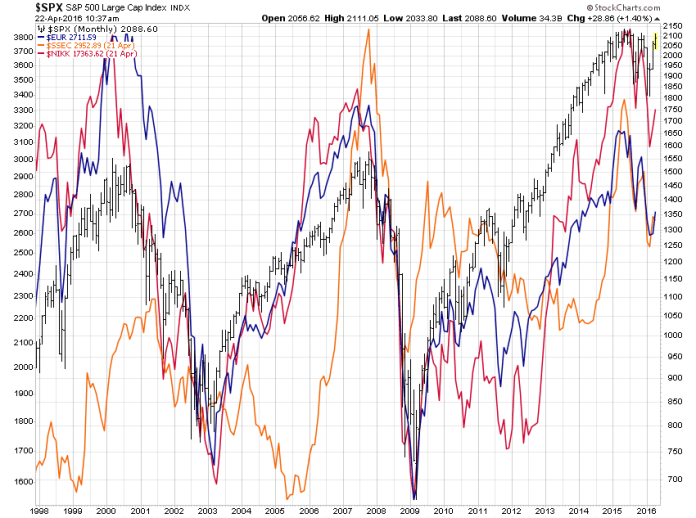

It’s fascinating to watch our stock market here in the US rally back near its all-time highs even as other major markets around the globe remain well below their own. As CBS News reports:

America’s stock market rally stands alone. Markets around the planet are much less ebullient, with the MSCI World Index (minus the U.S.) down nearly 15 percent from its high last summer. That suggests caution is warranted.

Why would that warrant caution? Well, let’s take a look at what’s driving the run higher here at home yet failing to inspire investors abroad. FT reports:

It’s all about the second half of the year. Forget the troubling signs that asset prices have rebounded sharply on the back of no real improvement in underlying fundamentals. There appears plenty of faith in the idea that bad debts related to the energy sector are contained and that the present S&P 500 earnings recession will fade, justifying rising valuations by the end of the year.

Those are some pretty optimistic assumptions, in my view What FT doesn’t mention but I believe is also built into investor assumptions at this point is that the US will be able to avoid being pulled into a global recession, a growing possibility reflected in the prices of global equities.

Historically, it appears that equities around the world regularly cycle together. As we become more of a globalized economy with each passing year, this makes perfect sense. And if we enter a global recession, driven by weakness in these other countries, it might be heroically optimistic to believe the US can avoid a similar fate.