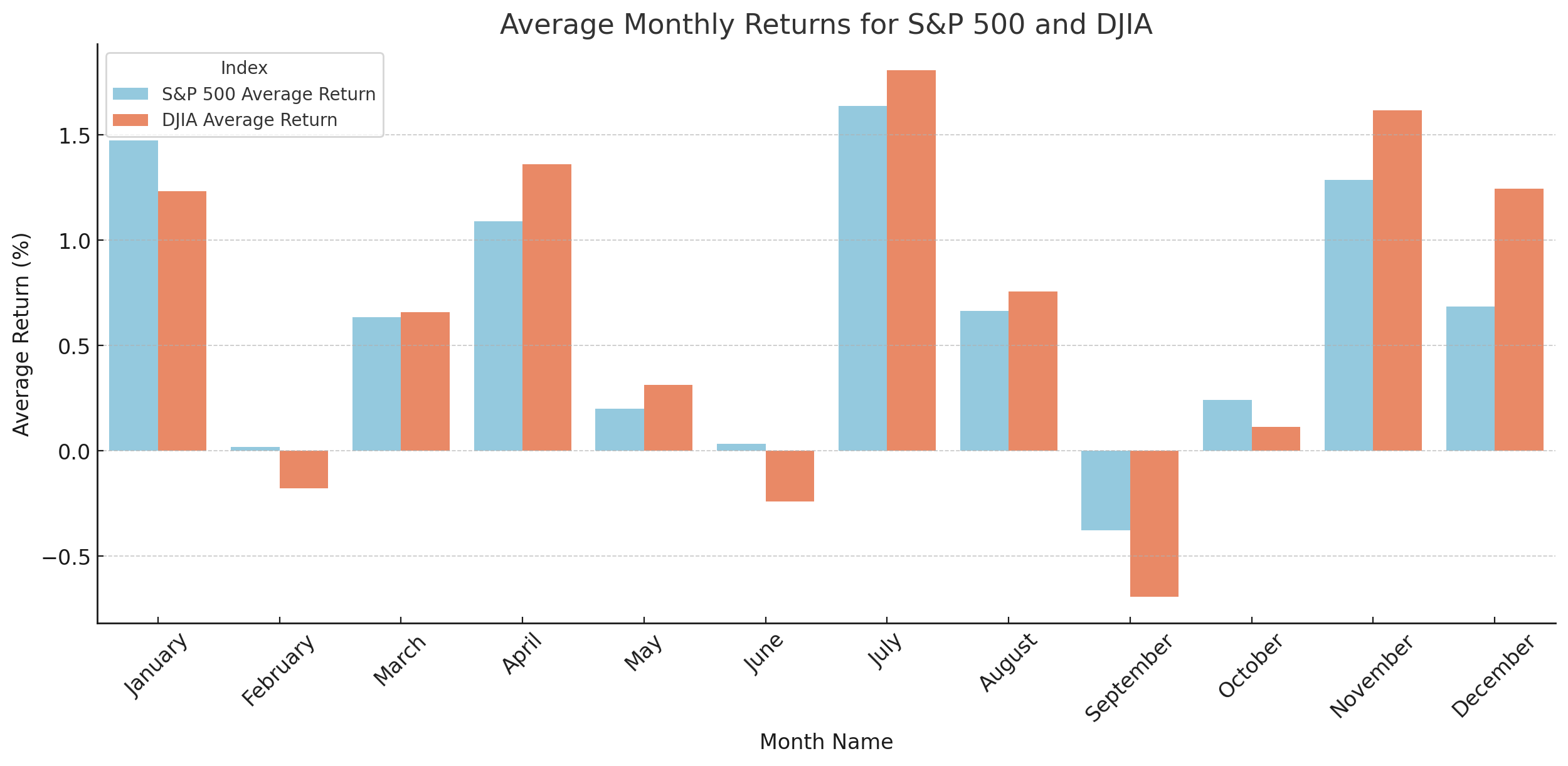

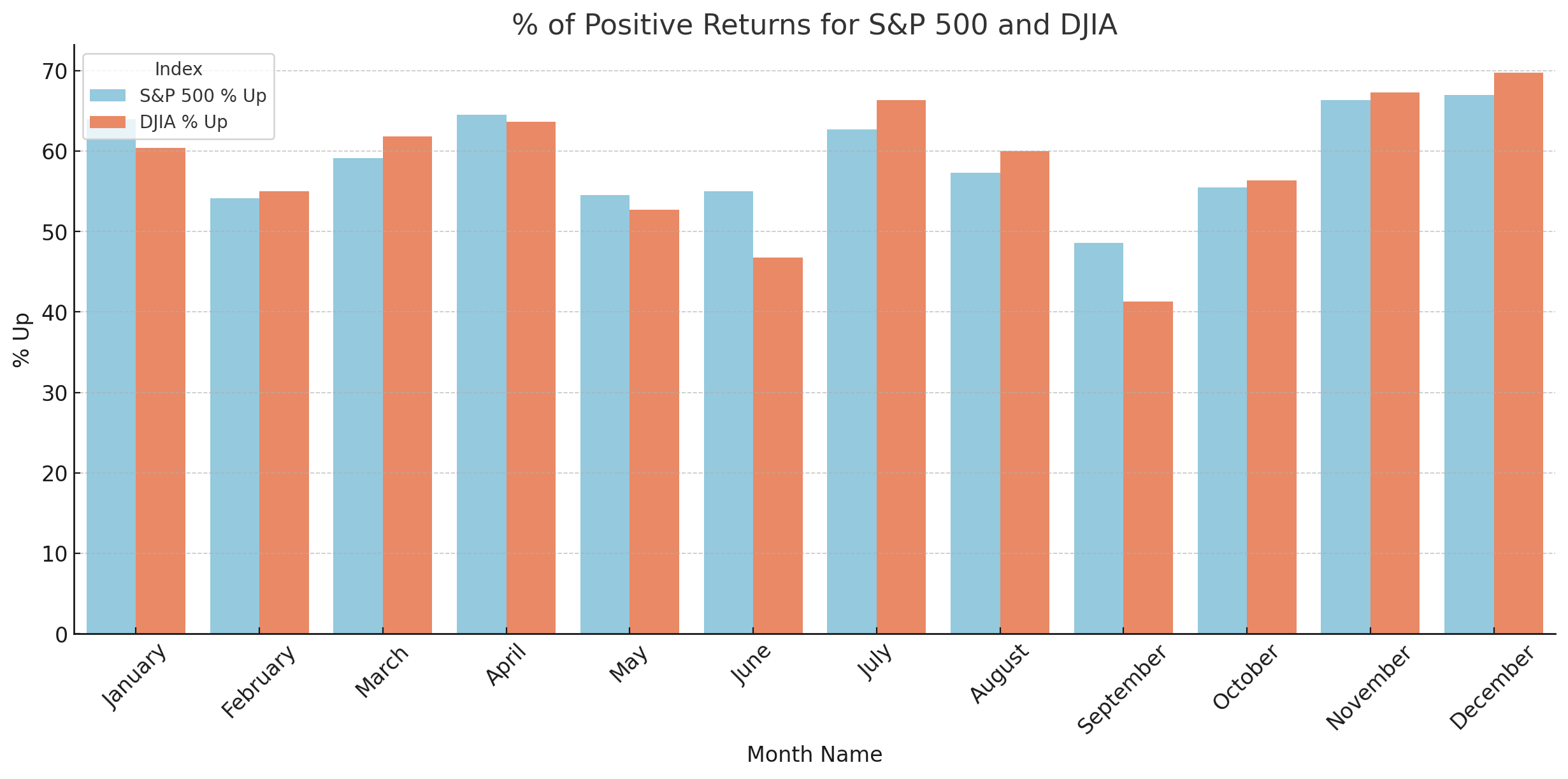

First things first, the average monthly returns for both the S&P 500 and the DJIA show some evidence of historical strength in January, though the first month of the year isn’t necessarily the strongest on average, nor is it the month most likely to finish higher historically:

Source: TradingView, StoneX

Source: TradingView, StoneX

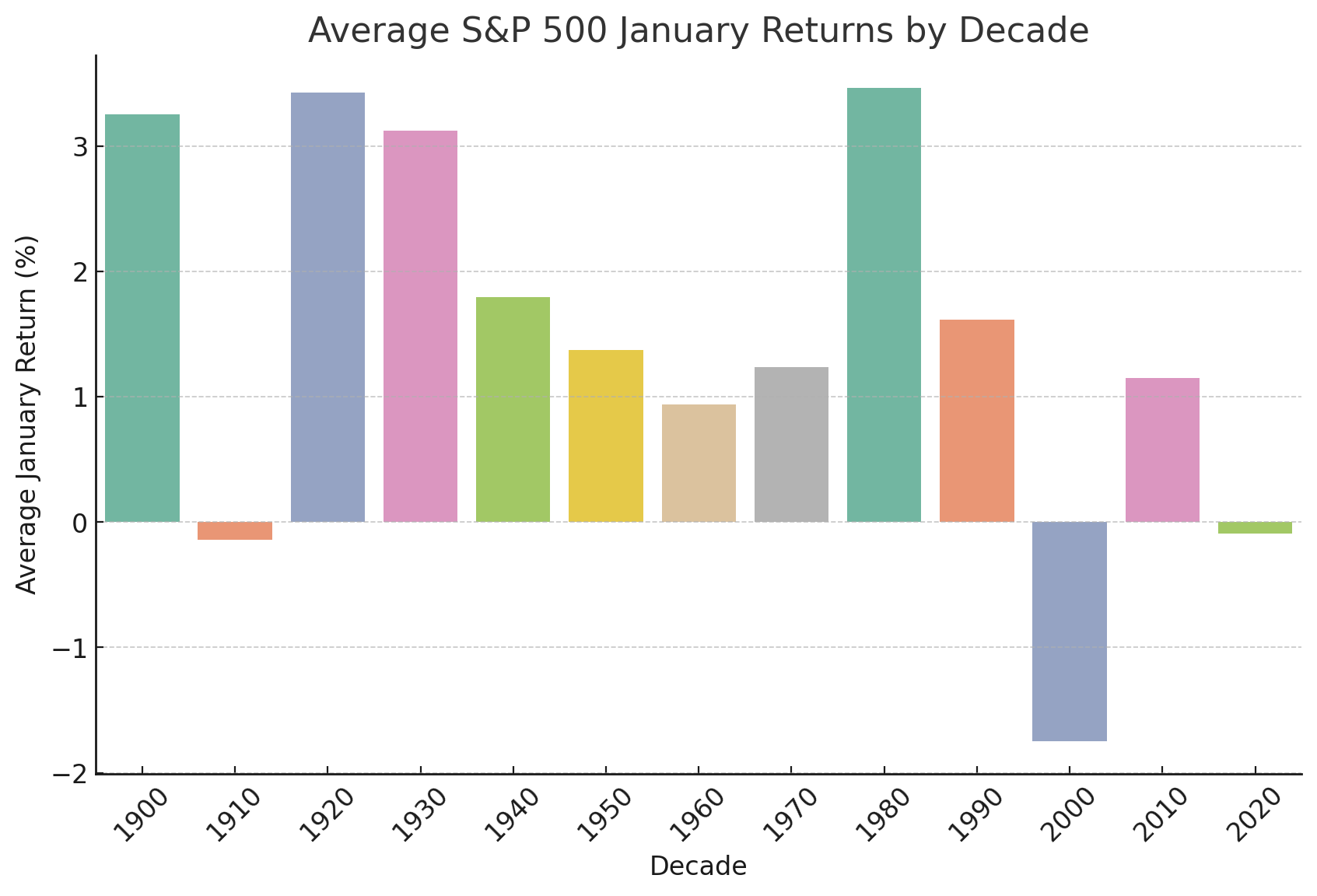

When we delve into the S&P 500's performance across the past century, the impact of the January Effect varies through the decades. There have been notable peaks, such as in the 1930s and 1980s, where the average January returns soared, potentially linked to post-recession rallies or periods of economic optimism. In stark contrast, the dawn of the new millennium has witnessed a more subdued January Effect, hinting at a possible shift in the effectiveness of this historically-reliable pattern:

Source: TradingView, StoneX

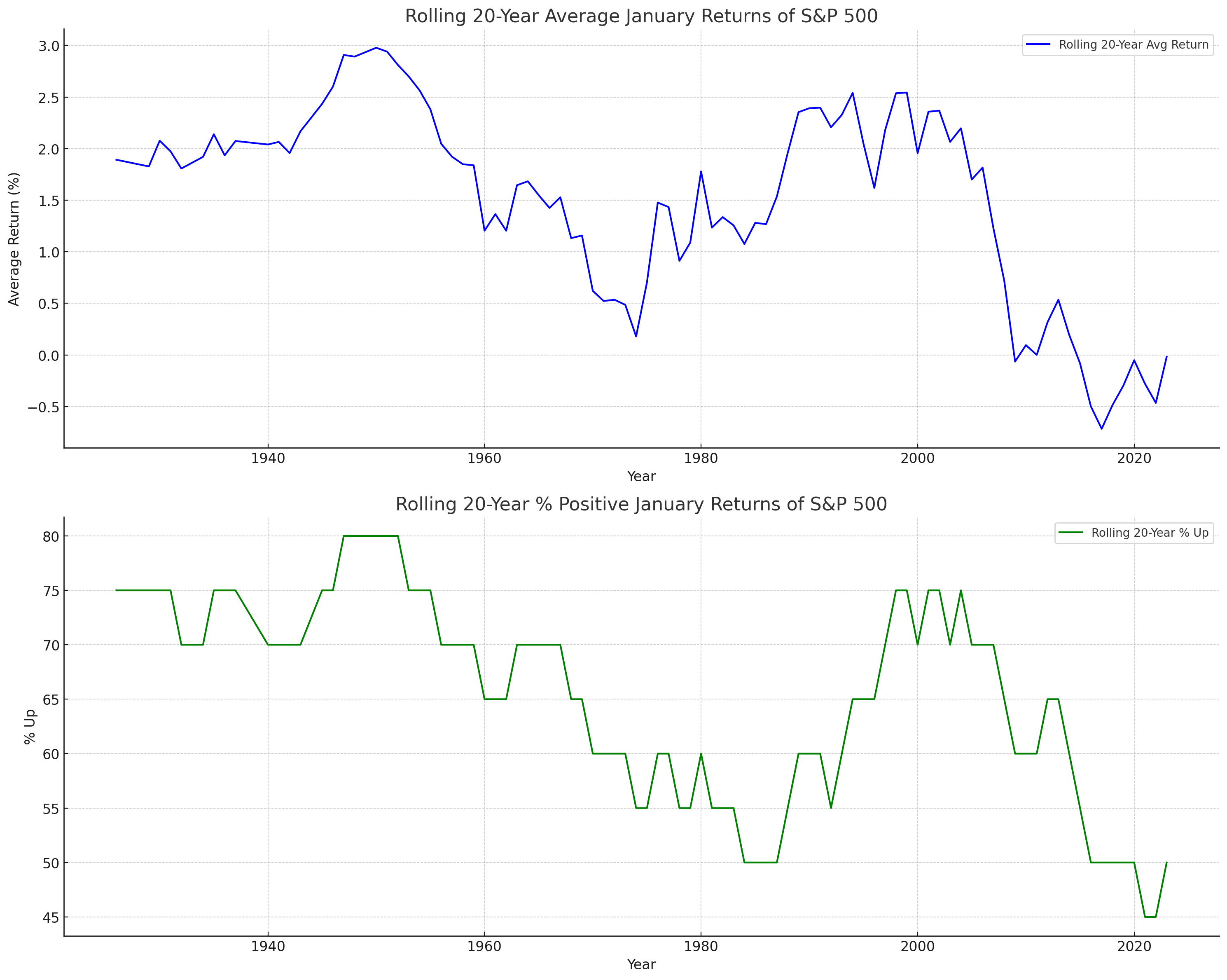

The variance of the January Effect over a rolling 20-year period casts further doubt on its consistency moving forward. While there were times when January consistently delivered positive returns, recent trends suggest the market has become more adept at adjusting for this once predictable pattern; as with many market phenomena, the discovery and wide awareness of the January Effect may have made it less effective than the long-term track record would suggest.

Source: TradingView, StoneX

The January Effect: What You Need to Know

Synthesizing the data on positive returns across the S&P 500 and DJIA, it's clear that while January has had its moments in the sun, it doesn't operate in a vacuum. The ebb and flow of this effect over the years reflect broader market trends and the cyclical nature of the economy.

Notably, other months also demonstrate similar seasonal trends, as the patterns of peaks and troughs in returns are not exclusive to January. This observation points to the possibility of other seasonal forces at work or the impact of external economic events on market performance.

The extended analysis indicates that the January Effect should be acknowledged but not overly emphasized in one's trading strategy. It's a single element in the larger scheme of long-term market trends and economic cycles that should inform a diversified approach to trading.

The visual data not only validates the existence of the January Effect but also signals its waning predictability. This observation underscores the need for traders to remain informed about market shifts and the foundational drivers of such anomalies. As markets evolve towards greater efficiency, the patterns of yesteryears may not serve as reliable indicators for the future.