In a previous article I compared results for the S&P 500 Index versus the S&P 500 Low Volatility Index. In this piece we will broaden our horizons to include the whole darn world.

The Test

For test purposes I am using the actual index monthly total return data for both the AMG Managers LMCG Small Cap Growth I and the iShares Edge MSCI Minimum Volatility Global (NYSE:ACWV) starting in June 1993 when the Low Volatility Index was first calculated.

Figure 1 displays the growth of $1,000 invested in both indexes on a buy-and-hold basis since 1991.

Figure 1 – Growth of $1,000 invested in MSCI ACWI Minimum Volatility Index (blue) versus MSCI ACWI Index (red)

Some observations, from 5/31/1993 through 8/31/2017;

*$1,000 invested in the ACWIXLV grew +586%

*$1,000 invested in ACWIX grew +481%

*586% versus $1,239 represents 22% more return for ACWIXLV

So does this mean that ACWIXLV is a better investment? Not necessarily. ACWIX vastly outperformed during the late 1990’s bull market. Also, the low volatility version experienced a maximum drawdown of -39%. While this is much better than the -55% drawdown experienced by the regular ACWIX index, it hardly qualifies as what most people would consider “low volatility.”

So let’s add another wrinkle – Sell in May and Go Away.

The Seasonally Adjusted Test

In order to develop a truly “lower volatility” method for this test we will compare:

*Buying and holding ACWIX

Versus

*Holding ACWIXLV only during the months of November through May. For June through October we will use the monthly total return for the Bloomberg Barclays (LON:BARC) Treasury 1-3 Year index.

Figure 2 displays the results.

Figure 2 – Growth of $1,000 invested in MSCI ACWI Minimum Volatility Index November through May (blue) versus MSCI ACWI Index buy-and-hold(red)

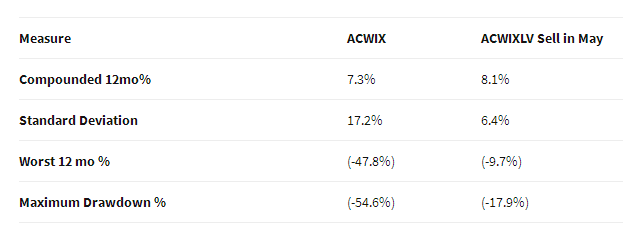

Figure 3 displays some performance numbers based on all 12-month returns

The key thing to note is that over the 24 year test period the seasonally traded version ACWIXLV has generated a slightly higher return than ACWIX – with significantly less volatility and downside action.

Key things to note:

*The worst 12-months and maximum drawdown respectively for ACWIX was -47.8% and -54.6%

*The worst 12-months and maximum drawdown respectively for seasonally traded ACWIXLV was -9.7% and -17.9%

*The annual standard deviation for the low volatility version was roughly 1/3rd of that for buying and holding ACWIX (6.4% versus 17.2%)

The MSCI ACWI Index can be traded via ticker ACWI which is the iShares MSCI ACWI ETF

The MSCI ACWI Minimum Volatility Index can be traded via ticker ACWV which is the iShares Edge MSCI Min Vol Global ETF

Summary

Is trading the MSCI ACWI Minimum Volatility Index a good idea? Even with a seasonal adjusted that reduces volatility even more? Not necessarily. But for investors looking for less volatility in their returns it’s something to think about.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.