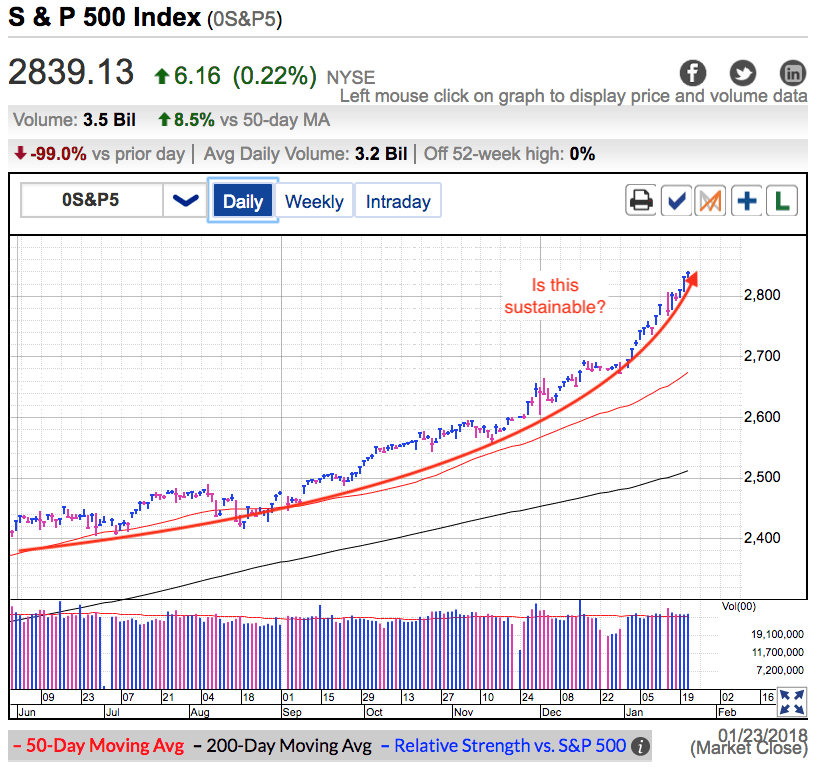

On Tuesday the S&P 500 finished higher for the 12th time this year out of 15 trading sessions. And honestly, two of those down-days hardly count since the losses were barely more than -0.1%. Clearly the crowd is in a buying mood and few are showing any fear of these heights.

The market surged Monday when the Senate agreed to a temporary extension that reopened the government, but there is little reason to think a handful of days will patch the divide between Republicans and Democrats. But this style of all-or-nothing standoffs is typical of political negotiations and eventually a compromise will be reached. The market knows this which is why its reaction to the government shutdown was almost nonexistent.

The bigger question is how many more up-days can we string together? Markets go up and markets go down. Except this one. We just set the record for the longest stretch in market history without a 5% pullback. Extended runs occur all the time. Unfortunately most good stretches are inevitably followed by extended moves in the other direction. Only a person who thinks the stock market has forever changed believes this period of prosperity will continue indefinitely.

The funny thing about investing is the more expensive something becomes, the more excited people are to buy it. Rather than wait for Black Friday sales, investors cheer Christmas markups. And the recent surge in prices is making the crowd even more excited to buy stocks. This market makes experienced investors nervous, but investing novices are diving in head-first because they are more afraid of missing out than losing money. While the good times last far longer than anyone expects, they almost always end in tears. Enjoy the ride higher, but stay close to the exits. The more greedy other people become, the more fearful we should be.

For the time being everything still looks good and this market clearly wants to go higher. We are well past the point of a normal and routine pullback because buyers insist on chasing prices higher. We are long overdue for a dip, but since owners are keeping supply tight by stubbornly holding for higher prices, it will take a fairly shocking headline to dampen the market’s mood. And as we just witnessed, it needs to be a heck of a lot bigger than a government shutdown. Until then, the path of least resistance is higher. But always keep in mind, the higher we climb, the harder we fall.