If there’s one thing investors love, it’s consistency and reliability. Two attributes that deftly describe the trend of exchange-traded funds that track low volatility stocks.

This unique category of the ETF universe has rapidly expanded in recent years through a combination of persistent fund flows and sector momentum. The factors that ultimately shape low volatility indexes have proven to offer attractive characteristics for conservative investors that want equity exposure without the downside risk of a typical broad-based benchmark.

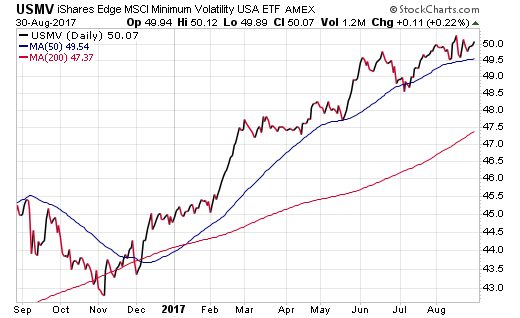

One leading fund in this group is the iShares Edge MSCI Minimum Volatility (NYSE:USMV), which has amassed nearly $14 billion in total assets. USMV is composed of nearly 200 large and mid-cap U.S. stocks with characteristics of reduced historical price volatility versus their peers. In short, it’s a cross section of the U.S. stock market that has demonstrated less downside risk over a short look-back period.

The USMV portfolio is multi-sector in nature with caps placed on the maximum allocation for any single group. At present the top holdings include healthcare, technology, and consumer staples companies such as McDonald’s Corporation (NYSE:MCD) and Johnson & Johnson (NYSE:JNJ). It also charges a very reasonable expense ratio of 0.15%, making it suitable as a long-term core holding in certain portfolios.

On a year-to-date basis, USMV is slightly outpacing the gains of the broad-based SPDR S&P 500 ETF (NYSE:SPY) with a total return of +11.54%. It also has a 7% lead on SPY over the last three years as well.

The high demand for innovation in the low volatility category has created a great number of ways to slice varying indexes using this criterion. Other top funds include the Powershares S&P 500 Low Volatility Portfolio (NYSE:SPLV) and PowerShares S&P 500 High Div Low Volatility Portfolio (NYSE:SPHD). There is also the iShares Edge MSCI Minimum Volatility EAFE (NYSE:EFAV) to consider for those who want a similar strategy directed towards international equities. I could easily name 10 more with varying flavors of global exposure, dividends, or some other tangential quality.

Having owned and observed these ETFs as core portfolio holdings, I can attest to their strengths. They work well to provide low-cost exposure to a subset of high quality stocks. They are also fantastic for conservative investors who would normally be scared out of owning a benchmark-like index with far more downside risk.

Nevertheless, they have certain drawbacks as well. The same factors that create the low volatility screens also lead to herding and potentially overcrowding in certain sector groups. The methodology is such that stocks with the lowest volatility are consistently momentum driven and can suffer from higher valuations than comparative indexes.

That’s not necessarily a bad thing if the trend for those overweight sectors continues to consistently seek out higher prices. Like any smart beta index, funds like USMV and SPLV will ultimately experience periods of outperformance and others where their more conservative nature doesn’t fit the market’s mood.

The Bottom Line

This is certainly one of those times where smooth sailing, low costs, and sector makeup are in the sweet spot for low volatility ETFs. Yet, some fundamentals such as price/earnings and price/book suggest abnormally high valuations on a relative and absolute basis.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.